A stock can experience a pullback for a variety of reasons, be it disappointing quarterly results, the impact of internal politics, or the effect of the coronavirus on the economy. Yet, traditionally, those with strong fundamentals will bounce back and be propelled upwards again. As the pros will tell you, the best play in the investing game is to seek out the promising names when they’re beaten down as opposed to when they’re already moon bound. Or as industry parlance has it, to “buy the weakness.”

With this in mind, we set out to put this maxim to work. Using TipRanks’ Stock Screener, we found three stocks that have experienced a recent pullback but which the analysts think are ripe for a turnaround. What’s more, according to the data crunching tool, all currently boast a Strong Buy consensus rating from the Street.

Builders Firstsource (BLDR)

There’s no beating about the bush here. Builders Firstsource does what it says on the tin; the Dallas, Texas based company manufactures and supplies building materials, and is the US’s largest supplier of building products and prefabricated components.

BLDR had an outstanding 2019; boosted by consistent earnings beats, the stock appreciated by 138% throughout the year. In the last week, though, sentiment has turned bearish and BLDR stock has tumbled by 17%.

The drop came following the release of BLDR’s latest earnings results. BLDR’s F4Q19 EBITDA came in at the high end of management’s guidance ($109.3 million), along with gross margin exceeding expectations, whilst the -2.9% sales comp was within the company’s -2% to -5% guide.

According to Wedbush’s Jay McCanless, there are reasons for investors’ disappointment: “We believe a continuing EPS number of $0.31 (excludes an ~$0.04/share tax benefit from a 13% tax rate versus the 25% we expected) versus the F4Q19 Thomson consensus estimate of $0.33 may be one explanation. Another may be the 60bp Y/Y increase in BLDR’s SG&A/sales ratio to 22.8% which was 80bp above the consensus estimate,” said the 4-star analyst.

Nevertheless, McCanless notes “the key metrics beat our forecasts and we would buy on any weakness.” Accordingly, McCanless reiterated an Outperform on BLDR, along with a price target of $29. The implication for investors? Potential upside of 38%. (To watch McCanless’s track record, click here)

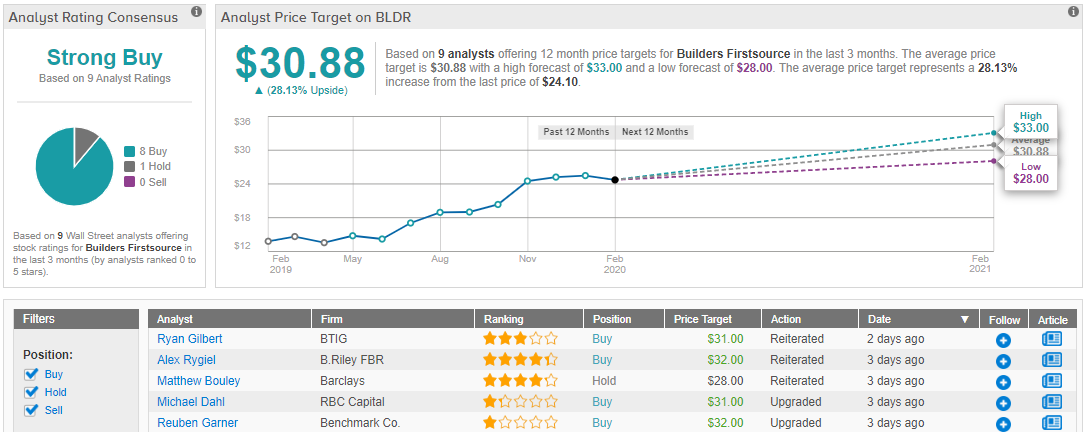

Overall, the Street is with the bulls on Builders. 8 Buys and 1 Hold add up to a Strong Buy consensus rating. At $30.88, the average price target implies possible gains of 33% in the year ahead. (See BLDR stock analysis on TipRanks)

Heron Therapeutics (HRTX)

From builders to biotechs, where we encounter Heron Therapeutics. This San Diego small-cap develops treatments to address unmet medical needs, with a focus on patients suffering from cancer or postoperative pain. Year-to-date, Heron stock is down by 21%.

Heron is currently waiting for approval from the FDA on its experimental post-operative pain medication HTX-011. The FDA recently extended the review period for the drug by up to three months. The PDUFA date is now June 26, 2020, but the regulator has indicated the review may be completed sooner.

The announcement of the delay was accompanied by a positive update. The FDA has recommended that the manufacturing site for HTX-011 should be approved by the inspector. To recall: Last May, HTX-011 was rejected by the FDA not because of clinical or safety issues, but on account of a lack of Chemistry, Manufacturing and Controls (CMC) data.

Cowen’s Boris Peaker believes the delay is just a minor setback. The 4-star analyst expects approval for HTX-11, and also recommends to “buy the stock on weakness.”

Peaker further added, “We are not changing the long-term outlook for HTX-011 in our model and anticipate only an incremental delay in the launch date without an impact on competitive positioning of this drug. We continue to believe that Heron is in a strong position to launch HTX011 with~ $390MM in cash and investments at YE19 and we model operating cash burn of ~$120MM in 2020. The company has sufficient capital to maintain pre-launch activities ahead of the new PDUFA date.”

Accordingly, Peaker kept his Outperform rating as is, with the price target remaining at $40. This conveys his confidence in Heron adding 115% to the share price over the next 12 months. (To watch Peaker’s track record, click here)

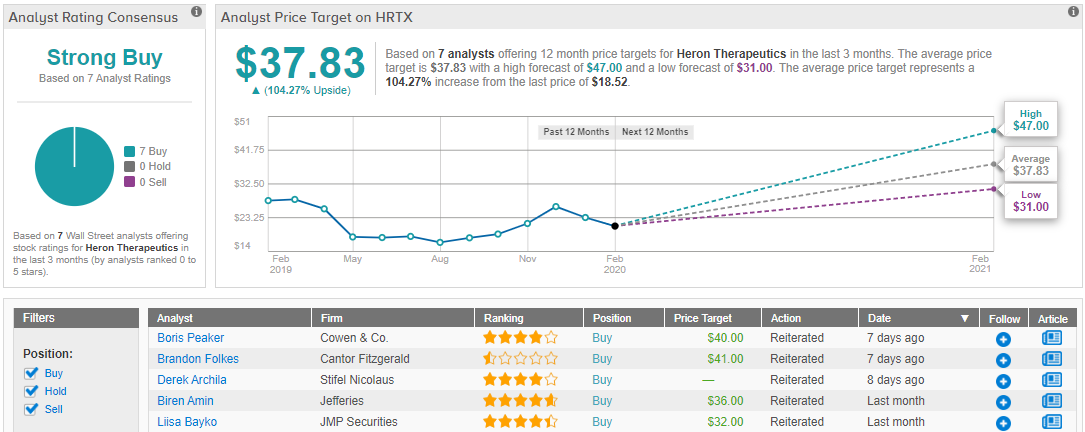

Overall, a full set of Buys – 7, as it happens – means HRTX currently hold a Strong Buy consensus rating. The analysts see the biotech gaining 104% this year, should the average price target of $37.83 be met in the year ahead. (See Heron stock analysis on TipRanks)

Lithia Motors (LAD)

Lithia Motors has built its way up to become one of the US’s largest car retailers. The company has been on a shopping spree and the constant expansion means it is now the third largest automotive retailer in the country. Only last week, Lithia announced that it had acquired two Lexus stores in Sacramento and Roseville, California. The company has also been receiving plaudits from its peers; yesterday it was announced that twenty-eight Lithia Motors stores have been awarded 2020 Dealer of the Year by DealerRater, a leading car dealership reviewer.

The growth was mirrored by an excellent market performance in 2019, with 95% added to the share price over the year. Year-to-date, though, LAD stock is down by 15%.

The company’s recent earnings results were mostly in-line with expectations. Revenue of $3.27 billion, indicated 10.1% year-over-year growth and beat the estimate by $50 million, although at $2.95 the company slightly missed on EPS by $0.02.

Despite the decent quarter, shares dropped following the report’s release. J.P. Morgan’s Rajat Gupta believes there’s a simple explanation. The analyst notes the well above-average growth metrics were not like the strong beats seen at peers. According to Gupta, though, the drop is an opportunity to snap up shares at a discount.

“We would treat any weakness in the stock as a buying opportunity, as we continue to see room for upward revisions to forward estimates with further upside from capital deployment,” he added.

Bottom line, Gupta’s Overweight rating stays put along with the $175 price target. The figure implies possible upside of 40%. (To watch Gupta’s track record, click here)

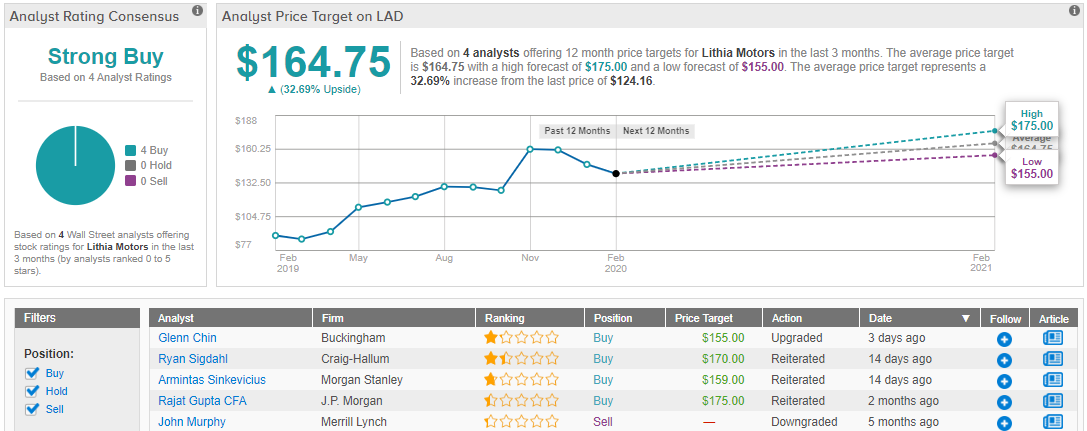

The Street revs up its engine in agreement. All 4 analysts tracked over the last 3 months agree Lithia is a Buy. Accordingly, Lithia has a Strong Buy consensus rating. The average price target of $164.75, indicates potential gains of 33% from current levels. (See Lithia stock analysis on TipRanks)