Apple (AAPL) stock has been under pressure again, with the broader FAANG trade showing subtle signs of weakness.

Despite the recent release of the iPhone 13, which is showing early signs of promise, and an October Mac event that could be underway, the broader bout of profit-taking in October has been difficult to offset.

I remain bullish on Apple stock going into year-end.

Apple stock is not all about the iPhone, or speculation on next-gen products such as the Apple Car or Augmented Reality (AR) glasses. When and if they launch, such products will likely propel the stock. However, there’s no sense in timing their release as an investor.

Over the long run, Apple is still very much a services-push story. More services aren’t just a boon to margins; they’re also likely to beckon in non-Apple users into its ecosystem and be a boon to sales growth.

Even with anti-trust issues or the concerns surrounding the App Store, the continued service push is likely to continue moving the needle much higher on AAPL stock. (See Analysts’ Top Stocks on TipRanks)

Price Justification

There’s no question that Apple hardware is on the expensive side. Spec-for-spec, in terms of the hardware you’re getting, odds are you can find a better deal with a non-Apple PC or an Android smartphone or tablet.

This could change in a big way, though, as Apple’s chips look to raise the bar every year.

Moreover, a case could be made that Apple’s high price is justified by its impressive integration of hardware and software. This has been made clear by CEO Tim Cook at many past keynotes.

While Apple’s software service push is no mystery to Wall Street, its push into producing its own chips may still be.

At the very least, analysts may be discounting the firm’s ability to beef up margins, and take share in a global market where it’s not yet taken the No. 1 spot.

As the A chip looks to outpace rivals, Apple’s price tag may be wholly justified by better hardware and software. Not just that, but the ability to access Apple’s growing line of exclusive services at low prices may also be taken into consideration by prospective Apple users.

There’s a reason Spotify (SPOT) was not happy when Apple introduced its Apple One service bundle, which included Apple Music alongside a slate of other software services such as Apple News+ and Fitness+. For users of such services, the deal is tough for the competition to match.

Apple’s Chips

Undoubtedly, the A-series smartphone chips and M-series Mac chips have blown the competition out of the water of late.

Apple can now justify its higher prices, not just through its powerful brand, but through faster and more energy-efficient hardware.

Apple’s chips are genuinely breakthrough, and every iteration could allow the company to further outpace its rivals across its slate of products.

Indeed, Apple is striving to become the very best at both hardware and software. While the value of its products was up for debate in the past, it’s clear that the spec-for-spec argument will not hold up as Apple’s chips look to widen the gap with competitors.

Wall Street’s Take

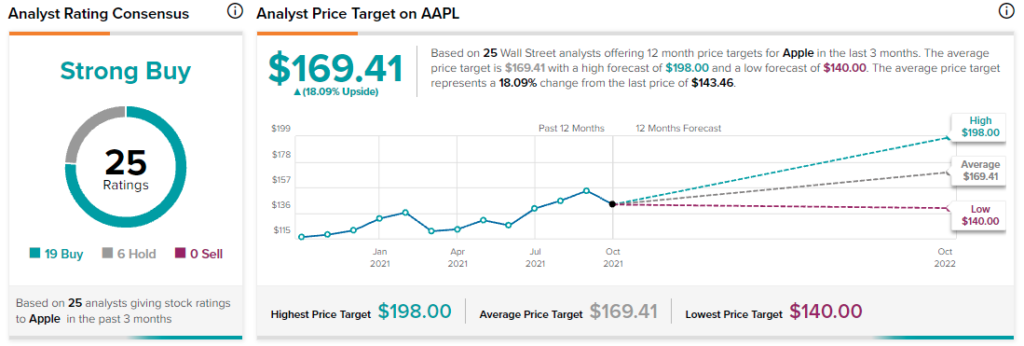

According to TipRanks’ analyst rating consensus, AAPL stock comes in as a Strong Buy. Out of 25 analyst ratings, there are 19 Buy recommendations, and six Hold recommendations.

The average Apple price target is $169.41. Analyst price targets range from a low of $140 per share, to a high of $198 per share.

Bottom Line

With such a solid foundation in services and chips, Apple’s ever-improving value proposition and more affordable base-level, non-pro hardware could allow Apple to be a significant share-taker over the next decade.

Disclosure: Joey Frenette owned shares of Apple at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.