Aviva (GB:AV) posted its interim results for the first half of 2022 – and the company painted a pleasing picture depicting the company’s profitability and sound health.

Shareholders celebrated news of the company returning more capital to its shareholders. For income investors, the dividends are sustainable and flourishing, well-supported by a solid balance sheet and cash inflows.

Aviva: solid sales and profit

Amanda Blanc, the chief executive, said, “Sales are up, operating profit is higher, and our financial position is stronger. This has been an excellent six months for Aviva. “

The leading insurer saw its operating profit increase by 14% to £829 million, as compared to £725 million in the half year of 2021. This was mainly driven by general insurance segment growth and cost efficiency measures.

On the flip side, the company reported an IFRS loss after tax of £633 million. However, the company mentioned it as an outcome of adverse market movements, which does not affect cash outflow.

The solvency II coverage ratio, which assesses the financial health of the company, was at 213%, up from 186% last year. This ratio helped the company to push its interim dividend and return more to its shareholders.

Aviva: attractive dividends

The company increased its interim dividend by 40% to 10.3p, as compared to 7.3p in the half year of 2021. The dividends are on track with the guidance of 31p in 2022 and 32.5p in 2023.

The company’s dividend yield of 7% is much higher than the sector average of 2.1%.

Investor pressure

The company aims to launch a share buyback along with its final results in 2022. The size of the buyback depends on the board’s approval, considering the financial situation of the company.

Activist investor Cevian Capital, which holds more than a 6% stake in the company, will surely be happy with the news. Cevian has been putting pressure on the company for higher returns to shareholders for quite some time now. Cevian had previously requested £5 billionby the end of 2022.

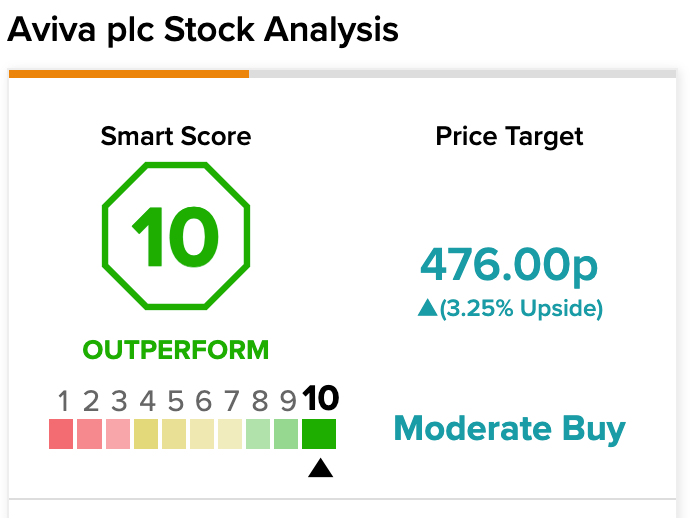

TipRanks Smart Score

Aviva’s shares have a perfect smart score of 10 which means they are more likely to outperform the market averages going forward.

Smart Score is a TipRanks scoring system, which is based on various factors such as analysts’ ratings, blogger opinions, investor sentiment, and more. The stock is analysed on these factors and a score is assigned between 1 and 10.

This tool can guide investors in choosing profitable stocks with the potential to outperform the market.

Analyst views

James Pearse of Jefferies commented on the results, “Aviva has reported a remarkably strong Solvency II capital ratio, allowing the company to confirm that it will commence additional capital returns to shareholders with its full-year 2022 results.”

“This is in line with our expectations, where we are forecasting a recurring £250 million buyback from the full year 2022 results onwards.”

View from the City

According to TipRanks’ analyst rating consensus, Aviva stock has a Moderate Buy rating, based on eight analyst ratings. It includes five Buy and three Hold recommendations.

It has an average price target of 476p, which represents a 2.85% change in the price from the current level. The price has a low and high forecast of 420p and 553p, respectively.

Conclusion

Aviva has a fundamentally strong business, attractive dividends, and an optimistic outlook for the next few years. What’s not to like?

The company is well positioned to achieve its guidance numbers amid challenging economic conditions. The company’s first-half performance will restore shareholder confidence and will be reflected in share prices as well.