Despite chip giant AMD (AMD) taking meaningful market share away from rivals, its stock has been unable to steer clear of industry headwinds. Undoubtedly, there’s no way for AMD CEO Lisa Su to control macro issues. The PC market has slowed down, and macro headwinds could weigh down the stock further. Recession or not, though, AMD is well-positioned to continue taking share and building upon its lead, making AMD stock an intriguing pick-up amid the tech slump.

In simple terms, AMD is firing on all cylinders, doing many things right amid unprecedented headwinds. The company’s latest quarterly results were solid. Still, the company erred on the side of caution, with a more downbeat tone for its coming third quarter. Regardless, AMD is sticking with its original full-year guidance of 60% revenue growth.

As the company continues doing its best to navigate through challenges, there’s a real chance the firm can make strides over its rivals.

Intel (INTC) is a top rival that’s really felt the pressure dealt by AMD. The company missed the mark in its latest quarter by a landslide, sparking a vicious sell-off. As AMD looks to raise the bar with its latest generation of Ryzen 7000 Series Zen 4 processors, I’d look for AMD to build its lead over Intel on the market cap front. Indeed, AMD has come a long way, and it’s not finished.

AMD Flexes Its Muscles in the Second Quarter

Intel had a pretty low bar to pounce over in its latest quarter. Still, it failed to get its feet off the ground. Meanwhile, AMD posted a slight earnings beat, with EPS (earnings per share) numbers coming in at $1.05, just slightly higher than the analyst consensus estimate of $1.03. With another quarter of double-digit top-line growth, it’s clear that AMD is the author of Intel’s pain.

With recent headwinds facing the video-gaming scene, there’s a real chance that AMD’s intriguing GPU offerings could fall into a short-term rut. The weakness in the gaming market appears to be tied to a more selective consumer and a slowing in must-play titles.

Though CPUs (central processing units) and GPUs (graphics processing units) are discretionary items, AMD has some of the market’s most budget-friendly offerings. Arguably, a recession could help AMD edge further into rivals’ turf.

AMD has no problems outmuscling Intel in the CPU market these days. On the front of GPUs, there’s much work to do to catch up to the likes of Nvidia (NVDA). With every Nvidia innovation, AMD runs the risk of falling further behind. Still, underestimating Lisa Su and company is never a good idea.

AMD: Still Expensive, but It Deserves to Be

At writing, shares of AMD trade at 51.9x trailing earnings, 7.5x sales, and 43.9x cash flow, all of which are above the semiconductor industry average multiples of 31x, 8.1x, and 23.5x, respectively. The stock isn’t cheap, but it doesn’t deserve to be, given its increased competitive pace.

Meanwhile, Intel stock trades at a mere 7.8x trailing earnings and 2x times sales. Intel is an underdog that’s fallen behind in its recent quarter. Despite its clear plan to catch up over the next three-to-four years, the odds of Intel winning its uphill battle seem to be weakening by the day.

Though I’d be willing to give Intel stock a second look if it can show evidence that it can outmuscle AMD, I would much rather pay a premium price tag than go with the underdog. It’s hard to play catch up in the commoditized realm of chips. The slightest hiccup could have considerable consequences in the form of fading sales growth and nosediving margins.

As supply constraints (and the chip shortage) ease, fading demand could pave the way for a chip glut, leading to heavier discounting. Essentially, the semiconductor scene faces the perfect storm of headwinds up ahead. AMD can offset such headwinds by gaining further ground on Intel. With an impressive slate of new chips on the horizon, I think it can apply further pressure on its biggest CPU rival to better ride out the storm.

In such a commoditized market as CPUs, there tends to be a sort of zero-sum game in the works. One firm’s gain is another’s loss. Right now, AMD is gaining while Intel treads water.

Is AMD Stock a Buy, Sell, or Hold?

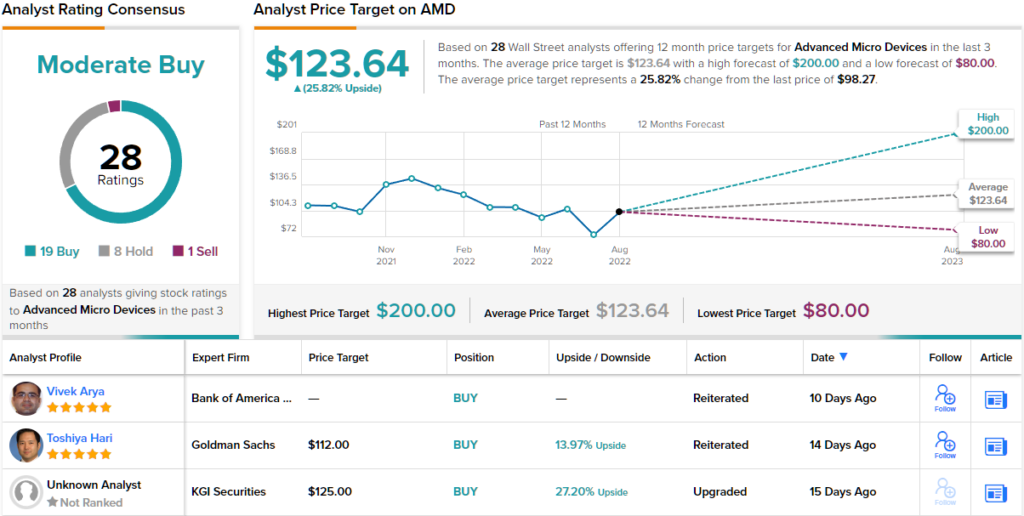

Turning to Wall Street, AMD stock comes in as a Moderate Buy. Out of 28 analyst ratings, there are 19 Buys, 8 Holds, and just a single Sell. The average AMD price target is $123.64, implying upside potential of ~26%. (See AMD stock forecast on TipRanks)

Conclusion

AMD stock is up against it going into its third quarter. That said, I think management is being overly conservative. Perhaps erring on the side of caution could help set the stage for another earnings beat. In any case, AMD stock appears as hungry as ever, with a potential opportunity to hurt Intel in the data center with its Zen-based EPYC server chips.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. At the time of publication the writer did not have a position in any of the securities mentioned in this article.