Barrick Gold Corp. said that it accepts a Chilean court’s ruling to “uphold the closure order” imposed on its Pascua-Lama project by the country’s environmental regulator.

Barrick Gold’s (GOLD) Pascua-Lama project, which is situated on the border between Chile and Argentina, was put on hold in 2013 due to environmental issues and other political and labor unrest issues. The company said that it would not appeal the court’s ruling and “Pascua would now be transitioned from care and maintenance to closure in accordance with the Environmental Court’s decision.”

Barrick’s executive director for Chile and Argentina, Marcelo Álvarez, said Pascua-Lama was an important project and the gold miner would try to re-evaluate its potential, though the project is now suspended following the ruling. Meanwhile, he confirmed that any new project would comply with the laws of both Chile and Argentina.

On Aug. 10, Barrick reported 2Q earnings of $0.20 per share, ahead of the Street estimates of $0.18 a share. Its revenues of $3 billion also came marginally ahead of analysts’ expectations of $2.9 billion. (See GOLD stock analysis on TipRanks).

Following Barrick Gold’s upbeat 2Q results, Fundamental Research analyst Siddharth Rajeev gave a Buy rating and a price target of $31.82 (10.1% upside potential) on the stock, saying that the company still has upside potential.

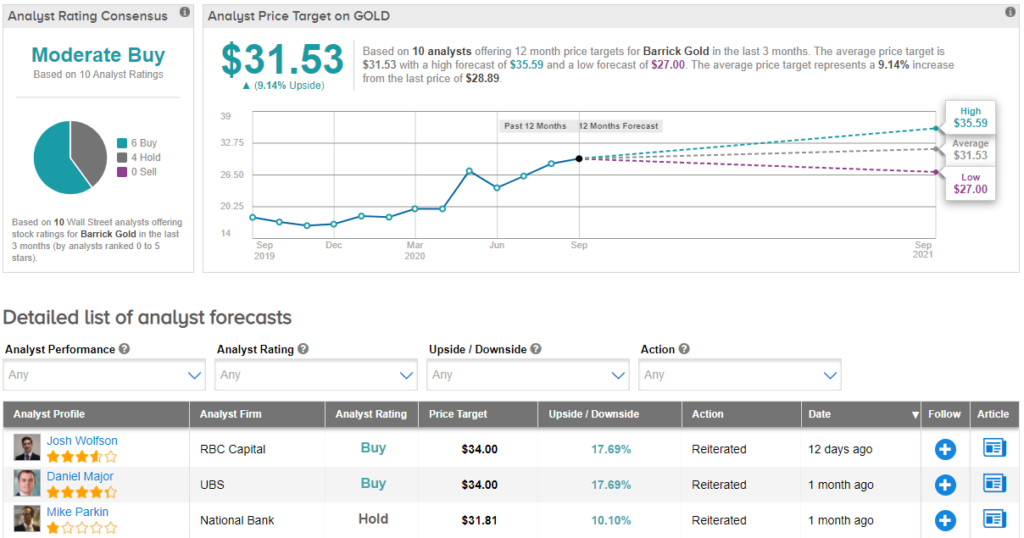

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 6 Buys and 4 Holds. The $31.53 average price target implies upside potential of about 9.1% to current levels. Shares have gained 55.4% year-to-date.

Related News:

Kinross Reinstates Dividend, Plans To Boost Output; BMO Upgrades To Buy

Dave & Buster’s Sinks 26% On Bankruptcy Threat Report; Truist Says Buy

Stifel Nicolaus Lifts Penn National’s PT, Shares Jump Over 9%