By Carly Forster

Five-star analyst Brian Wieser of Pivotal Research Group came down hard on four big player internet stocks on July 13 when he cut his price targets for Facebook Inc (NASDAQ:FB), Twitter Inc (NYSE:TWTR), Yahoo! Inc. (NASDAQ:YHOO), and Google Inc (NASDAQ:GOOGL).

The analyst’s price target cuts stems from “the higher cost of capital incorporated into equity market valuations vs. [his] last round of quarterly updates in April,” which he believes “in general should have a depressing effect on valuations.”

Despite lowering his price target for Facebook from $107 to $105 and Twitter’s price target from $50 to $41, Wieser still maintains a Buy rating on both stocks.

He specifically pointed out his optimism on Facebook’s growing traction with advertisers, noting, “We have incorporated raised expectations for the company given ongoing traction with various segments of advertisers that should help Facebook [capture] a growing share of digital advertising budgets.”

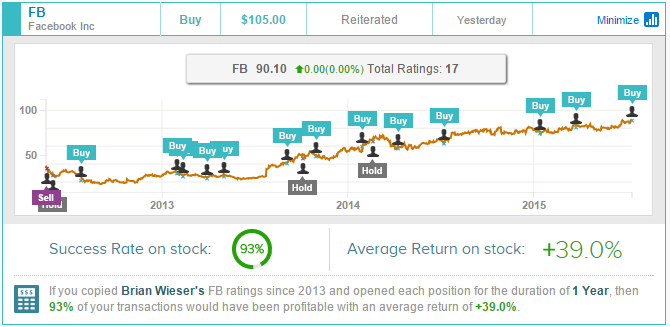

Wieser has rated Facebook a total of 17 times, earning a 93% success rate recommending the company and a +39.0% average return per recommendation when measured over a one-year horizon and no benchmark.

Wieser is also positive on Twitter’s business but believes the company has been most affected by higher capital costs. He cites that “a disproportionate share of current period value is dependent on discounted value of future cashflows.”

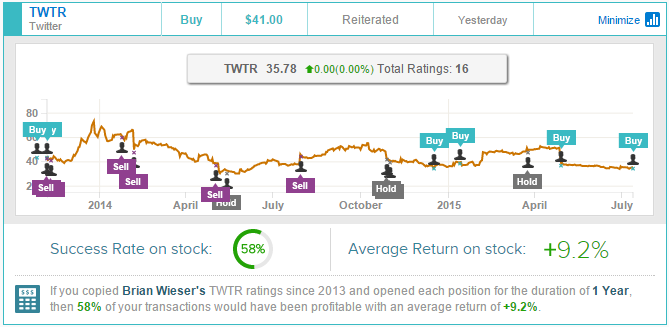

The analyst has rated Twitter 16 times total, earning a 58% success rate recommending the stock and a +9.2% average return per recommendation when measured over a one-year horizon and no benchmark.

Wieser maintained his Hold rating on Yahoo! and cut his price target on the stock from $49 to $42. Aside from the high cost of capital, the analyst attributed his neutral rating and lower price target on Yahoo to Alibaba’s recent drop due to the fall of the Chinese economy. Yahoo has been planning to spin off its stake in Alibaba by Q4 2015 and with the recent drop in the stock, Weiser sees Yahoo as a “slightly higher risk.”

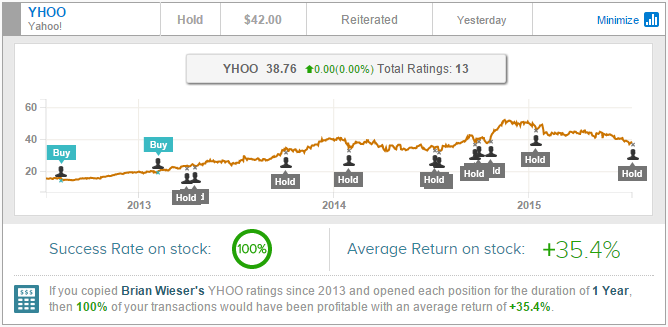

The analyst has rated Yahoo a total of 13 times, earning a 100% success rate recommending the stock and a +35.4% average return per recommendation when measured over a one-year horizon and no benchmark.

Wieser did not maintain his rating for Google like he did for the others, however, downgrading the stock from Buy to Hold and significantly cutting his price target from $640 to $570. The analyst anticipates the company’s Q2 revenue to come in lower than Q1 as a result of foreign exchange headwinds. While Weiser forecasts “+12% growth in revenue” for the quarter and “+12% full year growth (both as reported, after currency effects),” his “model incorporates slightly upticked operating margins on the quarter and the year, but slight declines over longer time-frames.” He also notes that “capital expenditures remain a significant wild-card in valuing Google, although the question is really how much capex rises with each passing year rather than whether it will go up and down over time.”

Weiser has rated Google a total of 9 times, earning a 100% success rate recommending the company and a +9.9% average return per recommendation when measured over a one-year horizon and no benchmark.

Brian Weiser has an overall success rate of 82% recommending stocks and a +19.6% average return per recommendation when measured over a one-year horizon and no benchmark.

Carly Forster writes about stock market news. She can be reached at Carly@tipranks.com