Even prior to the horrible September quarterly report, analysts were questioning the cash position of Aurora Cannabis (ACB). A big part of the problem was a large convertible debt due in March hanging over the stock. The recent decision for substantially all of the debtholders to convert into common shares was a painful dilution for existing shareholders, but necessary in order for Aurora Cannabis to attract new investors. The company still has more work to improve the balance sheet before the stock becomes a buy, but this convertible debt conversion was a key step.

Convertible Debt Conversion

Aurora Cannabis announced that 99% of the company’s C$230 million, 5% unsecured, convertible debentures due March 9, 2020 voluntarily elected to convert to common shares. As a result, the Canadian cannabis company will issue an aggregate of 69,135,117 common shares at a conversion price of C$3.2837.

The company already had a diluted share count above 1.1 billion shares. This conversion places the diluted share count above 1.2 million shares.

For investors not paying attention to this logical conclusion, the dilution is painful considering the stock once topped $10 earlier this year. At a stock price of $2.50, the fully diluted market cap is ~$2.6 billion.

Still Needs More Cash

The big question is where Aurora Cannabis goes now with the stock beaten down to $2.50 and the crucial convertible debt handled. The biggest remain hiccups are the operating losses combined with still large capital spending requirements despite halting the spending on their two primary facilities.

On the FQ1’20 earnings call, management still outlined the following quarterly capital spending requirements for the rest of this fiscal year ending next June:

- FQ2 – C$108 million

- FQ3 – C$70 million

- FQ4 – C$50 million

Aurora Cannabis ended the September quarter with C$153 million in cash on the balance sheet. When combined with already completed at-the-market equity offerings, the company has raised enough cash to fund these remaining large capital spending plans for the year.

The problem remains the ongoing operating losses must be completely funded. The company has plenty of options including selling assets with C$973 million in facilities and property and another C$115 million in investments or completing further equity offerings via the ATM, amongst other options. Of course, the other option is to cut the adjusted EBITDA losses from the large C$34 million loss in FQ1 to reduce funding requirements. This likelihood of cutting losses appears small in the near term as Aurora Cannabis invests for the Cannabis 2.0 rollout in Canada and the CBD market in the U.S.

The requirement to raise more funds while these convertible debt holders are allowed to immediately unload their new shares will pressure the stock. A potential investor can wisely wait on the sidelines until further financing is resolved and the Canadian market rationalizes more supply while demand catalysts as Cannabis 2.0 take fold.

Analyst Commentary

- CIBC’s John Zamparo: “Aurora has unveiled a promising array of items which should allow the company to maintain its market share leadership. The conversion of its 2020 debentures and $190MM reduction in capital spending on production reduce worries over the company’s liquidity, though ongoing dilution still presents an impediment to owning shares. Net, we continue to view Aurora as fairly valued, as its strong Canadian performance is weighed against its balance sheet and lack of U.S. presence or strategic partners […] Our price target falls to $5

(was $7), and Aurora remains Neutral rated. (To watch Zamparo’s track record, click here) - MKM’s William Kirk: “When a company shifts so rapidly toward conserving capital at the expense of diluting existing shareholders, one would normally start to look toward solvency concerns. However, at odds with recent trends, management sounded very confident about Aurora’s strategy and viability, and its strong gross profit margin makes funding (which Aurora still needs) a bit easier to obtain. Kirk rates the stock a “sell” along with a C$3.00 price target. (To watch Kirk’s track record, click here)

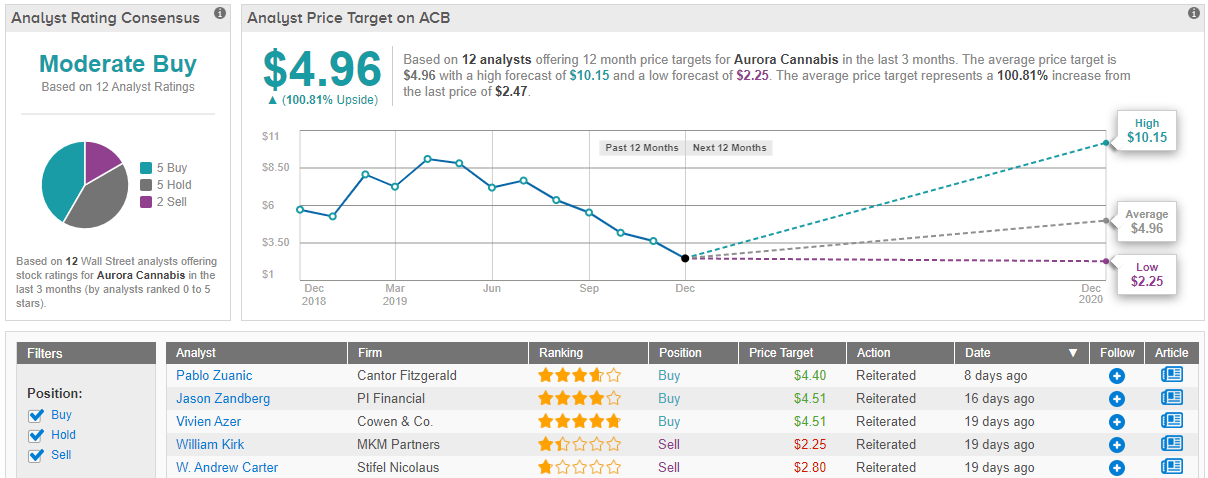

Overall, Wall Street is pretty evenly split between the bulls and those choosing to play it safe. Out of 12 analysts tracked by TipRanks in the past 3 months, 5 say “buy,” 5 suggest “hold,” while 2 recommend “sell.” However, the 12-month stock-price forecast stands tall at $4.96, marking nearly 100% in upside potential from where the stock is currently trading. (See Aurora stock analysis on TipRanks)

Takeaway

The key investor takeaway is that Aurora Cannabis has made several smart moves to position the company for a bright long-term future in the cannabis market. Unfortunately, the company still needs to fund ongoing capital losses while facing a tough competitive situation in the Canadian market.

The best move for investors is to continue waiting for further weakness in the shares while awaiting more clarification on the dilutive impacts of additional capital raises.

To find good ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.