In mid-March, Aurora Cannabis (ACB) hit a 52-week low of $0.60 per share, with some commentators believing it hadn’t hit bottom yet. While it appears a bottom is in, the question going forward is whether or not the company can hold on to some of its recent gains.

After hitting its bottom, a little over a week later the company soared to over $1.13 per share, pulling back to $0.85 per share as I write.

In this article we’ll look at whether or not the company will be able to sustain or increase these gains, and what it would take to do so.

The key factor in the near term

Without a doubt the key to short-term growth for Aurora is recreational sales in Canada. If it is able to do well there, it will surprise the market to the upside and give its share price another boost that would have a good chance to hold if there are no negative surprises in its next earnings report.

If Aurora is able to match last quarter’s recreational pot revenue, it should exceed it by at least several million because of the inclusion of derivative sales in this quarter; that means higher revenue, margins and earnings from those sales. Another element would be if it is able to attract new customers to derivatives, which would represent a significant increase in its performance if the new customers represent meaningful numbers in the reporting period.

Add to that the gradual increase in retail outlets to sell in, and it points to a possible solid win in this quarter. The caveat will be if it is in fact able to at least sell as much recreational pot as it did last quarter; that’s not a guarantee, so we’ll have to wait and see if the increase in stores and sales of derivatives will allow it to exceed recreational pot sales expectations.

On the positive side, if it is able to generate the same number of sales with recreational pot without derivative sales, it could surprise to the upside in a big way. That could happen if it is able to regain some Canadian market share.

The negative catalyst would be if coronavirus ends up having a detrimental impact on Canadian sales.

International sales

After dropping the ball last quarter in regard to licensing in Germany, the company temporarily lost some business until it met German requirements. With that behind them, there is no doubt Aurora will win back that business, although it could take a couple of quarters to do so.

What it means is revenue from international sales in the last quarter should rebound, and combined with the potential increase in recreational sales, would add more fuel to the fire.

Over the long term Aurora Cannabis will be one of the international market leaders in the cannabis sector, but for now it’ll take time to build that business out.

Eventually I think this will be the best performing segment Aurora competes in.

Consensus Verdict

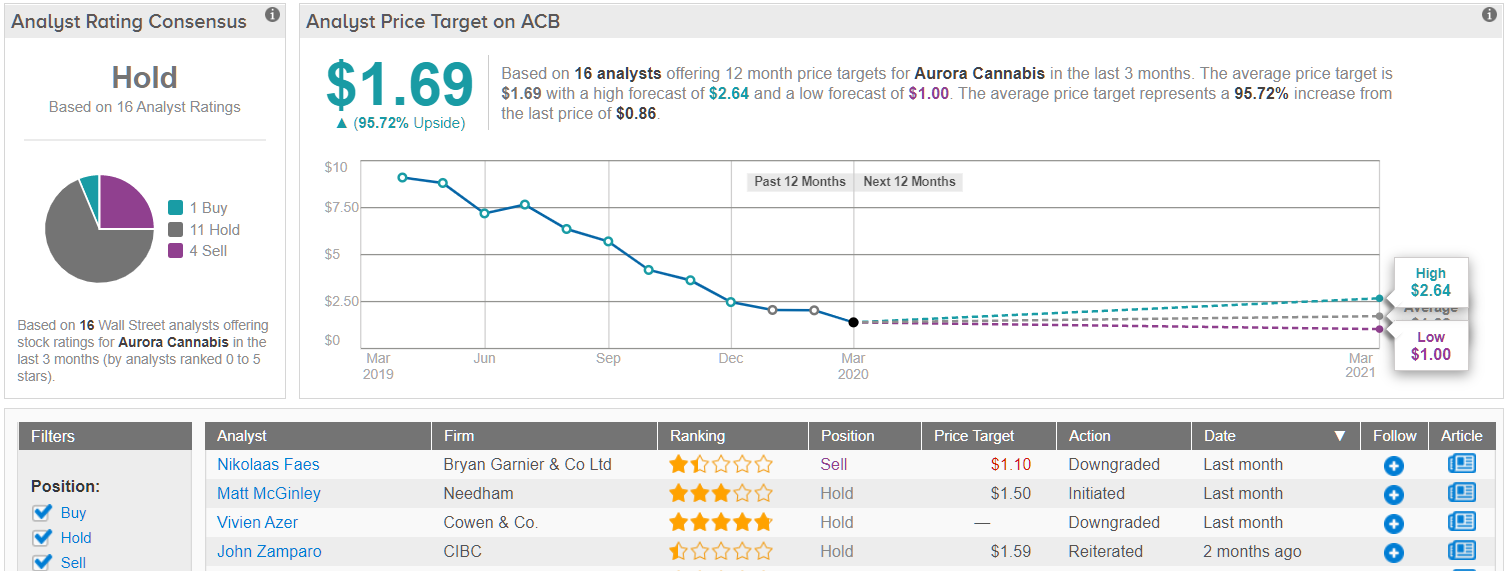

Most of Wall Street is surveying the cannabis player from the sidelines, with TipRanks analytics demonstrating ACB as a Hold. Based on 16 analysts polled in the last 3 months, only 1 say “buy,” while 11 suggest “hold,” and 4 recommend “sell.” That said, the 12-month average price target still stands at $1.69, which marks about 96% upside from where the stock is currently trading. (See Aurora Cannabis stock analysis on TipRanks)

Conclusion

As has been the case in the recent past, some of the things having a negative effect on Aurora Cannabis and its Canadian peers remain in place, and that has been potentially worsened with the emergence of coronavirus.

I don’t think coronavirus will have an impact on sales to long-term cannabis users, but it may slow down the number of new users entering the market. That could undermine the company in the near term because it’s highly probable that derivatives will be more palatable to new users who don’t want the perceived stigma that smoking or vaping cannabis would have on them. The company has said about 20 percent of its sales in this quarter are from derivatives, which based upon sales from last quarter, would be over $7 million.

If it is exceeding last quarter’s sales, that number could be higher.

How this will play out is Aurora is partially reliant on growth from opening new retail stores in Canada, and should grow nicely in conjunction with the openings.

Whether or not coronavirus has had a lot of impact on the performance of Aurora won’t be known until the earnings report. So far it hasn’t been suggested that has been the case, but it should be considered a probability.

If the things outlined in this article go right for Aurora, it will surprise the market to the upside in the short term, and would lay a foundation for incremental, sustainable growth.

As the number of retail stores multiply and international sales climb, Aurora’s future prospects look bright, as it has the potential to quickly ramp up production with the production facilities it can quickly bring on line and complete construction on.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.