Opinions can heat up as fast as an overloaded GPU processor, when the conversation among gaming enthusiasts turns to their favorite GPU manufacturer. AMD and Nvidia are the two dominant forces in the field, and each boasts legions of fans.

While hardly any companies have been immune to the destructive effect of coronavirus, the two chipmakers have withstood the macro storm relatively well. As Wall Street analysts make adjustments to fit the new coronavirus driven paradigm, these market leaders have caught Wall Street’s attention.

Investment firm Wedbush just added both AMD and Nvidia to its “Best Ideas List.” The list – which comprises 29 stocks – highlights the firm’s highest rated equities, chosen by its analysts, and vetted by its Investment Committee.

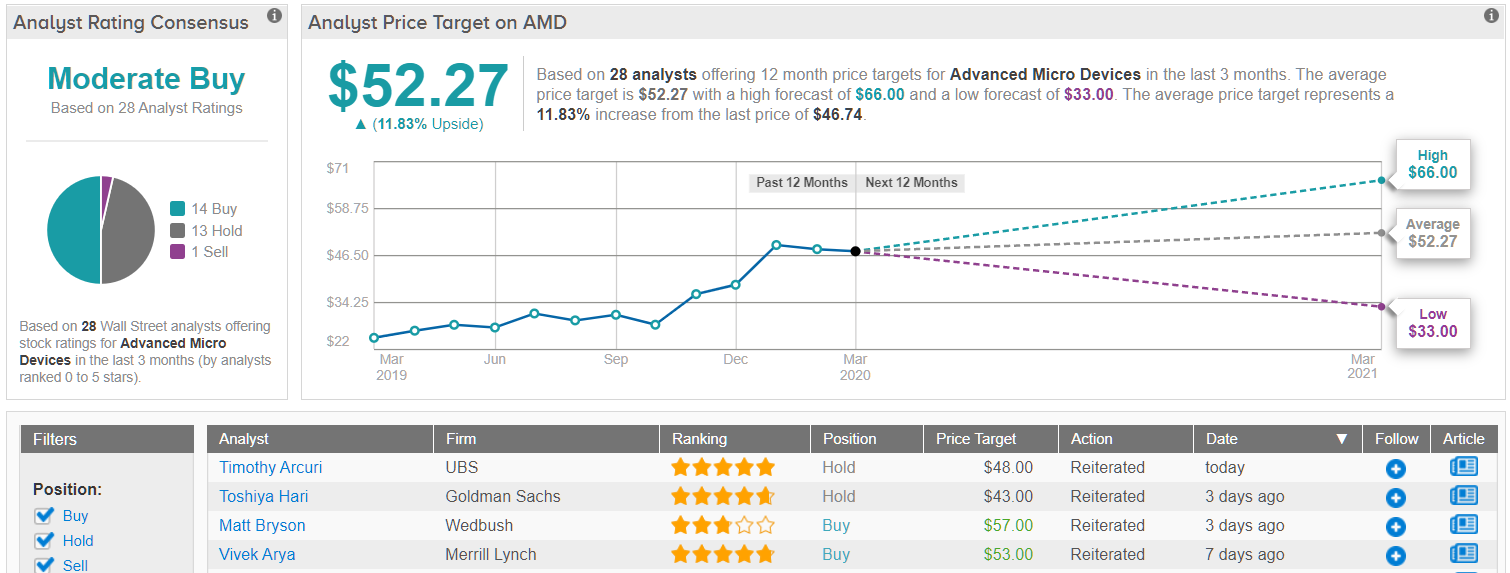

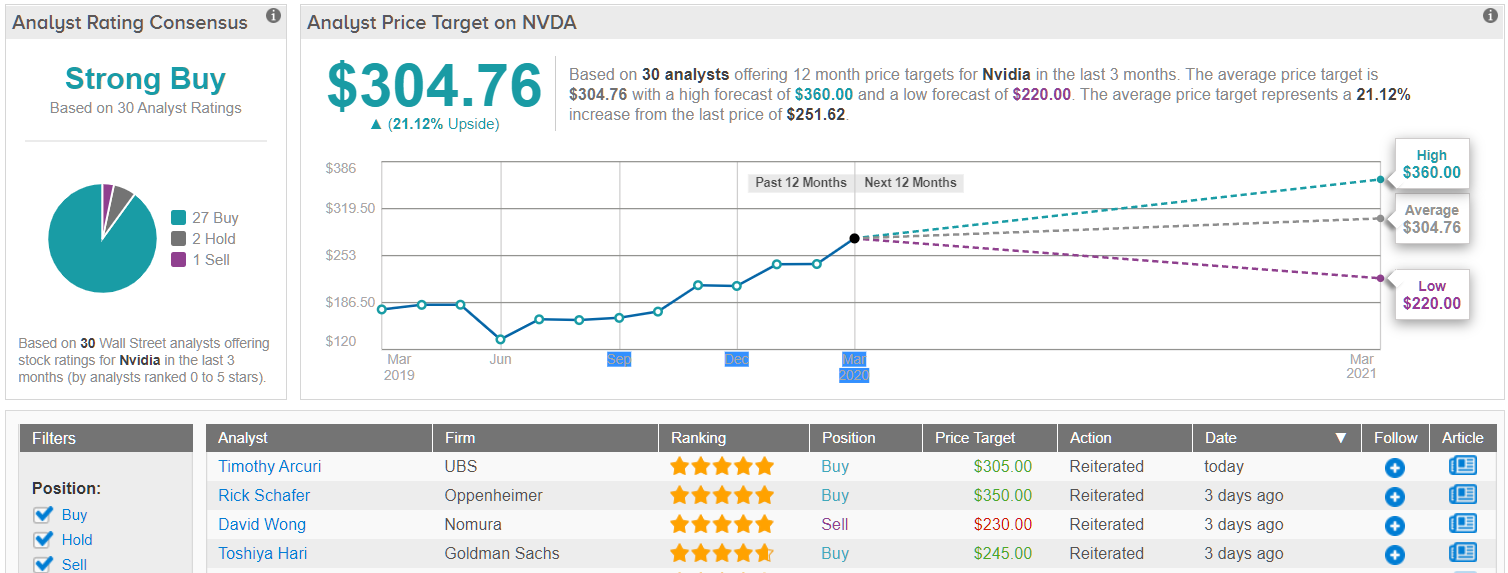

We ran the two through TipRanks database to further gauge the Street’s sentiment towards the GPU giants. It appears, that in addition to Wedbush’s call, both are Buy-rated and are poised to offer investors returns of at least 10% in the next 12 months. Let’s take a closer look.

Advanced Micro Devices (AMD)

Considering AMD was last year’s star performer, adding an extraordinary 156% to the share price over the year, you might’ve expected a sharp downturn in the recent demolition of the market. But true to form, the chip giant has given little back to Mr. Market, and in the current climate its year-to-date loss of only 3%, displays investors’ confidence in AMD’s strength.

Wedbush’s Matt Bryson agrees. The analyst keeps his Outperform rating on AMD intact, along with a $57 price target. Expect the GPU player to add an extra 28% to the share price should Bryson’s thesis play out over the following months. (To watch Bryson’s track record, click here)

Backing up his call, the Wedbush analyst notes AMD’s strong balance sheet, which includes more than $1 billion in net cash. Additionally, because the company no longer has any fab assets (the costly plants where integrated circuits are manufactured), it does not have “either fab utilization risk or exposure to significant capital requirements,” which in difficult times such as these, can weigh heavily on the balance sheet.

Most of AMD’s revenue is from gaming, data center and PCs. Bryson anticipates all three segments to “outperform in a downturn”, and notes that social distancing equates to more gaming time, while people shifting towards remote work should provide an uptick in AMD’s data center and PC segments.

Bryson expounded, “AMD’s revenue growth is tied to share gains in PC and Server CPUs (rather than broader market trends). While lower market growth will weigh on revenue/earnings, continued share shift (they gained roughly 1%/Q in ’19) should allow AMD to outperform market peers struggling with economic trends… While the current environment clearly creates significant uncertainty; AMD’s FY’20 and intermediate term guide looked very conservative prior to concerns around COVID-19 appearing, a setup that should insulate AMD (in contrast to its peers).”

Out on the Street, AMD’s Moderate Buy consensus rating breaks down into 14 Buys, 13 Holds and 1 Sell. Investors can expect returns of 17.5%., should the average price target of $52.44, be met in the year ahead. (See AMD stock analysis on TipRanks)

Nvidia (NVDA)

Although not as quite a market shredding act as AMD in last year’s bull run, Nvidia still managed to add an extra 73% to its share price over the year. The run had extended right up until March, when the stock was pulled down along with everything else. Nevertheless, the recent strong bounce back appears to be a good sign, and Nvidia stock at its current price seems to be attracting a lot of Street attention.

Wedbush’s Matt Bryson (who also covers AMD) evidently thinks so, and notes Nvidia is “advantaged vs many peers in dealing with COVID-19.” So, what lies behind the analyst’s positive assessment?

Well, for starters, Bryson notes the percentage of FY20 revenue two of the GPU leader’s segments – gaming and Datacenter – make up. Both are well suited to benefit from the current crisis, with the former amounting to 57%, and the latter– its largest growth driver – making up 21%. As with AMD, the current stay-at-home climate bodes well for both divisions.

The similarities extend further. You can add Nvidia’s fabless model to the list, and while the analyst was impressed by AMD’s strong balance sheet, Nvidia’s is even more eye popping. With cash and investments worth $10.9 billion, reduce the $2 billion of debt, and it leaves Nvidia with a net cash position of $8.9 billion.

There are other near-term catalysts, too. Last year, Nvidia outbid Intel for Mellanox Technologies. The acquisition of the Israeli chip designer is its biggest-ever, in a transaction worth $6.8 billion and is expected to be completed shortly. A further catalyst is anticipated from the forthcoming release of Ampere, Nvidia’s next generation GPU.

So, what does it mean for investors? Bryson reiterates an Outperform rating, along with a $311.00 price target. From current levels, the upside is 27%.

The Street is almost unanimously on the Wedbush analyst’s side. 27 Buys, 2 Holds and 1 Sell add up to a Strong Buy consensus rating. The average price target is $304.76, and implies possible gains in the shape of 305%. (See Nvidia stock analysis on TipRanks)