COVID-19 has complicated matters when investing in Apple (AAPL). At least that is the view of Nomura analyst Jeffrey Kvaal.

The 5-star analyst has been grappling with his investment thesis for Apple, and said, “The seismic changes over the past several months in Apple’s supply capacity, demand outlook, and valuation has stretched and strained the Apple thesis in new ways. Emerging bull theses have joined existing ones; similarly, new bear themes have appeared and strengthened. Our ordinary angst over our Apple rating has risen further.”

This has caused Kvaal to lay out the case for both the bulls and the bears. Let’s look at both arguments:

The Bull Case

Apple’s robust ecosystem indicates the loss of demand in 1H20 will return in the second half of the year, maybe even “with a higher ASP 5G iPhone 12.” Additionally, Apple’s business model is becoming ever more resilient due to “rising product diversity and declining iPhone cyclicality.” What’s more, with nearly $100 billion of cash in the coffers, and generating roughly $60 billion in FCF annually, Apple has a strong balance sheet to back it up in times of economic uncertainty. “This argues that Apple’s historic 3x discount to the S&P500 is overly conservative,” says Kvaal.

The Bear Case

The upcoming 5G cycle, argues the analyst, is not enough to fend off the looming recession. Kvaal believes the decline in growth for phone sales during the previous recession, from “20% in 2006 and 2007 to the low-single digits in 2008 and 2009,” is a pattern that is set to repeat this time around. Additionally, the analyst believes the idea of a 5G supercycle “wilts under scrutiny.” The consumer benefits of 5G are over hyped and incomparable to the initial benefits, such as video streaming, that came with the advent of 4G.

Nailing the final nail in the coffin, Kvaal argues that despite the fact Apple’s “ten-year FY2 PE multiple of 13x is a three-turn discount to the S&P500,” it cannot be granted consumer staple status on the blunt assertion that, as its signature product retails for the better part of $1000, it is “a meatier purchase than say toilet paper.”

The Verdict

Kvaal sums up, “After some contemplation, we side more with the bear case than the bull case. We are now factoring in a 4-6 week delay in the iPhone 12 launch, modest 2H20 build plans, and a deeper economic slowdown.”

Accordingly, Kvaal reiterated a Neutral on Apple, although the analyst raised the price target from $225 to $240. The new figure still implies downside to the tune of 10%. (To watch Kvaal’s track record, click here)

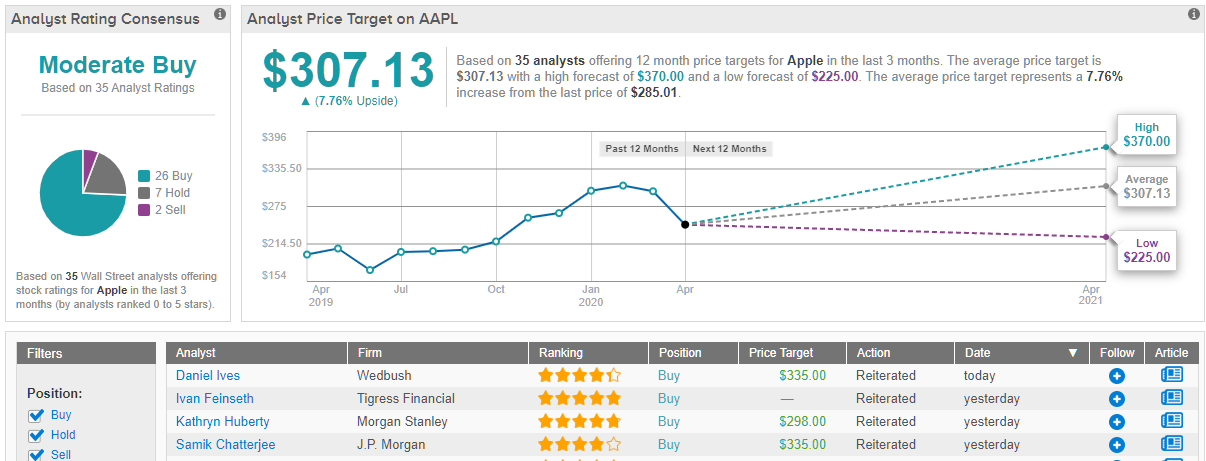

Most of the Street, though, disagrees with the Nomura analyst. Apple’s Moderate Buy consensus rating is based on 26 Buy ratings, 7 Holds and 2 Sells. At $311, the average price target suggests possible upside of a further 16%. (See Apple stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.