In 1982, the late Neil Peart wrote, with conscious irony, “constant change is here to stay.” The years since have only proved his insight, with the added twist that the true constant is the steady acceleration in the rate of change. And nowhere is that more evident than in the tech industry.

The continuing shift to 5G digital is a perfect example. The new digital technology promises to thoroughly upend the cellular market, bringing in faster mobile internet connection times and download speeds, and clearer voice signals. The new tech has been available since 2017, and nationwide networks debuted in the US last year. 5G has been available at smaller scales, mainly in urban areas, since late 2018.

The switchover, like any great change, promises opportunity and profit to those able to get in on the ground floor. Wall Street’s top analysts have been busy searching the market, finding those companies that are best positioned to strike it big in the 5G shift. We’ve run three of their top choices through the TipRanks Stock Comparison tool, to see where they stand now, as the “Year of 5G” get started. Let’s take a closer look.

Inseego Corporation (INSG)

Our first stock is an IoT company. Inseego specializes in mobile connection systems for industrial internet, providing advanced modems and routers for enhanced device-to-cloud integration. It’s no surprise, then, that Inseego is deeply involved in 5G; the faster connection and download times will be essential in developing the full potential of IoT systems. Last year, Inseego took a step in that direction with the first commercially available 5G mobile broadband hotspot.

Inseego’s potential as it moves toward the new digital tech is clear from the stock’s recent performance. INSG shares gained 76% in 2019, with particularly strong gains in Q4. That quarter’s earnings will be reported in early March. Analysts expect to see a net loss of 13 cents, a common occurrence for cutting edge tech companies. It’s important to remember, however, that the company’s revenues are growing. In Q3, INSG posted $62.72 million in revenues, beating forecasts by 5.4% and growing 23.8% year-over-year. A similar showing in Q4 will reinforce investors’ faith in the company.

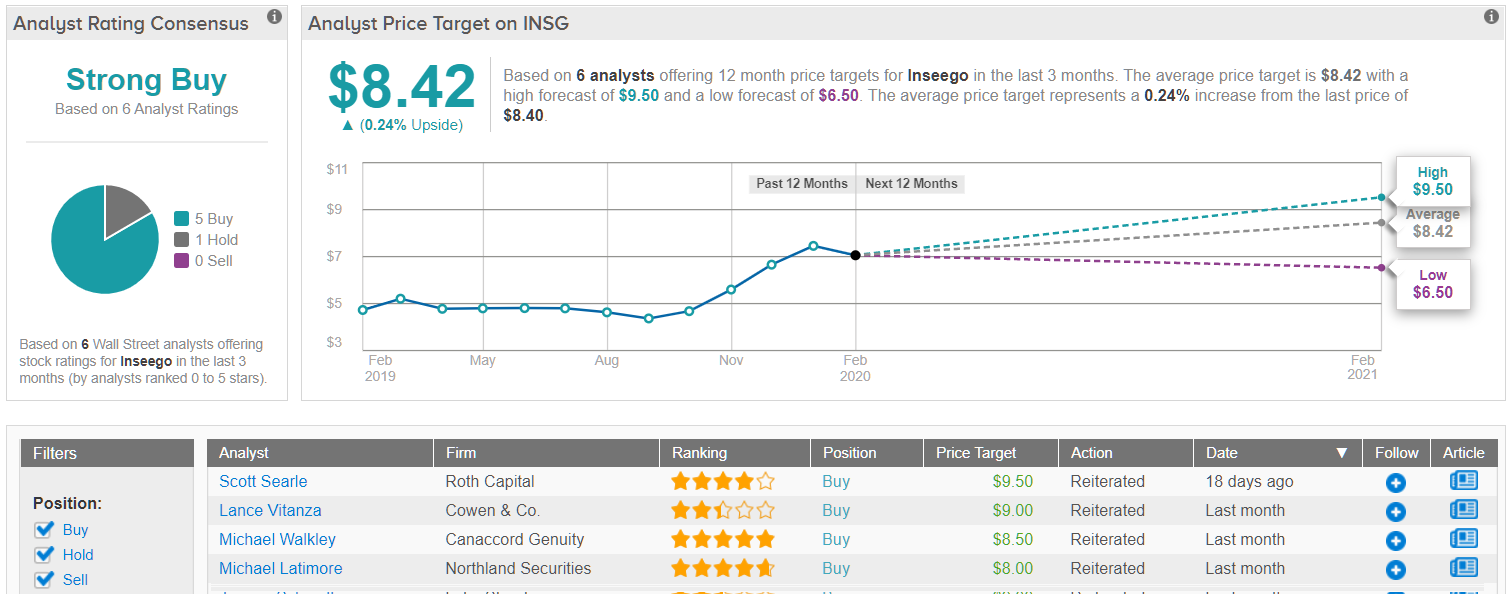

Roth Capital analyst Scott Searle, who rates 4 stars from TipRanks, says of the company, “Entering 2020 Inseego is positioned to transform its balance sheet, embark on a new enterprise product platform and solutions strategy, and benefit from general 5G momentum. Importantly, increasing spectrum availability and an expansive 5G FWA market will be key global drivers into 2021 and beyond.”

Searle’s gives INSG a $9.50 price target with his Buy rating, implying an upside of 14%. (To watch Searle’s track record, click here)

Overall, the average price target of $8.42 suggests a minimal upside – but also reflects the stock’s recent gains. The stock’s Strong Buy consensus rating is based on 5 Buys and a single Hold given in recent weeks. (See Inseego stock analysis at TipRanks)

Skyworks Solutions (SWKS)

The semiconductor industry also stands to gain from 5G, as device and equipment manufacturers buy upgraded chips to handle the new signal bands and speeds. Skyworks, which supplies chips to the wireless handset industry, is perfectly positioned to gain from this. The company’s main focus is on small-cell and MIMP tech, which are directly applicable to the 5G ramp. 5G, especially on the higher-end, is shorter ranged than existing 4G signals, and the new networks will require denser grid systems of small-cell towers and transmitters.

Among Skyworks’ chief products are the RF chips that make broadband, mobile, and wireless infrastructure possible. The company is invested in Samsung and Huawei, with about 10% of sales going to the two Asian giants, but its largest customer is Apple. Apple makes up about 47% of Skyworks’ total sales, and the chipmaker provides components for the latest 5G capable iPhone models.

Skyworks reported fiscal Q4 results late last year, beat both revenue and EPS forecasts. At $1.52 per share, EPS was 1.3% better than expected. Revenues came in at $827.4 million, a quarter point over expectations.

More recently, the company’s fiscal Q1 results showed even stronger beats. The Q1 EPS of $1.68 was 1.8% over the forecast, while the $896.1 million in revenue beat estimates by 2%. Management credited the better-than-expected earnings and revenue to increased 5G business, especially in cell phone handsets. Mobile products made up 73% of the revenues.

Wall Street’s analysts were upbeat after the Q1 report. Harsh Kumar, from Piper Sandler, wrote of the company’s Q1 performance, “Skyworks reported solid December quarter results and provided strong March quarter guidance, as both were higher than Street expectations. The company is now starting to ship 5G components to Chinese OEMs… We expect 5G to be a meaningful tailwind for Skyworks, and management sounded extremely optimistic about its prospects with the large U.S. handset OEM.”

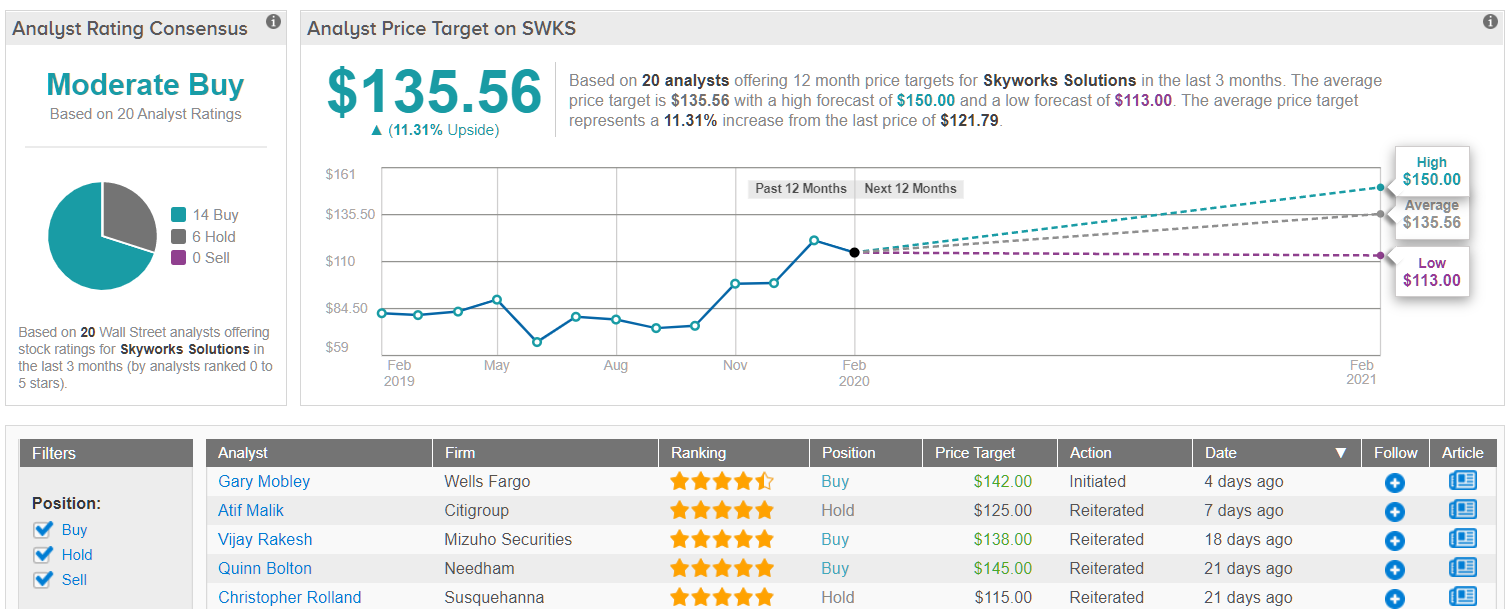

Kumar’s $140 price target implies an upside of 14% for SKWS, supporting his Buy rating. (To watch Kumar’s track record, click here)

5-star analyst Ruben Roy agrees with Kumar. He wrote, “SWKS management executed well in the sometimes challenging 2019 calendar year and the Company’s margin and cash flow metrics remain amongst the best across the semiconductor group. With the 5G handset cycle now ramping, SWKS delivered results and March quarter outlook above consensus expectations.”

Ruben gives SWKS another $140 price target, along with a Buy Rating. (To watch Ruben’s track record, click here)

With 14 Buy ratings against 6 Holds, Skyworks has a Moderate Buy from the analyst consensus. Shares are not cheap, priced at $122, but the average price target suggests room for 10% growth on the upside – a clear incentive for investors. (See Skyworks’ stock analysis at TipRanks)

MasTec, Inc. (MTZ)

Our final stock today may not strike you as a clear gainer from 5G. MasTec is an engineering firm, solidly based in the energy and construction industries. The company has a 20-year history and has grown into a $4.9 billion behemoth. And, it has a workforce of trained technicians capable of actually putting up the new cell towers that expanding 5G networks require.

The company is optimistic about gaining 5G construction and installation business. By mid-2019, MasTec was even reporting a labor shortage – there simply weren’t enough technicians to manage all of the installation jobs, and the company had about 15% more tenders than available crews. Recruiting and training have become major expenditures for MasTec as it works to attract 5G-related business.

In the meantime, MTZ has been reporting strong earnings. For Q3, the company showed $2.02 billion in revenue, up 2% year-over-year, and EPS of $1.73. The EPS number was 6% over estimates and up 30% yoy. Looking ahead, MTZ is expected to report $1.22 EPS for Q4 on February 27. The slip from Q3 would be in-line with past performance patterns.

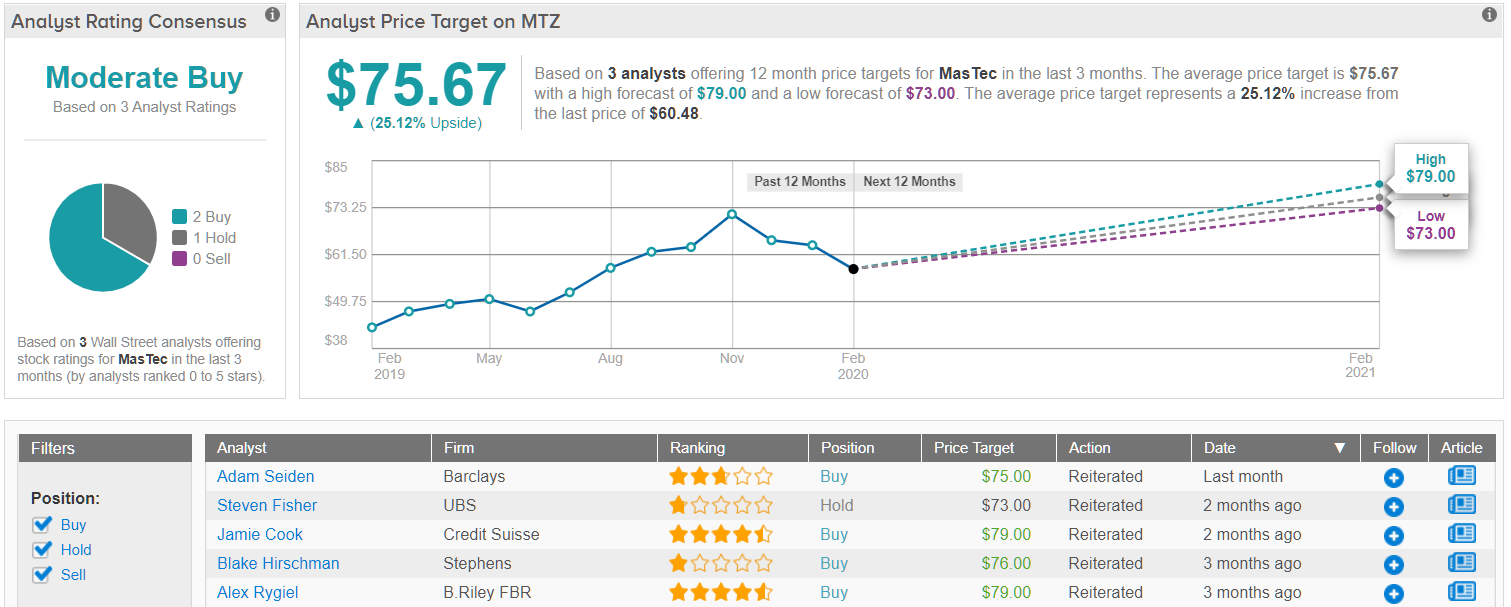

Barclays analyst Adam Seiden writes of MTZ’s prospects, “The start of the 5G buildout has been later than anticipated, but is not a matter of if, but a matter of when. MTZ noted at a conference in Dec that both its Wireless and Wireline businesses could grow at double-digit rates until 3Q20-2Q21, when 5G spending could start to inflect even higher.”

Seiden set a $75 price target on MTZ, along with a Buy rating. His price target indicates confidence in a 23% upside potential. (To watch Seiden’s track record, click here.)

MTZ has only three recent analyst reviews, split 2 Buys to 1 Hold for a Moderate Buy consensus rating. The stock sells for $60.75, and the average price target of $75.67 suggests an upside potential of 24%. (See MasTec’s stock analysis at TipRanks)