Amid soaring inflation, rising interest rates, and chip shortages, semiconductor stocks have taken a beating this year. Shares of semiconductor giants including AMD, Intel, Nvidia, and Qualcomm (QCOM) have tanked 38.3%, 20.7%, 43.6%, and 29.5%, respectively.

However, demand for semiconductors remains strong. In the past two years, demand for PCs, gaming consoles, and laptops has soared as more people worked from home due to the pandemic. Moreover, the usage of semiconductors is increasing in different applications from automobiles to mobiles.

According to a Fortune Business Insights report, the semiconductor market is likely to grow at a compounded annual growth rate (CAGR) of 8.6% between 2021 and 2028 to $803.15 billion.

In this scenario, using the TipRanks stock comparison tool, we look at three semiconductor behemoths, Nvidia, AMD, and Intel, who recently announced their quarterly earnings. We will also examine what Wall Street analysts are saying about these stocks.

Nvidia (NASDAQ: NVDA)

Shares of Nvidia have plunged the most among semiconductor giants this year with a decline of 43.6%. This is even after the company posted better-than-expected results in Q1 but its outlook left investors disappointed.

Investor concerns over the company’s outlook were justified as Nvidia’s management stated on its Q1 earnings call that its Q2 outlook assumes an impact of around $500 million “relating to Russia and China COVID lockdowns.”

As a result, the company has projected a sequential decline in gaming revenues while total revenues are anticipated to be $8.1 billion in Q2, with an increase or decline of 2%.

However, Mizuho Securities analyst Vijay Rakesh believes that NVDA “continues to drive Data Center and AI [artificial intelligence] leadership.”

This is supported by the fact that for Nvidia, its data center has become its “largest market platform, and we see continued strong momentum going forward.”

In Q1, the company’s data center revenues surged 83% year-over-year to $3.75 billion. The gaming segment saw revenues soar 31% year-over-year to $3.6 billion.

While analyst Rakesh is of the view that the current valuations for the stock are “steep”, he believes that “improving PCs, AI deep learning and inferencing markets, gaming trends, automotive and datacenter position it for upside to estimates.”

In view of these positive trends, the analyst is bullish on the stock with a Buy rating but lowered the price target to $290 from $345. Rakesh’s price target implies an upside potential of 71.4% at current levels.

The rest of the analysts on the Street side with Rakesh are also bullish with a Strong Buy consensus rating based on 25 Buys and five Holds. The average NVDA price target is $275.89, which implies a 63.1% upside potential to current levels.

AMD (NASDAQ: AMD)

AMD is a semiconductor giant which primarily offers x86 microprocessors, server and embedded processors, development services, and technology for gaming consoles and semi-custom System-on-Chip (SoC) products.

Shares of AMD have been on an upward trajectory, up 8.8% this month, following its Q1 results that crushed estimates.

Will AMD be able to sustain this momentum going into Q2 and for the rest of the year? Analysts are divided in their opinion. An important inflection point for the company was the closing of its acquisition of Xilinx in February of this year.

AMD Chair and CEO Dr. Lisa Su had commented on the momentum for its products in its Q1 press release, “Demand remains strong for our leadership products, with our increased full-year guidance reflecting higher AMD organic growth and the addition of the growing Xilinx business.”

However, Baird analyst Tristan Gerra has a different view. According to the analyst, “Xilinx is the entire component” of AMD’s FY22 updated adjusted gross margin estimate of 54% from an earlier 51%.

Another concern for Gerra is that while there is a “robust ramp” for AMD’s EPYC processors, he believes that growth is slowing down. In addition, “weak consumer GPU outlook [and] slowdown in client computing” kept the analyst sidelined on the stock with a Hold rating.

As a result, the analyst lowered his price target from $125 to $100 on the stock, implying an upside potential of 4.4% at current levels. Gerra’s price target for the stock is the lowest on the Street.

In contrast, Bank of America analyst Vivek Arya is upbeat about AMD following the unveiling of AMD’s Ryzen 7000 series at the Computex 2022 trade show. The analyst stated, “The combination of AMD design agility, management’s proven execution, roadmap consistency and strong foundry volume/cost support could help to potentially double [AMD’s] PC + Server revenue share.”

Arya is bullish on the stock with a Buy rating and a price target of $160, implying an upside potential of 67% at current levels.

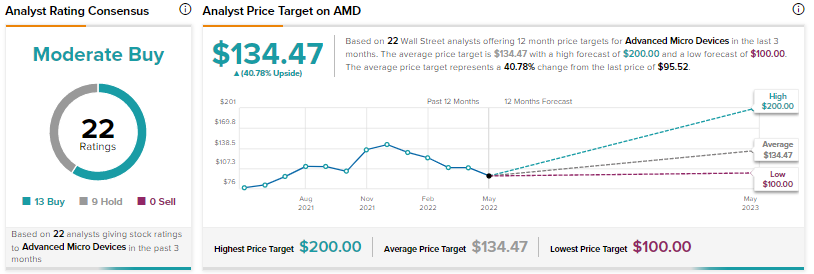

However, other analysts on the Street are cautiously optimistic with a Moderate Buy consensus rating based on 13 Buys and nine Holds. The average AMD price target is $134.47, which implies 40.8% upside potential to current levels.

Intel (NASDAQ: INTC)

Intel’s products include processors that power PCs, a standalone system-on-a-chip (SoC), a multichip package, and memory and storage products.

Shares of Intel have declined 7.3% in the past month as rising costs and increasing competition weighs on the minds of investors, even as the company posted better-than-expected results in Q1.

These investor concerns appear to be justified, as Intel forecasts several headwinds in Q2 and the rest of FY22.

The company stated on its Q1 earnings call that while commercial demand for its personal computers (PCs) is expected to be strong, there is likely to be a “softness” in demand for consumer and education PCs.

Moreover, INTC’s management pointed out that supply chain constraints compounded by recent “COVID lockdowns in Shanghai” and rising inflation is likely to adversely impact the total addressable market (TAM) for PCs this year.

While these challenges are likely to impact Intel’s Client Computing Group (CCG) revenue forecast, the company anticipates demand to pick up in H2 as “normal seasonality boosts demand” and higher demand for its Alder Lake and Raptor Lake CPUs.

Besides these concerns, Wells Fargo analyst Aaron Rakers also flagged the deceleration in Intel’s data center business segment’s operating margins at 27.9% in Q1 versus 34.5% in the same period last year.

Furthermore, Rakers pointed out that “Intel’s decision to no longer disclose CPU unit volumes/sales by segment will be seen as a negative; making it more difficult to gauge what percentage of margin declines are driven by competitive pressure vs. process ramp.”

In this scenario, Rakers is sidelined on the stock with a Hold rating and lowered his price target from $60 to $55 for the stock, implying an upside potential of 27.3% at current levels.

The rest of the analysts on the Street echo Rakers with a Hold consensus rating based on five Buys, eight Holds, and six Sells. The average INTC price target is $50.13, which implies a 16% upside potential to current levels.

Bottom Line

In the list, all the three semiconductor giants continue to expect macroeconomic headwinds to persist this year. However, given the popularity of NVDA’s products and analysts’ bullishness on the stock, it appears to be well-positioned to weather the storm.

Read full Disclosure.