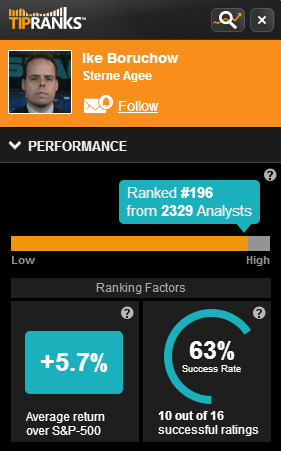

Sterne Agee analyst Ike Boruchow is no stranger to the good life. Ike’s familiarity stems from his research and recommendations of retail companies such as, Gap (GPS), Tiffany & Co. (TIF) and Urban Outfitters (URBN). Ike has been recommending to BUY and SELL said companies, earning the 196 spot out of 2,329 analysts with a 63% success rate of recommended said stocks and a +5.7% average return over S&P-500. Ike has proven his successful shopping skills, knowing when to BUY and when to SELL.

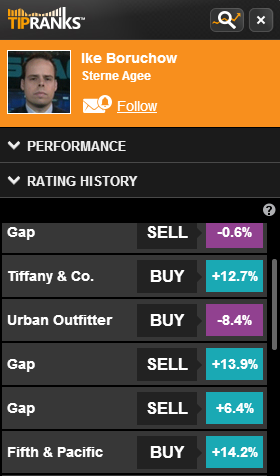

In October of 2013, Ike recognized all of Tiffany’s positive business momentum and recommend BUY TIF. Ike argued, “the company has a highly visible margin recapture opportunity over the next 18-24 months, a rapidly growing international platform (50% of sales comping HSD) and a US business that, while lagging the past 18 months, has recently made a number of key hires and implemented several new product initiatives that should lead to improving performance over the medium-term.” Ike took advantage of the pullback and used the entry point to secure a positive return, earning +12.7% over S&P-500.

Ike also knows when to recommend SELL in order to stay on top. Despite better-than-expected results for revenue of Gap stores that were opened for at least a year, Ike took into consideration other key extenuating circumstances. Ike admitted to Gap’s solid performance of strong denim and dress sales and Old Navy flip flops, but he maintained his SELL rating due to, “tougher comparisons that are coming up, high inventory levels and concerns that Old Navy’s recent strong performance may have been due to promotions.” Following this SELL recommendation, Ike earned +6.4%.

Of course, not all of Ike’s recommendations have earned him success. Ike initiated coverage on Urban Outfitters (URBN) with a BUY rating and a $45.00 price target. Ike chose to make his recommendation focusing on the strength of the company’s brands, “While a recent slowdown at the Urban brand has put the stock in the ‘penalty box,’ URBN still has two of the strongest apparel brands in retail today (Anthro and Free People) to drive top-line growth.” However, these brands were not enough to pull in a positive return, and instead Ike was left with -8.4% over S&P-500.

Most recently, Ike received a negative return from his BUY Ross Stores (ROSS). Ike argued “that any drop in its share price should be looked at as an opportunity to pick up shares at a discount.” And, even though he felt that the company was managing its inventory well and selling products at full price, he still ended up with -2.9%.

While you may not depend on Ike for fashion advice, his recommendations might be just the financial advice you were looking for. To continue following Ike’s recommendations, as well as other analysts’ financial advice, download TipRanks today and start making informed decisions for your portfolio.