There are thousands of stocks traded in the major exchanges, and it’s not easy to track their movements. A head for numbers helps, but so does a knack for timing. Understanding both helps to make sense of the earnings season.

Once every quarter, publicly traded companies are required to release their financial results – revenues, sales numbers, earnings, and the like. These are the metrics that stock followers use to decide their investment allocations, and share prices tend to rise and fall on the expectations, and the realities, of the quarterly reports.

Just last week, three great stalwarts of the Dow Jones index reported their earnings for the final quarter of calendar year 2019. The Dow, of course, is the classic stock index – a group of 30 companies selected to represent the larger market, as their smaller number makes them easier to track collectively – and the companies comprising the index are major names in their sectors.

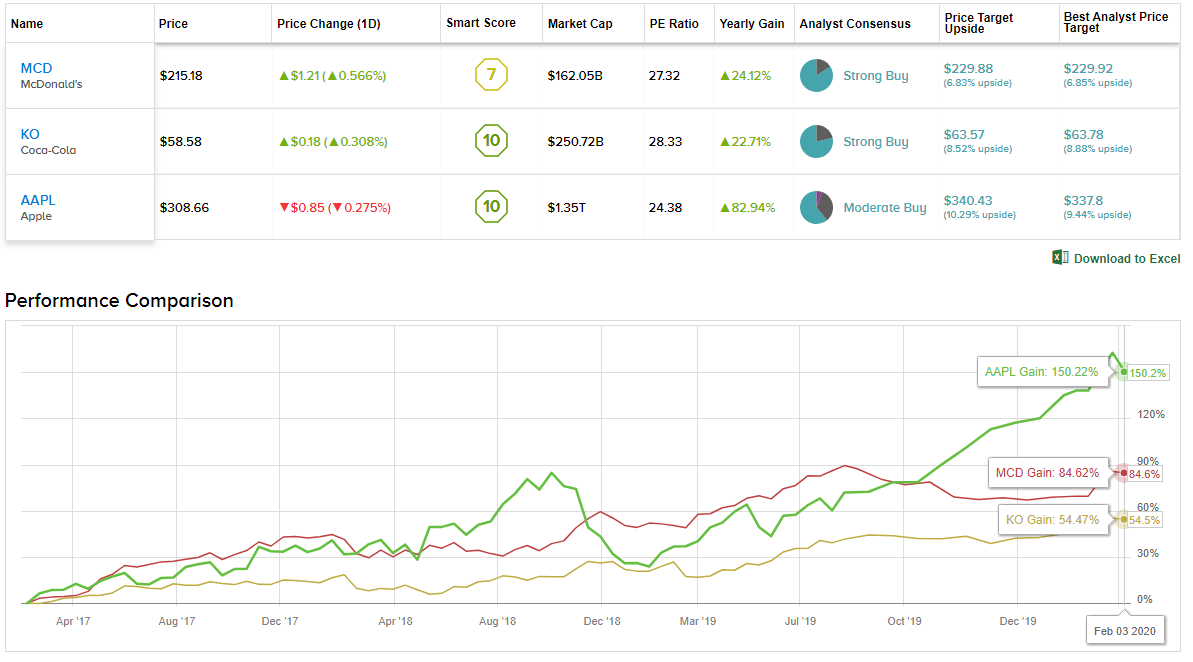

Using the Stock Comparison tool from TipRanks, we can look at these three companies, side by side, comparing their attributes. All are Buy-rated, show an upside between 5% and 10%, and are on an upward trajectory. Let’s take a closer look.

McDonald’s Corporation (MCD)

McDonald’s – the modern fast-food colossus created from the vision of salesman Ray Kroc – has shown strong gains in recent years, the fruits of an ambitious turnaround plan by now-former CEO Steve Easterbrook. While Easterbrook had to leave the company in disgrace this past November, causing the stock to dip sharply in response, his plan continues to bolster the company’s prospects. MCD shares gained 12% in 2019, less than the broader market but still a reliable gain. Also good for investors is the dividend, which at 2.31%, yields significantly more than the market average.

The company’s earnings disappointed in Q3, but Q4 gave MCD shares a boost. EPS came in at $1.97 and revenues were reported at $5.3 billion, both in line with the Street’s forecast. The numbers were a relief, coming from a company that had to fire its CEO during the quarter. In better news for investors, and a testament to the company’s success at rebranding itself, global same-store sales numbers grew 5.9%, well above the forecast. Investors have been sanguine about MCD’s prospects heading into 2020, and the stock is up 9% so far this year.

Writing on the stock for Evercore ISI, 5-star analyst David Palmer says, “We believe 2020 is positioned to be a strong year for McDonald’s. A large portion of the US EOTF investment heavy lifting is in the rear view mirror and there is strong system alignment around the outlook for 2020 with a focus on: 1) advertising effectiveness, 2) value marketing efficiency, 3) premium menu innovation/renovation, 4) improving focus on operations, and 5) technology integration…”

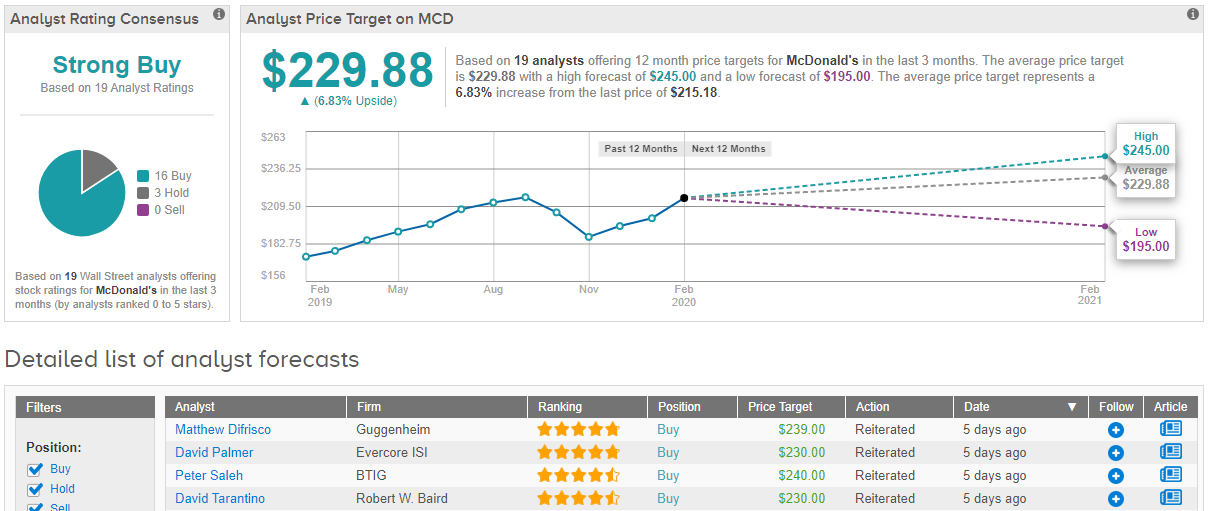

In line with his bullish view of the stock, Palmer maintains his Buy rating and puts a $230 price target on MCD, implying a possible upside of 7%. (To watch Palmer’s track record, click here)

McDonald’s holds a Strong Buy consensus rating from the analysts, based on a lopsided split of 16 Buys to 3 Holds. There are no sell-side reviews. Shares are trading for $215.18, and the $229.88 average price target suggests a potential upside of 7%. (See McDonald’s stock analysis on TipRanks)

Coca-Cola Company (KO)

Our next stock is a beloved staple of Warren Buffett’s portfolio. The investing guru has always loved the product, but even more, he loves the stock. Coke’s superb branding (everyone recognizes it), long-term gains (it’s up 41% over the past five years), and its reliable dividend (at 2.74%, the yield beats the market average and Treasury bonds) combine to make the stock a fine vehicle for steady returns.

Coke’s steady momentum shows in its 2019 gain of 20%. It underperformed the broader market by about a third, but nothing seems to slow it down. The 40-cent dividend is reliable, paid out every quarter, and the 71% payout ratio shows that the company can afford the dividend and is committed to sharing profits with stockholders. This is a near-perfect long-term investment, as Buffett would attest.

KO met or exceeded Wall Street’s expectations for 2H19, with solid performances in both Q3 and Q4. The Q4 report showed EPS as forecasted, at 44 cents, while revenues beat the consensus estimate at $9.07 billion. Even though soda consumption has been slowing in recent quarters, the company has compensated with a combination of new products and smaller cans. This drove a 135% increase in net income from the year-ago quarter.

The analysts are pleased with Coke’s performance. Nik Modi, of RBC Capital, laid it out clearly, saying, “KO continued to ride on its momentum and exited 2019 with solid results, with a top-line beat and in-line earnings growth. 2020 guidance was in line with consensus and our expectations. A really good quarter with hardly any holes to poke.”

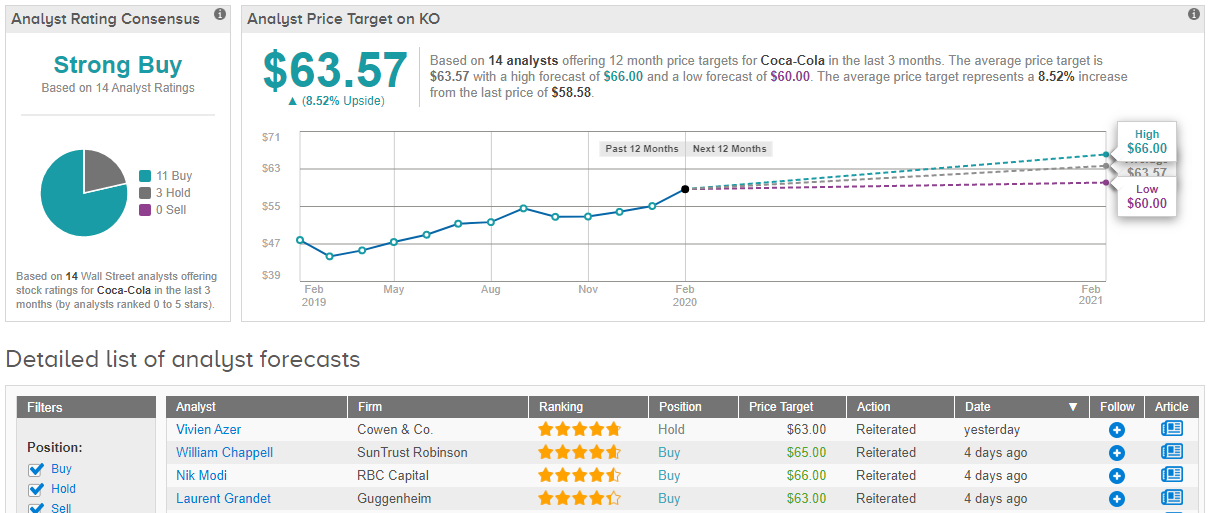

Modi gives KO shares a Buy rating with a $66 price target, raised from his previous target of $60. His new target implies room for 13% share appreciation. (To watch Modi’s track record, click here)

Analyst Stephen Powers of Deutsche Bank concurs, writing in his recent review of the stock, “We have great confidence that KO is well-positioned to grow in line with its +4-6% top-line algorithm into the future, given global revenue growth management initiatives, innovation, portfolio expansion, and general global system alignment.”

Powers maintains his Buy rating and $64 price target, indicating 9% upside potential. (To watch Powers’ track record, click here)

With 14 reviews, including 11 Buys and 3 Holds, KO shares have a Strong Buy from the analyst consensus. The average price target of $63.57 suggests upside potential of 9% from the current share price of $58.58. (See Coca-Cola stock analysis on TipRanks)

Apple, Inc. (AAPL)

Last up is Apple, Steve Jobs’ baby that continues to shape the way we interact with the digital world. From the iPod to the wearable Apple Watch, this company has always positioned itself with one foot solidly at the forefront of technology. The strategy has worked, and today, Apple is the world’s most valuable publicly traded company, with a market cap of $1.35 trillion.

Like the other stocks on this list, Apple has momentum on its side. Shares are up 160% over the past five years, rose 89% in 2019, and have started 2020 with a 5% gain. It’s a steady record of share appreciation for stockholders’ benefit. The company pays a modest dividend, with a yield of just 1%, but the payment is reliable. Apple has also raised the dividend twice in the last three years.

Adding to the good news, AAPL beat the forecasts in every quarter of calendar year 2019, with the fourth (fiscal Q1) showing the widest margin. EPS beat the forecast by 44 cents, coming in at $4.99. Revenues were $91.8 billion, where the forecast was $88.5 billion. Additionally, iPhone revenues rose after a disappointing Q3, gross margins rose to 38.4%, and the company raised its Q2 guidance.

Among the bulls is Brian White, of Monness. He says of AAPL, “Looking forward, we anticipate healthy demand for Services and Wearables to continue. Also, we expect Apple to benefit from the launch of its first 5G iPhones in September… Our balanced view of this cycle reflects the maturity of the smartphone market and our expectation that consumers will take a measured approach to upgrading to 5G…”

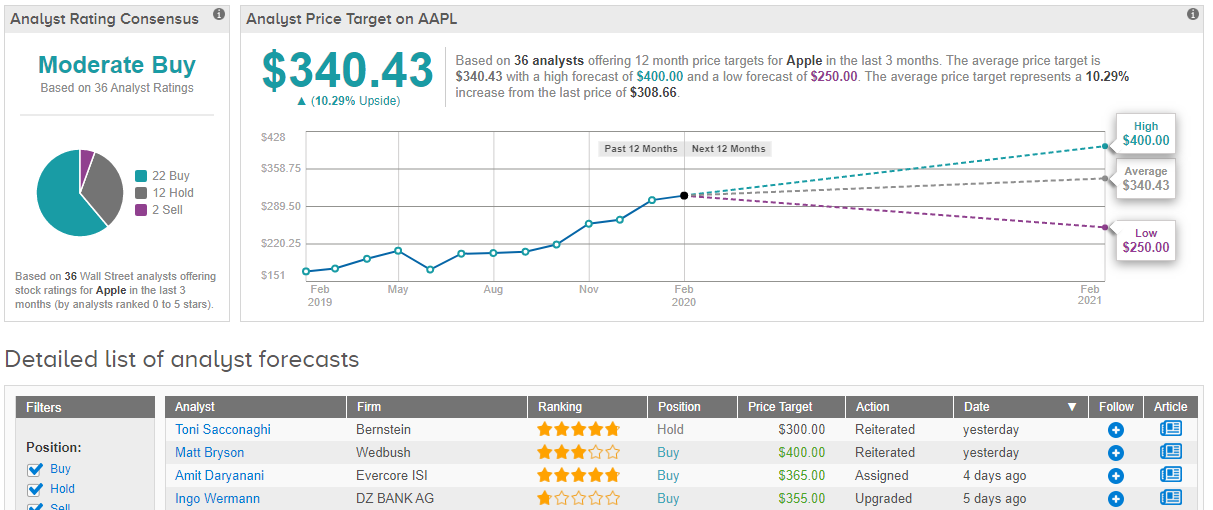

White raised his price target on AAPL from $300 to $370, implying an upside of 20%, and gives the stock a Buy rating. (To watch White’s track record, click here)

In agreement with White is Daniel Ives, 5-star analyst from Wedbush. After watching the Q1 earnings presentation, Ives said, “We … view last night as one of Cook’s crowning achievements which put the finishing touches on a comeback story for the records books.” Ives believes that Apple will reach a $2 trillion valuation within two years.

In line with his uber-bull stance, Ives gives AAPL shares a $400 price target and Buy rating. His target indicates confidence in a 30% upside potential for the stock. (To watch Ives’ track record, click here)

Apple has the most mixed reviews of the stocks on this list, 36 of them, including 22 Buys, 12 Holds, and 2 Sells. Shares are not cheap, at $308.66, and the $340.43 average price target suggests an upside potential of 10%. (See Apple stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.