2019 will be remembered for rounding out a decade of sustained stock market growth. What else will the year be remembered for? The IPO boom. During the course of the year, a stampede of ‘unicorns’ made their public market debut. Since then, things have gone off without a hitch for some, while others, unfortunately, can’t say the same.

With this in mind, investors want to know what 2020 has in store for the stocks that snuck in right at the end of the year and IPO’d in December. As Wall Street pros note that not all recent IPO stocks represent compelling investments, they suggest that investors do their homework.

That’s where TipRanks comes in. With the platform’s comprehensive market data at our fingertips, we were able to pinpoint 3 Buy-rated stocks that have been gaining favor among the analyst community following their recent IPOs. Let’s dive in.

Sprout Social, Inc. (SPT)

Sprout Social helps its customers manage their social media presence, with its solutions ranging from deep listening and analytics to social management, customer care and advocacy. Since its December 13 IPO which raised $150 million, shares have been able to post a modest 7% gain. While still in its early days as a publicly traded company, several analysts suggest giving SPT a ‘like’.

The social media company’s product offering is generating a lot of excitement. An all-in-one platform offers a more efficient way to schedule, launch, monitor, respond to and assess marketing activities in social channels. Additionally, there is a large market opportunity as the platform makes it easier to target both B2B and B2C customers. Canaccord Genuity’s Richard Davis estimates the opportunity to be $10 billion-plus in the U.S. alone, with this figure doubling after global markets are included.

While acknowledging that shares didn’t “pop” after its IPO, the five-star analyst argues that this is in fact a positive. “The fact that the stock didn’t explode higher off of the IPO finally gives us a chance to put a BUY rating on an IPO (rather than our typical playbook of waiting a year for over-valuation to burn off). We construct rational scenarios in which SPT shares could double in as soon as 3 years assuming some upside to consensus and a bit of multiple expansion as the company narrows its valuation gap with peers via consistent execution and scale,” Davis explained. This prompted him to initiate coverage with a Buy rating and $22 price target, implying 24% upside potential. (To watch Davis’ track record, click here)

Meanwhile, William Blair analyst Bhavan Suri cites SPT’s strong partnerships with other social media networks and its attractive valuation, 4.1 times 2021 revenue compared to its peers’ 7.0 times 2021 revenue, as reasons for his bullish thesis. “It is one of only eight official Twitter data partners in the world, providing the company with unique and essentially unfettered access to Twitter’s API and its data. These tight-knit, consultative relationships serve as a strong barrier to entry and give Sprout a competitive advantage in the market,” the five-star analyst commented. As a result, he also started coverage by publishing a bullish call. (To watch Suri’s track record, click here)

Judging by the consensus breakdown, it’s clear that other analysts have also been impressed. Out of 5 analysts that have reviewed the stock, 100% were bullish, making the consensus rating a unanimous Strong Buy. Not to mention the $24.25 average price target puts the upside potential at 36%. (See Sprout Social stock analysis on TipRanks)

OneConnect Financial Technology (OCFT)

Making its debut on the same day as SPT, Chinese fintech company OneConnect Financial offers a technology-as-a-service platform for financial institutions in China. While shares have already surged 19% since the IPO, some members of the Street argue that much more is in store for OCFT.

One analyst, Hans Chung of KeyBanc, tells investors that there are several reasons to believe that the fintech’s long-term growth prospects are strong. First and foremost, he highlights the huge market opportunity in the digital transformation of Chinese financial institutions. Part of this large opportunity is due to stricter regulation in China that has increased the demand for digital transformation in small and medium-sized banks.

Additionally, Chung thinks that its superior technology and industry expertise as well as its “highly recurring transaction-based revenue with upside potential from clients’ business growth” put OCFT in a solid position. Bearing this in mind, the analyst decided to get onboard, initiating coverage with an Overweight rating along with a $15 price target. (To watch Chung’s track record, click here)

Like Chung, Merrill Lynch’s Emerson Chan is also optimistic about the IPO stock. He expects revenue growth to be driven by “(1) steady 41% CAGR revenue contribution from the Ping An Group; (2) growing number of premium customers (to 997 in FY22E) on upselling; and (3) rising net expansion rate of premium customers (to 135% in FY22E) on cross-selling, new product launch and resumption of growth in Lufax.” To this end, Chan started OCFT as a Buy. At the $18 price target, shares could soar 51% in the coming twelve months. (To watch Chan’s track record, click here)

What does the rest of the Street think? While only one other analyst has published a rating, it was also a Buy. So, with 3 Buys and no Holds or Sells, the verdict is that OCFT is a Strong Buy. In addition, the $16.30 average price target indicates upside potential of 36%. (See OneConnect stock analysis on TipRanks)

Bill.com Holdings (BILL)

Unlike some other stocks that IPO’d in 2019, back-office automation software company Bill.com soared after its first day of trading on December 12, 61% to be precise. The company offers cloud-based products to provide small and medium-sized businesses with solutions that replace time-consuming and manual processes for tasks like invoicing and accounts payable.

Bhavan Suri, who also covers BILL, tells investors, “We believe the Bill.com platform is the only available end-to-end platform that provides accounts payable (AP) and accounts receivable (AR) automation with an integrated B2B payments piece.” He argues that as there has only been about 15% penetration of the market, BILL has plenty of room to capitalize on the opportunity.

On top of the fact that it already exhibited strong core revenue growth of 57% year-over-year in fiscal first quarter 2020, BILL has the advantage in terms of competitive positioning. “The Bill.com platform is unique in the target market and has established a competitive moat… Bill.com has also put a lot of work into establishing strong integrations with accounting software providers and financial institutions, which we view as a competitive advantage,” Suri commented. As a result, the analyst wrote in his initiation note that BILL is worthy of an Outperform rating.

Needham analyst Scott Berg also believes BILL is the only company of its kind in the space. The five-star analyst added, “While the stock may look expensive with an EV at 16x our FY21 revenue estimate, we believe a strong GTM strategy including burgeoning channel relationships with Financial Institutions will support price appreciation over an extended period. Also, we look for favorable unit economics and high retention rates to drive model leverage as growth decelerates.”

With this in mind, Berg initiated coverage with a Buy rating along with a $43 price target. This conveys his belief that shares could be in for an 18% boost in the next twelve months. (To watch Berg’s track record, click here)

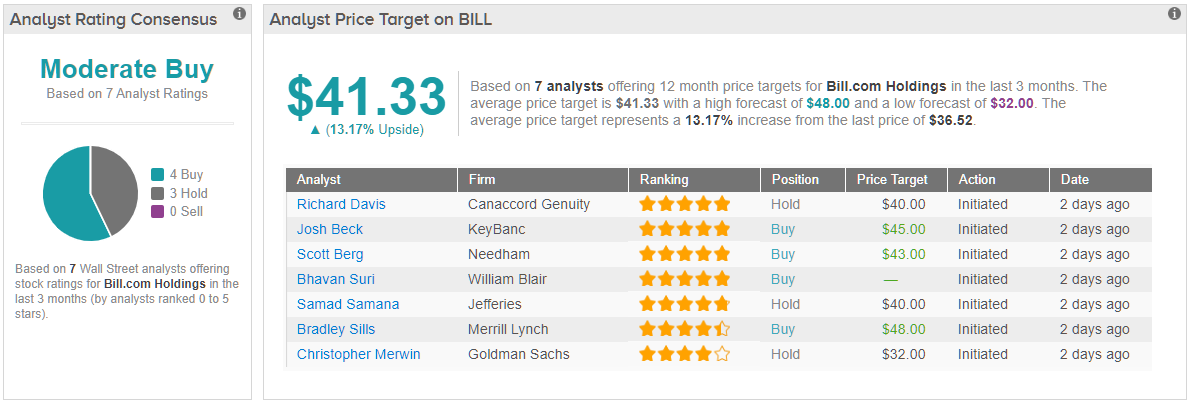

Turning now to Wall Street, other analysts’ take is more of a mixed bag. Based on the 4 Buys and 3 Holds assigned, the word on the Street is that BILL is a Moderate Buy. It should also be noted that the $41.33 average price target brings the potential twelve-month gain to 13%. (See Bill.com stock analysis on TipRanks)