Dividends are a wonderful thing for investors. These profit-sharing payments from companies to stock owners provide a steady income stream which can be reinvested in the shares, diverted to other endeavors, or even just pocketed. Payments are usually small – sometimes just a few cents per share, and provide an incentive for investors to buy up more blocks of stock.

Dividend stocks are even more attractive in today’s climate of low interest rate. The US Federal Reserve dropped its key rate three times in 2019, brining it down to just 1.75%. Bond yields are consequently low, in the neighborhood of 1.5% to 2.25%. For stock dividends, however, there is no set ceiling, and yields can grow as far as the paying company’s profits will allow.

Swiss banking titan UBS is getting into the January stock recommendations with three interesting dividend picks — each with a dividend yield exceeding 4%. Considering the average yield among S&P-listed companies is just about 2%, these picks will bring in more than double that return.

“We have used our quantitative models to find stocks which are high quality compared to their peers, which pay a dividend and are unlikely to cut it. We have chosen names to be representative of different regions and sectors. Finally, we asked our UBS sector analysts to further scrutinize each name,” UBS noted.

Running each equity through the Stock Screener tool at TipRanks, we’ve confirmed that UBS is in the majority on Wall Street in recommending these shares. Here’s what you need to know about them.

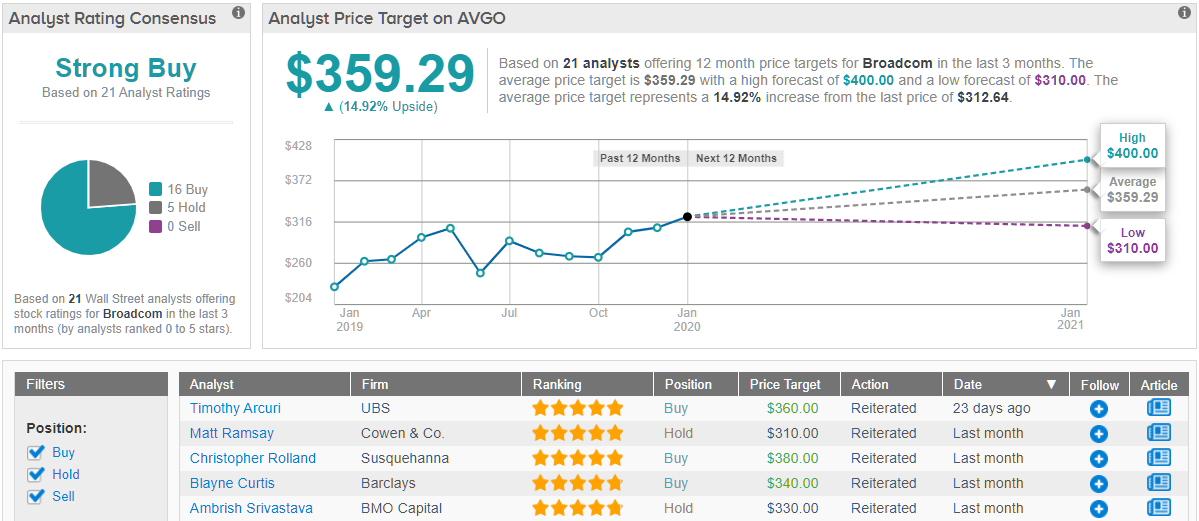

Broadcom, Inc. (AVGO)

Broadcom is a major player in the semiconductor industry. It was the world’s sixth largest chip maker in 2018, by sales, with revenues of $18.46 billion. The stock gained a solid 28% last year, matching the S&P 500’s gains, despite volatility during the year.

The company reported fiscal Q4 earnings in December, and continued its strong performance. Revenues and EPS both beat the expectations. Revenues were also up year-over-year; at the top line, the $5.78 billion reported was well ahead of last year’s $5.44 billion and was up $260 million sequentially. EPS, at $5.39, was a half-percent ahead of the forecast.

The key point for this article, however, is the dividend. AVGO raised its payment in December to $3.25 quarterly, or $13 per year. The yield, at 4.16%, is well ahead of the market average. Broadcom has a long history of reliable dividend payments, and in recent years has increased the payout substantially. In the last three years, the AVGO dividend has risen to its current rate from $1.02.

Timothy Arcuri, 5-star analyst, wrote up UBS’ review of AVGO shares. He stated, “[With] hyperscaler demand coming back, we view AVGO’s decision to invest in the higher margin data center bizz favourably… Ultimately we think the stock will re-rate higher on 5G, margin accretion from software exposure & higher dividends w/ the raise serving as another milestone on the path to ~$15 in dividends (2021), meaning even at our PT of $360, this works out to be >4% yield.”

Note that Arcuri sees AVGO’s dividend remaining at its current high-yield level. His stated price target, $360, indicates an upside for the stock of 15%. (To watch Arcuri’s track record, click here)

Overall, Broadcom holds a Strong Buy analyst consensus rating. The rating is based on an impressive split of 16 Buys versus 5 Holds. Shares are not cheap, at $312, and they are likely to get even more expensive. The average price target, $359, suggests an upside of 14%. (See Broadcom’s stock analysis at TipRanks)

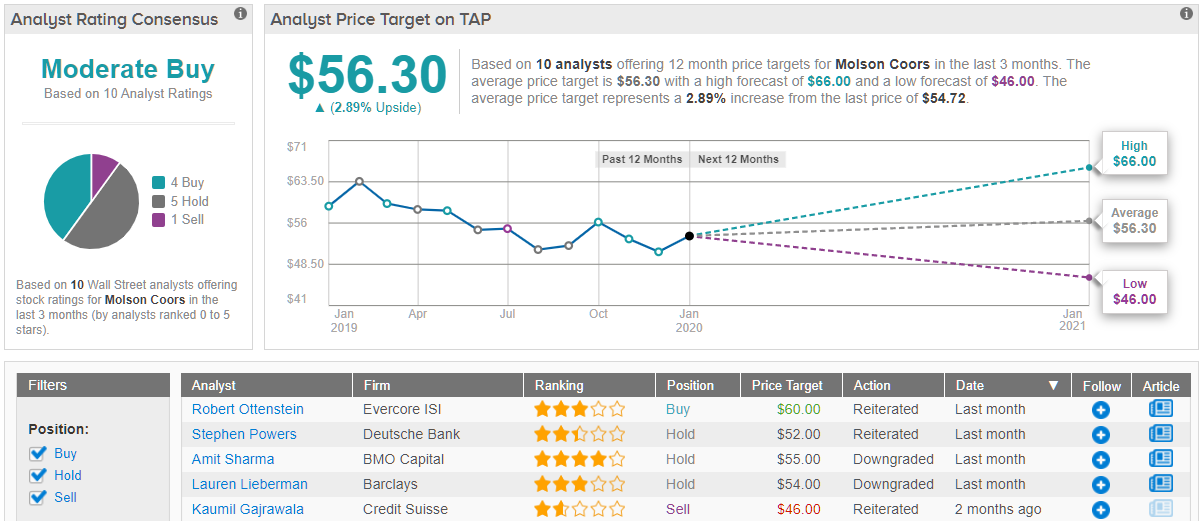

Molson Coors Beverage (TAP)

This giant of the brewing industry controls several household names familiar to beer drinkers everywhere – Coors and Molson, of course, but also Miller, Keystone, and, beloved of college students everywhere, Milwaukee’s Best. The company has a market cap of $11.8 billion, and saw total revenues of $10.77 billion in fiscal year 2018.

While TAP stands on firm ground, and remains profitable, 2019 was a difficult year for the company. TAP is taking proactive moves toward reversing that trend, including partnering with Canadian cannabis producer HEXO to create marijuana-infused beverages. Combining an established beverage marketing and distribution network with a large cannabis grower offers a reasonable path for expansion.

A sweetener for investors, however, is the company’s 12-year history of reliable dividend payments. After holding the quarterly payment steady for years, at 41 cents, TAP made a special payment in August 2019 of 57 cents. The annualized payout, $2.28, indicates that this may be the new normal for TAP dividends. And at the current share price, that puts the yield at a strong 4.35%.

Writing from UBS, Sean King sees TAP as well positioned for gains in the coming year. He writes, “We acknowledge that the ongoing production improvements are intended to support greater portfolio complexity, we believe that this flexibility is targeted for growth brands of the future rather than the legacy tail brands… We see a challenging road ahead for TAP but we remain constructive on the favorable event-path and our confidence in the dividend / de-leverage commitments at deeply discounted valuation.”

King places a $66 price target on the stock to support his Buy rating, indicating confidence in a 21% upside potential. (To watch King’s track record, click here)

All in all, Molson Coors’ Moderate Buy consensus is based on 4 Buys, 5 Holds, and 1 Sell, reflecting the tough market conditions the company has faced in recent years. Shares are priced moderately, at $54.49, and the average price target of $56.30 suggests an upside of 3.32% – not large, but still considerable when combined with the high dividend yield and robust product portfolio. (See Molson Coors’ stock analysis at TipRanks)

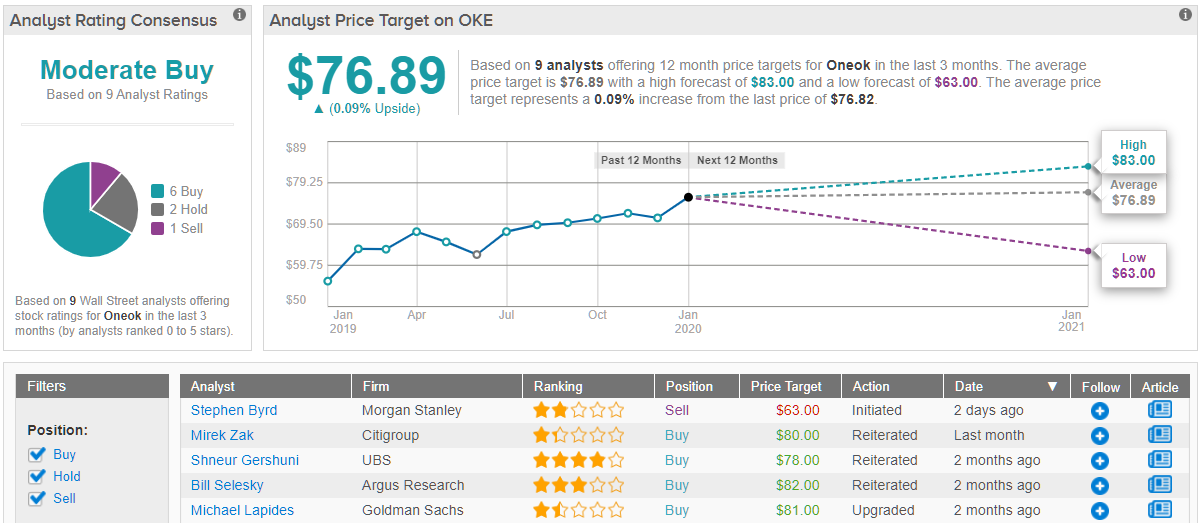

Oneok, Inc. (OKE)

Oneok is a natural gas midstreaming company, owning and controlling the pipelines that transport gas and gas products from production sites to refiners to storage and finally to the customers. The company operates in the Permian, Mid-Continent, and Rocky Mountain regions of the American West. Oneok saw $12.6 billion in revenues and a net income exceeding $300 million in 2018.

2019 numbers are not in yet for the company, but the Q3 numbers show reasons for optimism. While revenues missed the forecast by 4%, coming in at $2.26 billion, the 74 cent EPS was in line with expectations. And, despite a 12% drop in cash flow, the company reported a 19% increase in total assets, to $21.336 billion.

All of that supports the company’s regular dividend payments. OKE has been steadily increasing the payment since 2011. The current quarterly payment, 91.5 cents, annualizes to $3.66 per share – a strong payout. The yield is handsome, at 4.99%. Combined with a 46% share appreciation in 2019, it’s clear why OKE is an attractive stock.

4-star analyst Shneur Gershuni wrote up UBS’ stance on OKE. He put a Buy rating on the stock, and in his comments backed it up: “OKE reported an inline quarter; however, with this earnings season we expect the focus to be on capex. Since 1Q reporting season, OKE has been guiding the street to the upper end of the range despite an extremely wide range outlined in Feb… Overall OKE reaffirmed >20% earnings growth over ‘19 midpoint guide which is what investors were also probably looking for as well.”

Gershuni set his $80 price target on OKE at the end of October – the stock has since gained value and approached that target, leaving room for just 1.5% additional upside. (To watch Gershuni’s track record, click here)

OKE is another Moderate Buy stock, with the consensus rating based on 6 Buys, 2 Holds, and 1 Sell. As mentioned, the stock has gained recently, so the current share price of $76.89 is within a half percent of the $76.89 average price target. (See Oneok’s stock analysis at TipRanks)