Terry Booth, the founder and one-time CEO of Aurora Cannabis (ACB), has just sold 12.2 million shares of the company he once ran — a development, says Jefferies analyst Owen Bennett, that is “not great for sentiment” about the stock.

You don’t say!

As Aurora announced in a press release Monday, “Terry Booth has filed a report on the System for Electronic Disclosure by Insiders (SEDI) regarding his sale of approximately 12,161,900 shares into the open market … in connection with the previously announced transition of Mr. Booth’s role within the Company.” The transition in question being, of course, Booth’s resignation as CEO announced last month.

Why is Booth selling now? One might imagine that, because Booth is leaving the company, he’d want to cut ties with Aurora entirely, and is therefore selling off his stake in order to make as clean a cut as possible. But as Bennett points out, Booth “remains in a strategic advisor role” at the company. He has not in fact cut ties entirely. Moreover, as an important advisor to Aurora Cannabis, he presumably has a good insider’s vantage point to how things are going within Aurora, and what the company’s prospects look like.

In Bennett’s estimation, Monday’s stock sale suggests that Booth may see “some more difficult times ahead.”

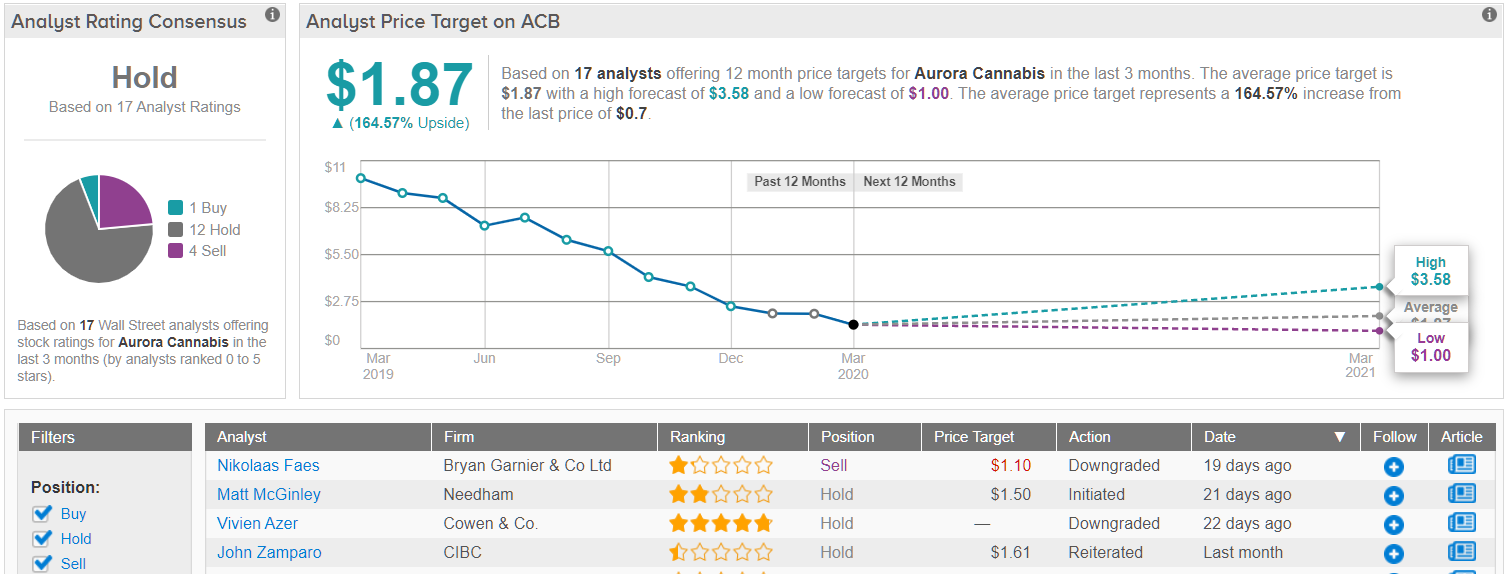

Which is not to say that the times behind Aurora have been all unicorns and rainbows. Indeed, a chart of Aurora Cannabis’s fortunes over the past 12 months shows an almost straight line down from the top left axes to the bottom right, as Aurora Cannabis stock has sunk from a share price of nearly $10 a year ago, to $0.70 today — a decline of 93%.

Most recently, Bennett notes, the company has lost its Chief Corporate Officer (Cam Battley, who resigned in December), followed by an announcement of a restructuring plan, including new “ambitious profitability targets” that no one seems to have much faith in.

Fact is, most analyst estimates still don’t see Aurora turning GAAP profitable before 2023 at the earliest — and the way things are going, the company may not make it that long. At last report, Aurora Cannabis was deeply unprofitable ($1.1 billion lost last year), burning cash (about $610 million burnt last year), and mired in debt (nearly $350 million in long term debt, against cash reserves of only about $140 million).

Sure, to hear management tell it, Aurora remains “the Canadian company defining the future of cannabis worldwide.” Executive Chairman and Interim CEO Michael Singer still insists, “the Board and management remain focused on the plan we laid out in February and we are progressing as planned toward appropriate capital allocation, balance sheet strength, and profitability.” And even Booth says he’s only selling because “market volatility with respect to COVID-19 and a number of opportunities in the industry led to me taking some cash to the sidelines … I believe many cannabis stocks including Aurora are undervalued and I will be watching present market conditions unfold. I will definitely be considering buying back in once the dust settles.”

Regardless, actions speak louder than words. Investors owning the stock today, and seeing its founder dumping his shares — even with an expressed intention of perhaps buying back later — might now be thinking to themselves “maybe we should think about buying back later, too, but for now — sell!”

Turning now to the rest of the Street, it appears that other analysts are generally on the same page. With 12 Holds, 4 Sells, and just single Buy, the consensus rating comes in as a Hold. The average price target among these analysts stands at $1.87, which is about 165% higher than ACB’s current value — most likely a result of the quick drop and analysts’ inability to turnaround new price targets so quickly. (See Aurora Cannabis stock analysis on TipRanks)

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.