You never can know what events will impact the stock market. In recent weeks, news of the coronavirus outbreak in China has been garnering headlines – and rightly so, as there have been over 2,800 confirmed cases of the contagious respiratory virus, and 81 people have died in China. With confirmed cases in the US, it’s clear that the virus has gotten into international travel routes – and while it’s not a particularly deadly disease, it does have potential for a serious epidemic.

That prospect spooked investors, at least temporarily, and the S&P 500 lost 1.57%. The NASDAQ, which is tech-heavy and also more exposed to China, saw the steepest daily loss, at 1.9%. Overall, it was the worst market day since October.

The key point is uncertainty. While the virus, as noted, is not very deadly, it does a contagious respiratory disease – and the potential impact on productivity, sick leave, and staffing in the event of viral epidemic is serious. Alec Young, in global markets research at FTSE Russell, points out that China is the worst possible place for such a virus to break out: “China is the biggest driver of global growth…” He adds, “Markets hate uncertainty, and the coronavirus is the ultimate uncertainty in that no one knows how badly it will impact the global economy.”

Uncertainty, however, is kissing cousins with volatility, and volatility isn’t necessarily bad. When markets start to swing, up or down, the extreme values extend outward. Yes, you can see sharp losses, but you can also see sharp gains. A new report from Evercore ISI outline where some of those gains are to be found.

The report is authored by Greg Gordon, one of Evercore’s Senior Managing Directors and the head of Power & Utilities Research. Gordon sees reason for optimism in the utility sector as 2020 gets rolling, and has upgraded three stocks from Neutral to Buy.

We’ve taken the analyst’s picks and looked them up in the TipRanks database. These are investments that the Stock Screener tool reveals as ‘Buy’ rated and, more importantly, all three offer reliable dividend yields. Let’s take a closer look:

CenterPoint Energy (CNP)

First up is Houston, Texas based CenterPoint, a major electric and gas supplier in Texas, Oklahoma, Arkansas, Louisiana, Mississippi, and Minnesota. The company does nearly $10 billion in business annually, and sees a net income exceeding $1.7 billion.

On the dividend front, CNP has been a consistent high performer. The annualized payment is $1.15, or 28.75 cents per share quarterly, which translates to a yield of 4.4%. This yield is more than double the 2% average found among S&P stocks, and CNP has a 14-year history of consistent payment. Even better, the 54% payout ratio indicates that the dividend is easily sustainable at current earnings.

Greg Gordon notes the shares’ poor performance in his comments, writing simply, “CenterPoint has underperformed significantly over the past year…” He goes on to point out, however, that the company has plenty of reasons for optimism in the near term: “CNP may or may not sell their unregulated businesses (per news reports) which while it would be EPS dilutive could improve its quality of earnings, enhance its risk profile and reduce equity needs because they have to shore up the balance sheet… [W]e believe they could grow EPS 6% annually through ‘22 after a repairing of the balance sheet due to above-average rate base growth at the utilities.”

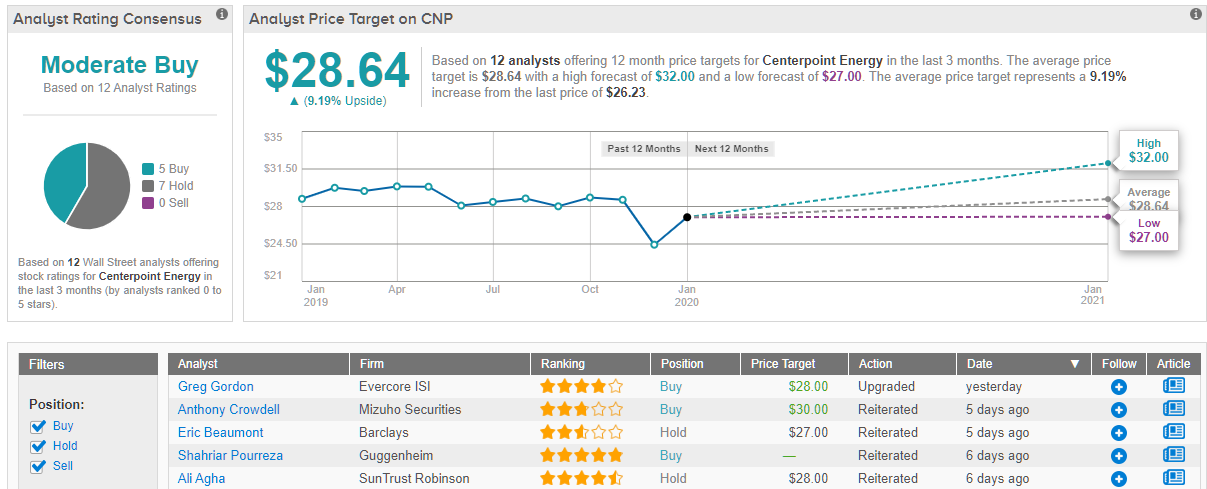

Gordon puts a $28 price target on CNP, showing modest confidence in this company; his target implies an upside of 7%. In-line with his belief that CNP can turnaround, Gordon has upgraded his stance from Neutral to Buy. (To watch Gordon’s track record, click here)

Chronic underperformance leaves a mark, even if the stock is ready to break out. CNP has 12 recent ratings, including 5 Buys and 7 Holds, giving it a Moderate Buy in the consensus view. The average price target, $28.64, suggests room for a 9.27% upside from the current $26.21 trading price. (See CenterPoint stock analysis at TipRanks)

NiSource, Inc. (NI)

Second up is a holding company. NiSource owns subsidiaries that deliver natural gas to 3.5 million customers, and electricity to another half million, across states in New England, the Midwest, and the Gulf Coast. The company is one of the largest utility providers in the US. Its northwest Indiana headquarters are conveniently located in a central point for its customer base.

NiSource has reliably maintained its dividend payment since 2011, sometimes adjusting the payout in order to keep the dividend sustainable for the long term. The current payment, 20 cents per quarter, was raised to its current level in two years ago. The yield, based on the annual payout of 80 cents, is 2.77%, slightly higher than the S&P 500 average and significantly better than the 1.5% to 1.75% yield on Treasury bonds. With a 57% payout ratio, NI should have no difficulty maintaining its dividend.

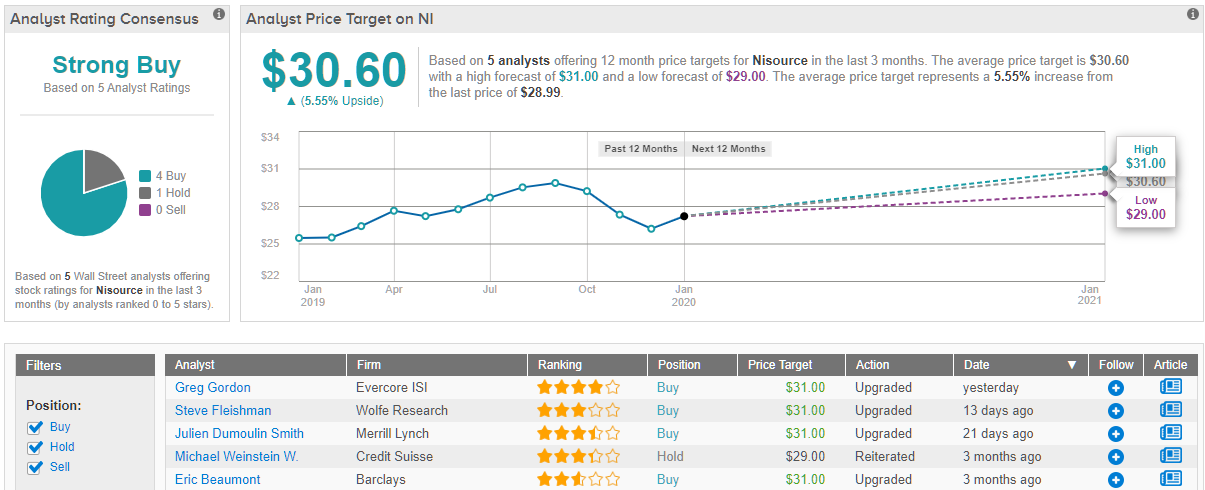

Gordon, of course, also sees a hopeful future for NI. He’s raised his stance on the stock to Buy, writing of the company, “NiSource stock has significantly underperformed the last two years and the stock now trades at a discount to peers. The company appears to have (finally) put a firm band around total costs for the Greater Lawrence incident, the cause of that underperformance… We derive a 9% estimated total return from our sum-of-the-parts analysis where, for the electric utility, we assign a 5% premium multiple to our base P/E target multiple of 19.5x ’22 EPS.” Gordon’s $31 price target suggests an upside potential of 7.3% here.

With NiSource, we get to a Strong Buy analyst consensus. This stock has 4 recent Buy ratings against a single Hold. Shares sell for $28.89, so the average target of $30.60 indicates a 6% upside. (See NiSource stock analysis at TipRanks)

DTE Energy Company (DTE)

Based in Detroit, DTE is Southeast Michigan’s major electricity provider. The company serves 2.2 million customers, mostly in Metro Detroit and the Thumb. Its operations include power generation from renewable energy sources. Another subsidiary, DTE Gas, provides natural gas to 1.3 million customers throughout the state. DTE is committed to encouraging green energy, and has a net-zero carbon emission goal date of 2050.

Being the major provider in its region has been good for business. DTE brought in $14.2 billion in revenues for fiscal 2018, up from $12.6 billion in 2017. Net income was essentially steady, at $1.11 billion in 2017 and $1.12 billion in 2018. The company has started 2020 with a modest share price gain of 1.86%.

Rising revenues and steady income have allowed DTE to be generous with the dividend. The $1.0125 quarterly payment annualizes to $4.05 and gives a yield of 3.06%. This makes DTE’s dividend return 50% higher than the average S&P listed company – and about double that of a Treasury bond. DTE has raised its dividend three times in the past three years, and with a payout ratio of 53% should have no difficulty maintaining the payment.

Greg Gordon’s outlook on DTE is upbeat. This is his third utility upgrade in a row, from Neutral to Buy, and he writes of the stock, “DTE has a long history of overcoming that skepticism by over delivering on financial targets and we believe this will continue, with our expectation that DTE will deliver toward the upper end of its 5-7% EPS growth plan, with growth at the utilities and gas storage and pipeline business offsetting the next roll off of Reduced Emissions Fuel Credits in 2022. We expect outperformance over the coming months as investors get more comfortable with DTE’s latest gas midstream acquisition and as the company potentially outperforms financial targets…”

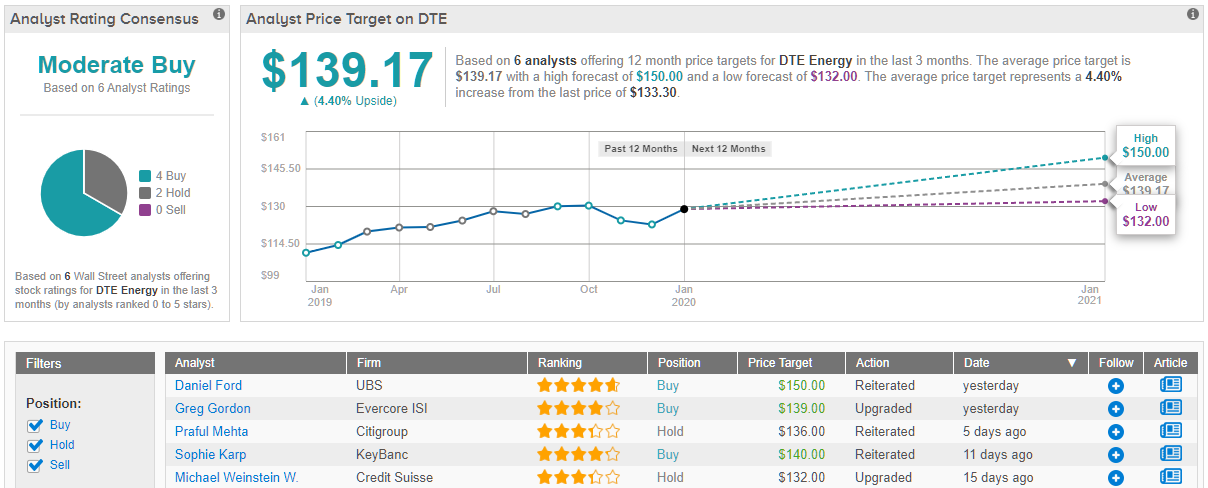

In line with his optimistic outlook for the stock, Gordon raises his price target on DTE from $128 to $139, implying a potential upside of 5%. (To watch Gordon’s track record, click here)

DTE holds a Moderate Buy from the analyst consensus, based on 6 recent reviews that include 4 Buys and 2 Holds. Shares are selling for $132.29, and the $139.17 average price target suggests room for a modest 5.2% upside. (See DTE stock analysis at TipRanks)