Australia’s Therapeutic Goods Administration (TGA) has granted provisional approval to Gilead Sciences’ (GILD) remdesivir (“Veklury”) as the first treatment option for COVID-19.

It has received provisional approval for use in adults and adolescent patients with severe COVID-19 symptoms who have been hospitalized. Remdesivir will not be available to Australians unless they are severely unwell, requiring oxygen or high-level support to breathe, and in hospital care.

“Remdesivir is the most promising treatment option so far to reduce hospitalisation time for those suffering from severe coronavirus infections” the TGA states, adding that remdesivir offers the potential to reduce the strain on Australia’s health care system. By reducing recovery times patients will be able to leave hospital earlier, freeing beds for those in need.

While this is a major milestone in Australia’s struggle against the pandemic, the administration emphasizes that the product has not been shown to prevent coronavirus infection or relieve milder cases of infection.

Australia is the one of the first regulators to authorize the use of remdesivir for the treatment of COVID-19, following on from recent approvals in the European Union, Japan, and Singapore.

Provisional approval, which is limited to a maximum of six years, was granted within 2 weeks of GILD’s submission of preliminary clinical data because there is the potential for substantial benefit to Australian patients, says the TGA.

GILD can apply for full registration when additional clinical data to confirm the safety and efficacy of the medicine is available.

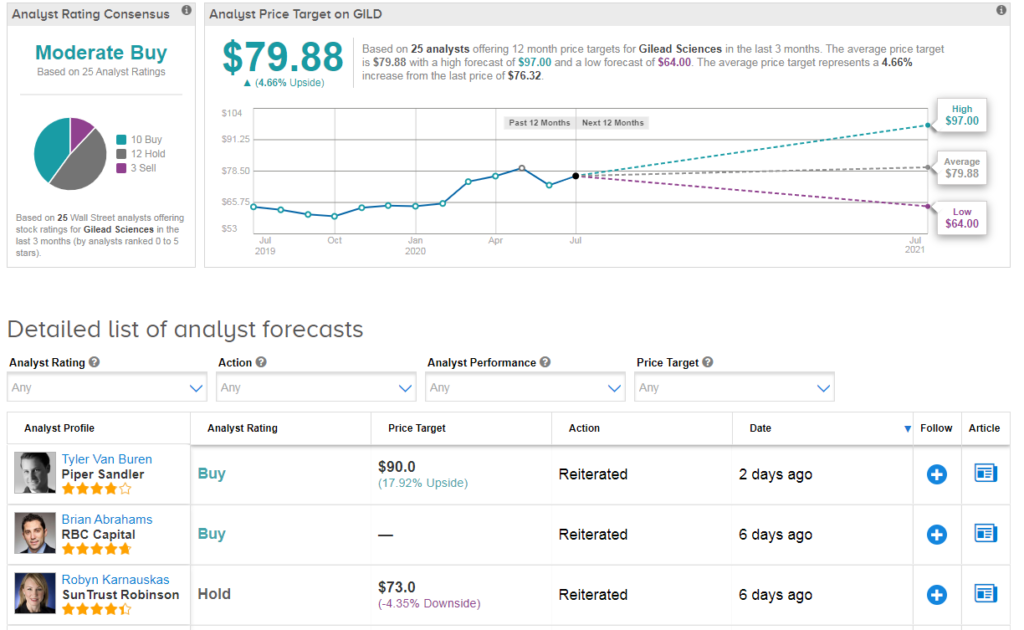

Shares in Gilead rose 2% to $76.32 at the close of trading on July 10 taking the year-to-date advance to about 18%. The $80 average price target implies 5% upside potential in the shares in the coming 12 months. (See Gilead stock analysis on TipRanks).

“We believe that even in the likely case they are able to derive revenue from remdesivir, it would likely be only for the very near term, and the much more important potential value driver remains GILD’s ability to maintain their HIV leadership and revenue durability long-term” comments RBC Capital analyst Brian Abrahams. He has a buy rating on Gilead and $89 price target.

Related News:

Novavax Spikes 42% Pre-Market On $1.6B U.S. Funding For Covid-19 Candidate

Gilead Reveals Covid-19 Treatment Remdesivir Reduces Mortality Risk

Moderna Inks Deal With Rovi To Supply Potential Covid-19 Vaccine Outside US