Bank of America Corp. (BAC) saw its profit plunge 48% in the first three months of the year as the U.S. investment bank set aside a $3.6 billion provision for potential losses in anticipation of a deteriorating economic outlook.

First-quarter pre-tax income fell to $4.5 billion, or 40 cents a share from the year-ago period. Credit loss provisions in the quarter increased to $4.8 billion from $1 billion a year ago, fueled by a $3.6 billion reserve buffer to cover for potential losses as a result of the economic impact induced by the coronavirus pandemic. Revenue slid to $22.8 million from $23 million. Net interest income decreased 2% to $12.1 billion, as interest rates dropped.

“Despite increasing our loan loss reserves, we earned $4 billion this quarter, maintained a significant buffer against our most stringent capital requirement, and ended the quarter with more liquidity than when we began,” said Bank of America Chairman and CEO Brian Moynihan. “Our customers trusted us with $149 billion in additional deposits since year-end, which enabled us to provide liquidity to people, small business owners and corporate clients.”

Bank of America shares declined 6.4% to $22.19 on Wednesday.

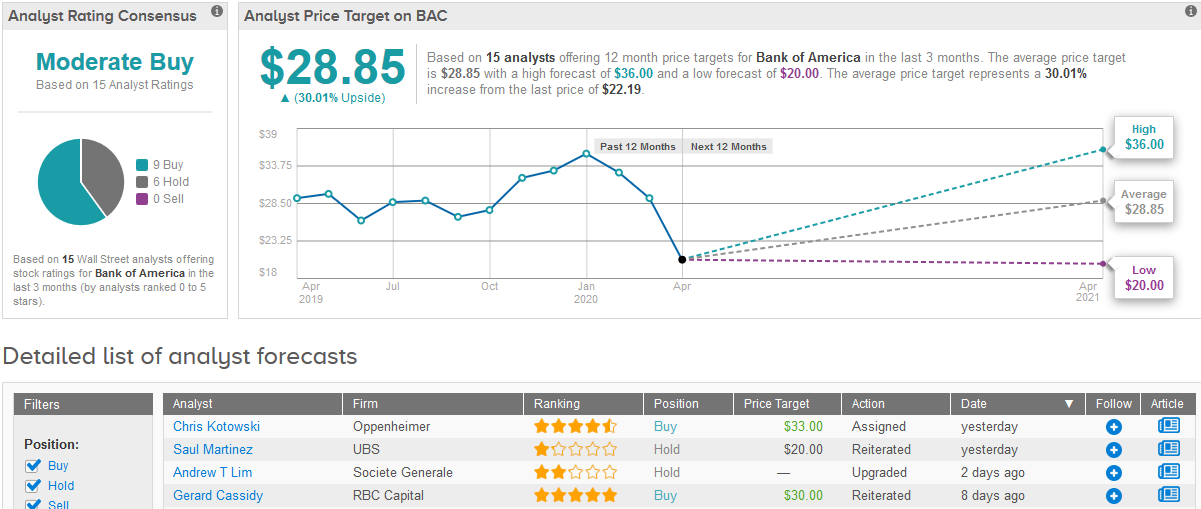

Meanwhile in a report released yesterday, Saul Martinez analyst at UBS maintained a Hold rating on the bank’s stock, with a price target of $20. Overall, the analyst community is a bit more bullish about Bank of America as 9 have Buys and 6 have holds. The $28.85 average price target projects 30% upside potential from current levels in the coming 12 months. (See Bank of America stock analysis on TipRanks).

Related News:

Citigroup Shares Take a Hit as Loan Losses Widen in the First Quarter

Goldman Sachs Profit Plummets 49% as Loan-Loss Provisions Balloon

Costco Ramps Up Dividend By 8%