Over the past several quarters, AMMO Inc’s (POWW) performance has been explosive. The company’s newest manufacturing plant is set to increase its production capabilities and sustain ongoing growth momentum. I am bullish on the stock.

AMMO Inc. manufactures high-quality ammo for pistols and large rifles. Until recently, the company could deliver roughly 400 million rounds per annum through its 50,000 square feet manufacturing facility in Manitowoc, Wisconsin. That facility served the company well, helping AMMO grow its revenues from $2.3 million in 2018 to $225.6 million last year.

An Ammunitions Powerhouse in the Making

With last year’s production selling out rapidly, the company began to expand by constructing another 165,000 square feet manufacturing facility that has now boosted AMMO’s total production capacity to a billion rounds of ammo per annum.

Besides the fact that the new plant will significantly boost the company’s revenues (management is confident it will double the company’s market share), it will help it unlock multiple operational efficiencies, allowing it to cut costs.

Management has already mentioned that up to $1 million of cost-cutting will be realized directly. In addition, the company should achieve significant economies of scale, as this plant will make full use of automation equipment that lowers the total labor needed to assemble finished products.

Furthermore, the equipment that will be used is already owned by the company, which translates to higher operating leverage and a decline in fixed costs as a percentage of the total production.

Finally, the facility should reduce transportation costs, as it is located next to the brass manufacturing plant. The company had to previously transport the brass, which added to its total costs.

However, what makes AMMO the ultimate ammunition powerhouse is the synergies it enjoys through gunbroker.com. The company acquired the online auction house company last year, which has come with multiple advantages.

Firstly, AMMO gained access to a higher-margin business arm that is generating frictionless fees from the marketplace’s sales volumes/listings and growing rapidly. The website has more than 7.3 million registered users and adds an average of about 55,000 new users per month.

Secondly, management is confident that GunBroker’s revenues (along with the core business) will double over the next couple of years. This should be accomplished through multiple avenues that remain unexplored for the company. For instance, the company is adding new sellers to the platform that resembles Amazon’s approach, which should drive user growth and transaction volume. This is a proven growth concept and will be the first effort to monetize one of the website’s greatest assets – data.

Finally, it’s worth mentioning that while customers will be able to purchase AMMO’s ammunition through GunBroker (i.e., vertical integration with the new plant), AMMO does not directly sell weapons. It only acts as a marketplace. Thus, it doesn’t face any of the regulatory risks that come with gun sales.

Increased Production & Expanded Margins to Drive Profits

As previously mentioned, AMMO’s revenues have been experiencing an explosive growth trajectory, which will be sustained by the new plant and GunBroker’s potential.

The company recently wrapped up its Fiscal Year for 2022, with revenues coming in at $240.3 million, equating to a year-over-year increase of 285%. For Fiscal Year 2023, management’s outlook includes revenues of $300 million to $310 million, with the new plant already online.

As the company achieves economies of scale, its margins should expand. To illustrate, POWW’s gross and net margins improved from 19.6% and -13.4% to 39.5% and 14.7% from Fiscal 2021 to Fiscal 2022, respectively. With the plant already online, margins should improve even further.

Wall Street’s Take on POWW Stock

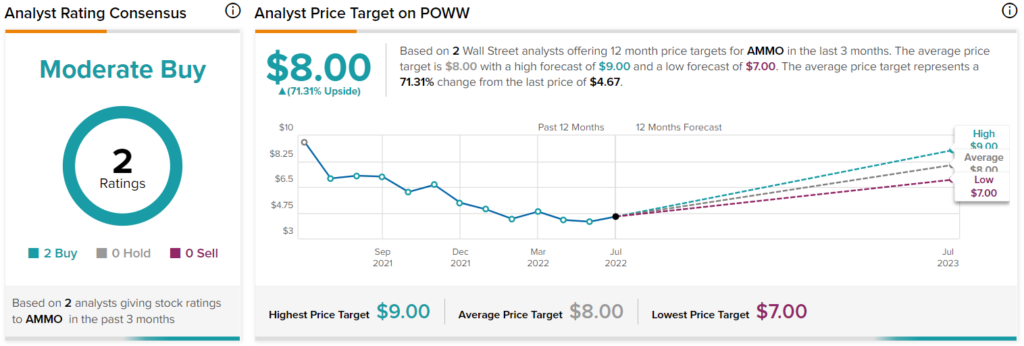

Turning to Wall Street, AMMO has a Moderate Buy consensus based on two Buy ratings assigned in the past three months. At $8.00, the average AMMO price target implies roughly 71.3% upside potential.

The Takeaway – AMMO’s Valuation Does Not Reflect Future Earnings Potential

AMMO’s growth trajectory over the past few years has been utterly impressive. Last year’s production was pre-sold quarters in advance. With the current geopolitical turmoil escalating, the additional rounds produced by the new manufacturing facility should be easily absorbed by the market.

In addition, with GunBroker’s full potential barely tapped and the company’s margins on the rise, AMMO’s profitability prospects are truly enticing.

Management’s outlook for Fiscal Year 2023 forecasts adjusted EBITDA to land between $108 million and $111 million. The stock is therefore trading at just around 4.8 times next year’s adjusted EBITDA. From another standpoint, assuming a 15% net margin at the midpoint of management’s sales guidance, shares trade at 11.5 times next year’s net income.

In my view, these make for quite attractive multiples considering the company’s growth momentum and market share expansion. This is especially the case considering that most defense-related stocks trade at a premium these days. Thus, the possibility for a multiple expansion is even stronger. For this reason, I am bullish on the stock.