Planning ahead in 2020 is turning out to be a fruitless task. Especially if you happen to be a cruise line eagerly waiting to resume operations.

On June 16, struggling cruise operator Norwegian Cruise Line (NCLH) laid any hope of a summer at sea to rest. The company extended suspensions due to fears over the coronavirus’ potential to wreak havoc on board its cruise ships. Previously, schedules were suspended through July, but now virtually all cruises between August 1 and September 30 have also been cancelled. Some have been suspended for even longer, until the end of October.

For Deutsche Bank analyst Chris Woronka, it is becoming clear “the summer months (typically the high season for cruising) are slipping away in terms of a potential restart period.”

This begs the questions: what conditions are required for “even limited sailing activity to resume?” Or what kind of passenger experience will such a cruise provide?

“Cruises are inherently social in nature and there are legitimate questions about the quality of the experience if physical distancing is required,” Woronka noted.

Additionally, such a diluted experience could leave a bitter taste among passengers who will then be reluctant to book again when normal conditions resume.

All of these facets lead Woronka to believe that until the elephant in the room is dealt with, cruise lines might not be going anywhere.

“We believe there is likely to be enhanced focus around the question of whether large scale cruising can (or should) realistically resume before there are additional medical breakthroughs on the treatment and/or prevention of COVID-19. To that end, there isn’t necessarily a direct read-through to the stocks,” Woronka stated.

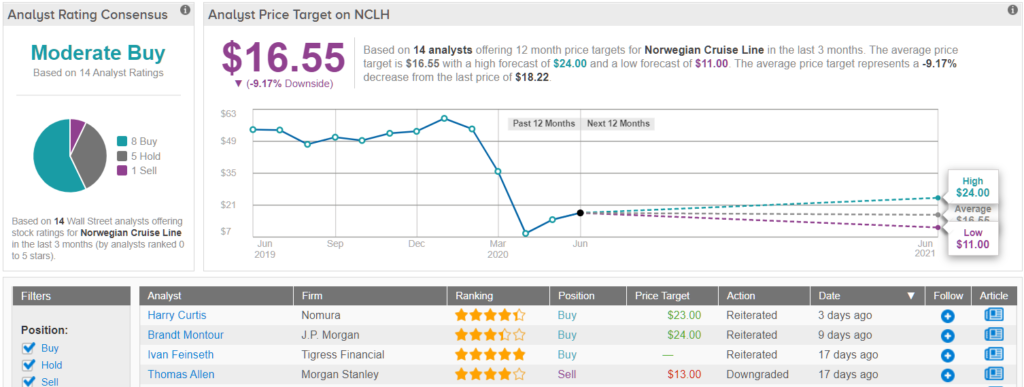

To this end, Woronka maintains a Hold rating on NCLH shares. The analyst also has an $11 price target, implying the share price could decline by a further 43%. (To watch Woronka’s track record, click here)

Overall, based on 8 Buys, 5 Holds and 1 Sell, the analyst consensus currently rates NCLH a Moderate Buy. However, the average price target of $16.55 suggests possible downside of 14%. (See NCLH stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.