After delivering a return of 63% over the last three years, the shares of Australia-based Westpac Banking Corporation (AU:WBC) are down by more than 6% in the last three months. Analysts have mixed opinions about the share price and have rated the stock as Hold.

Westpac is a banking and financial services company in Australia, serving more than 12 million customers. It is among the largest banks in Australia and also the oldest.

Let’s dig deeper into some details.

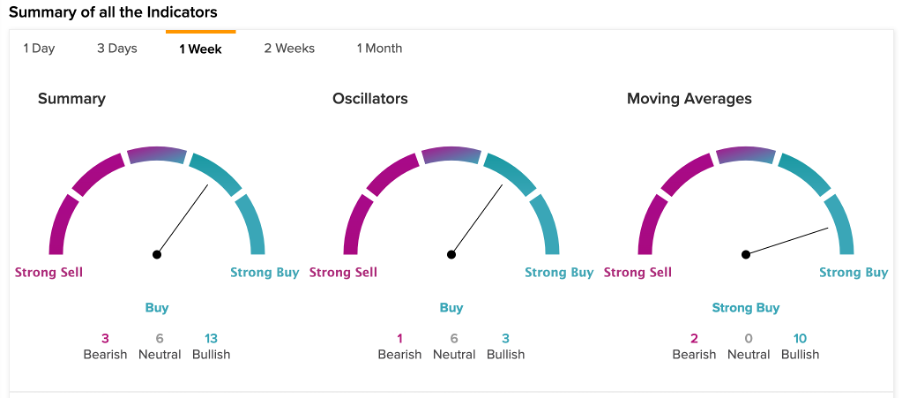

Technical Analysis Say Buy

According to TipRanks’ Technical Analysis, the indicators suggest a Buy within a time frame of one week. The summary signal suggests a Buy, which includes oscillators and moving averages. The summary is based on 13 bullish, six neutral, and three bearish signals.

Moreover, the 10-day and 100-day exponential averages are lower than the current trading price of AU$22.25, indicating a Buy.

A Dividend Gem

Westpac is a common name in Australia and has been investors’ favorite for a long time. Apart from its higher capital gains, Westpac has been paying dividends for decades now.

In 2022, the bank paid a total dividend of AU$1.25 per share, which was 6% higher than the payment of AU$1.18 per share in 2021. This was despite the bank posting a 1% decline in its cash earnings of AU$5.3 billion.

Goldman Sachs predicts the full-year dividends to increase to AU$1.44 per share in 2023 and to AU$1.5 per share in 2024.

Australia-based brokerage firm Morgans forecasted the fully franked dividends in 2023 to grow to AU$1.53 per share and AU$1.59 per share in 2024.

Analysts’ Views

Westpac is expected to post its half-yearly earnings for 2023 on May 8. Analysts expect the bank to post better performance with higher interim dividends driven by higher interest rates. However, analysts also remain cautious for the second half of 2023 and 2024, as margins will peak along with higher loan losses and costs.

Analyst John Storey from UBS mentioned the Australian banks’ interim results for 2023 as “the last hurrah,” and he expects the major banks to post their peak profits in the first half of 2023.

26 days ago, Storey downgraded his rating on WBC stock from Buy to Hold.

Morgan Stanley analyst Richard Wiles said, “The prospect of a double-digit earnings decline in the 2024 financial year and the potential for a ‘bumpy’ landing make it likely that the banks will underperform in 2023.”

Wiles has a Buy rating on WBC stock and predicts a 6% upside in the share price.

What is Westpac’s Target Price?

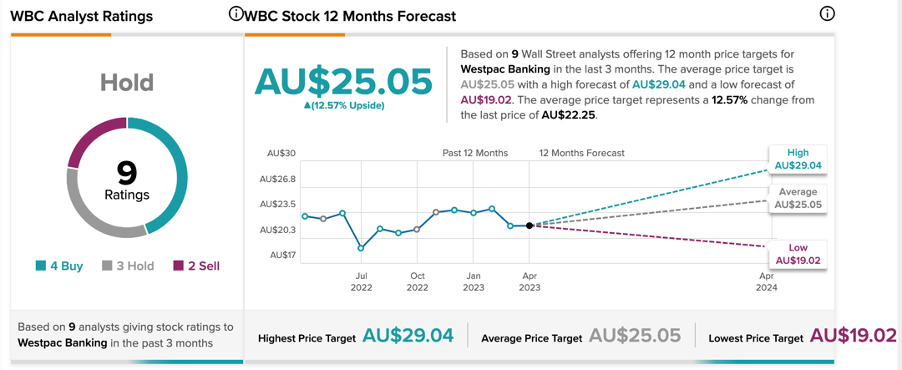

According to TipRanks’ consensus rating, WBC stock has a Hold rating, based on four Buy, three Hold, and two Sell recommendations.

At an average price target of AU$25.05, analysts predict an upside of 12.5% over the next 12 months.

Conclusion

Westpac is one of the most popular stocks among income investors in the Australian market. Analysts predict more growth in dividends over the next two years, making it an attractive option. In terms of capital growth, analysts have a Hold rating on the stock.