Back in April, Deutsche Bank analyst Michael Linenberg forecast that by 4Q20, American Airlines (AAL) will be will generating 65% of 4Q19’s revenue – i.e. a year-over-year revenue decline of 35%. But making any forward predictions in 2020 has been a thankless task, as Linenberg now admits: “What did we really know in April as we were attempting to make a fair assessment of the industry at the depths of the downturn?”

Since then it has become clear that this target was too optimistic. Linenberg now expects December quarter revenue to contract by as much as 65%.

Although the figure is a significant improvement on the September quarter’s 73% year-over-year downturn and better still on the June quarter’s 86% decline, it is still far below the original April estimation.

It’s not as if AAL is unique in this respect. Linenberg estimates the slow revenue recovery will result in most airlines only achieving break even cash flow by 2021, and American, specifically, by the June quarter.

That said, Linenberg notes the “fundamentals continue to improve.” It is notable too that the daily cash burn rate is getting steadily reduced. From $58 million in the June quarter to $43 million in the September quarter, and estimated to be between $25 – $30 million in the current quarter.

And while Linenberg acknowledges the risks at play, the analyst believes it all bodes well for when consumers are ready to confidently travel once again.

“The improvement in cash burn combined with a record level of liquidity ($15.6 billion, which includes the full amount available under the CARES Act Loan Program) gives us a confidence that not only will American be able to ride out the downturn, but is well-positioned to participate in the recovery once demand bounces back,” Linenberg said. “

“We are reiterating our Buy rating on American’s shares, but acknowledge the fact that the company is the most financially leveraged name in our coverage universe (net debt of $33 billion at September quarter-end). That said, and combined with the company’s operating leverage, we would expect AAL’s shares to outperform once an industry recovery gains momentum,” the analyst concluded.

The Buy rating is accompanied by an $18 price target, implying shares will rise by 60% over the next 12 months. (To watch Linenberg’s track record, click here)

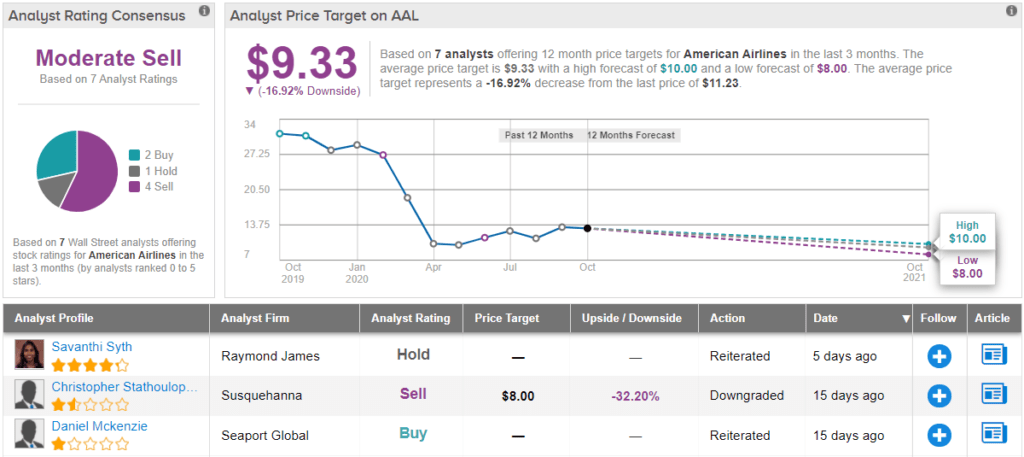

The rest of the Street, however, is not as optimistic. Based on 2 Buys, 1 Hold and 4 Sells, the stock has a Moderate Sell consensus rating. At $9.33, the average price target suggests shares will drop by another 17% over the next 12 months. (See AAL stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.