By Oz Talmor

Optimistic views on Alzheimer remedy in its making by Anavex Life Sciences Corp (NYSE:AVXL) and improved earnings report by Cytosorbents Corp (NASDAQ:CTSO) caused analysts to reiterate Buy ratings on both companies. Let’s take a closer look:

Anavex Life Sciences Corp

The 14th International Symposium on Advances in Alzheimer Therapy was an exciting day for Anavex Life Sciences as good news kept pouring in from its Phase IIa study of its prime drug, Anavex. Designed to reverse memory (and other cognitive) damage in mild-moderate Alzheimer Disease (AD) patients through potential disease modification, Anavex seems to demonstrate effective results and is accumulating hard data to show for it.

As a result of these findings, analyst Jason Kolbert from Maxim Group weighs in with his prospects for the company and its pipeline.

The company announced that it will extend its Phase IIa study in Australia for two years as a result of the positive response to the AD drug. Kolbert also explains that the long term data (3+ years) from the study will serve the company well. The analyst states, “Dose response data in the 32 AD patients treated with doses of 2-73 ranging from 3mg administered intravenously to 50mg administered orally, demonstrate a positive slope in MMSE and ERP/p300 changes which suggests a dose dependent improvement… The dose dependent changes in MMSE and ERP were statistically significant (P=0.0285 and P=0.0168, respectively).”

The future of the company seems bright according to Kolbert. He explains, “Anavex recently announced that it is moving forward with the development program for ANAVEX 2-73. Guidance received from the FDA confirms the strategy to advance ANAVEX 2-73 (Alzheimer’s) in a larger double-blinded, randomized, placebo-controlled P 2/3 study.” He continues, “The dose dependent improvements in AD patients builds on previous data (shorter dose period) pointing to positive signs of an efficacy ‘signal.’ Combined with positive feedback and a requested extension study to prolong patients getting therapeutic benefit, we see Anavex moving closer to establishing proof of concept.” Kolbert reiterates a Buy rating and sets a 12-month price target of $15.00.

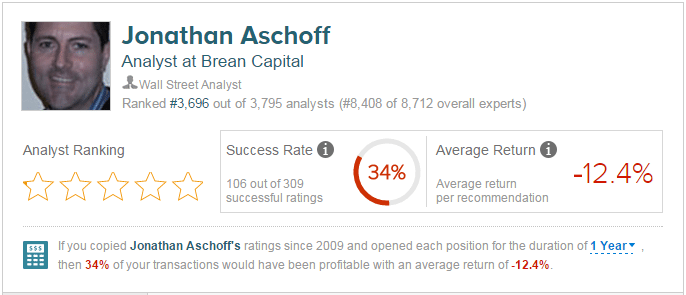

According to TipRanks, Jason Kolbert has a 29% success rate and his average loss per recommendation is (15.80%).

Cytosorbents Corp

Analyst Jonathan Aschoff of Brean Capital weighed in on Cytosorbents after the company released its 4Q15 earnings last week. The immunotherapy company posted revenues of $1.8 million and a loss of ($0.08) per share, in line with estimates. Cytosorbents’ earnings showed a remarkable improvement in sales despite foreign currency headwinds, up 39.7% from 3Q15 ($1.5M from $1.1M) resulting from “strong direct and distributor sales reorders.” More strategic actions by the company also attracted the analyst’s attention.

The analyst points out that Cytosorbents ended the quarter with $7.5M in cash reserves, “which should be sufficient to support operations through 2016.” In his opinion, it is a great head start for a capital intensive schedule. He explains, “We expect the company to have sufficient cash to support its operations through 2016, but it will need to raise capital to help fund its trials in the US and Germany,” expected to take place in 2016.

Aschoff elaborates on two new strategic moves taken by the company. He states, “CytoSorbents is actively working with KOLs as well as practicing physicians in its direct territories of Germany, Austria, and Switzerland.” He then proceeds to share his prospects on the company’s sales, stating, “CytoSorbents expects direct sales to account for more than 50% of CytoSorb sales in 2016 and to play a major role going forward.” Lastly, the company’s strategic partner, Fresenius Medical Care, started a pre-marketing campaign in several European countries which in the analyst’s opinion presents a market opportunity of 127 million people.

The analyst reiterates a Buy rating and lowers his target price down to $24.00 (from $25.00) “due to minor model adjustments.”

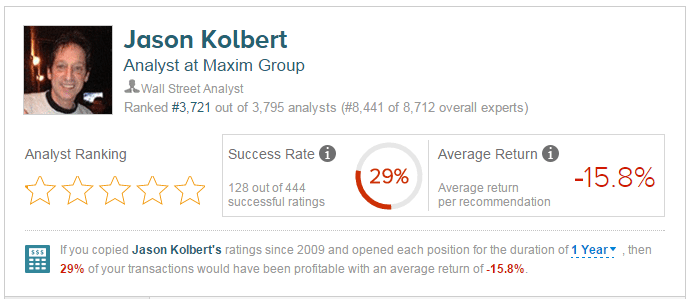

According to TipRanks, 34% of Jonathan Aschoff’s recommendations are profitable with an average loss per recommendation of (12.4%).