Retailers haven’t had an easy time in the 2010’s. The rise of online shopping has seriously eaten into the high street’s chunk of consumer spending. Therefore, the companies that will survive and flourish in the long run are those who adapt to the new reality and use it to their advantage.

Against this backdrop, two traditional retail stocks are thriving in the new paradigm. Nike and Lululemon operate in a similar niche and have both managed to stay ahead of the game. While other retailers have been closing shop, Lululemon has been building upon its strong brand identity and actually opening more stores. Nike, on the other hand, has been harnessing new technology to its advantage, whether through data science or brand related apps.

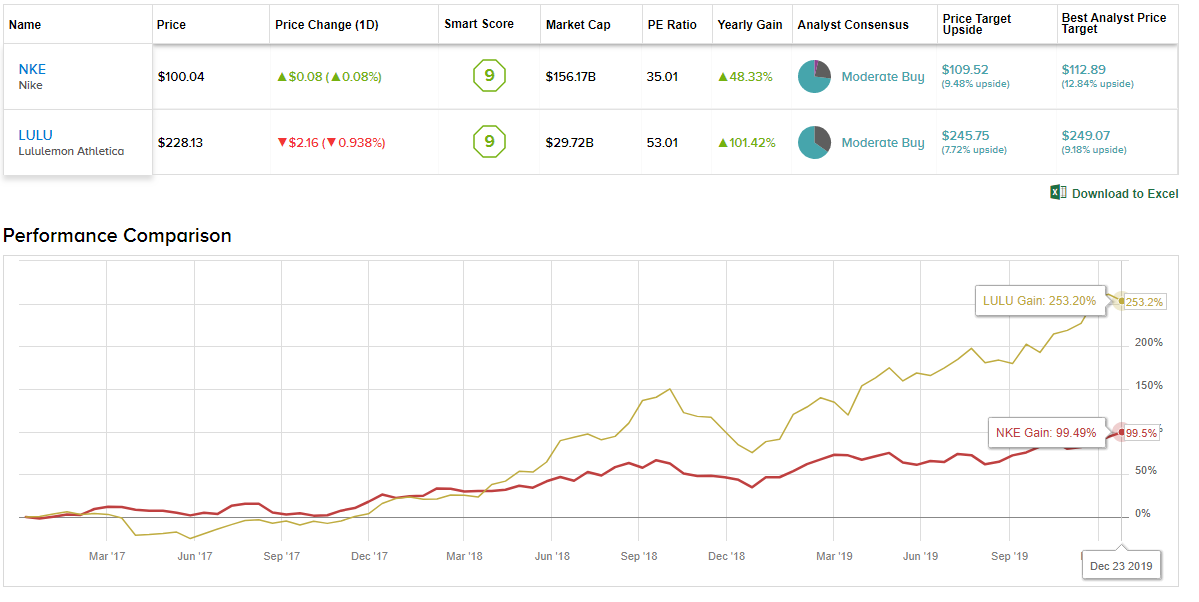

The Stock Comparison tool from TipRanks – a company that tracks and measures the performance of Wall Street’s analysts – lined up the two tickers alongside each other to measure performance, giving us an idea of what the Street thinks is in store for the year ahead. Let’s take a closer look.

Nike Inc (NKE)

Nike is so ubiquitous, it is even recognizable by making a certain sound. We are referring to the ‘swoosh’ sound, of course, inspired by the world-famous company logo. The sportswear giant’s expansion continues as it notched another all-time-high on December 19, closing at $101.15 per share, and only slightly dipping since.

The word on the Street is that the party isn’t about to stop here, either. Last week’s F2Q20 report beat the analysts’ forecast on several fronts; revenue reached $10.33 billion, beating the estimate’s $10.09 billion. EPS also exceeded the estimate, coming in at $0.70, as opposed to $0.58. The beat raised the company’s two-year-stacked revenue growth rate to 27%, an unheard of level for a brand of Nike’s size.

Among the report’s highlights was a 7th consecutive quarter of over 30% digital business growth (+38%), a figure not lost on Evercore’s Omar Saad, who thinks “the market still underappreciates just how early Nike likely is in its DTC (direct to consumer)/digital journey.”

In a note to clients following the report, the 4-star analyst cites Nike’s “early and aggressive” digital and technology investments as key for setting the scene for further growth. Furthermore, Saad notes how Nike’s deployment of “its technology edge thru data collection and analytics and consumer insight”, has benefitted the consumer experience with respect to its SNKRS app, Nike.com, and the Nike app.

Nike is also reaping the benefits from its recent acquisition of data science platform Celect. The company’s management has credited the addition as “accelerating our ability to better predict the right supply of products down to the style, color, and size… and enabling more accurate forward positioning of inventory in stores, online, and in DC’s.”

Saad concludes, “Given Nike’s significant scale and IT spend advantage, coupled with its early lead in digital, we remain very bullish on the company’s ability to continue to maintain its momentum in digital (which remains just 13% of the business – up from 4% four years ago).”

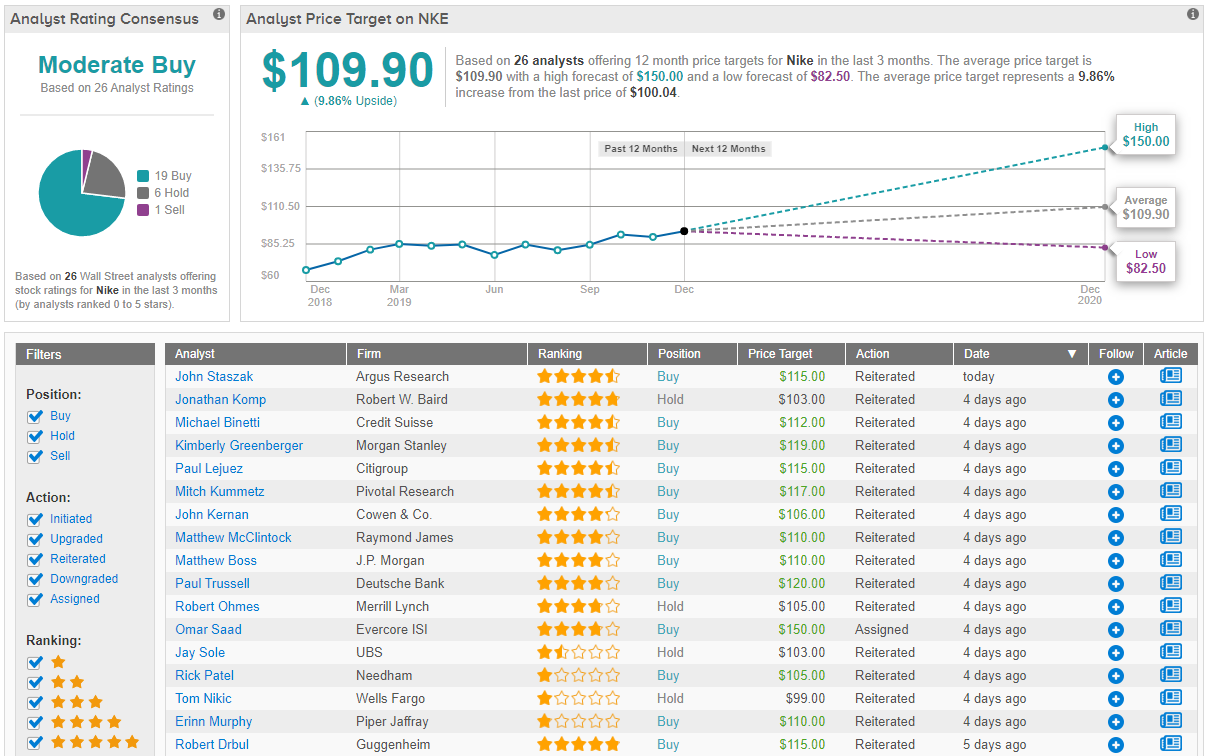

Following the analyst’s assessment, it is hardly surprising to learn Saad assigned an Outperform rating on Nike, alongside a price target of $150. The target indicates upside potential of 50%. (To watch Saad’s track record, click here)

Is the rest of the Street feeling the swoosh? Apparently so, though not quite reaching the level of enthusiasm the Evercore analyst displays. Nike has a Moderate Buy consensus rating, which breaks down into 19 Buys, 6 Holds, and 1 Sell. The average price target of $109.90 implies upside of 10%. (See Nike stock analysis on TipRanks)

Lululemon Athletica Inc (LULU)

Not to be outdone by Nike, athletics apparel specialist Lululemon Athletica is showing no signs of slowing down yet. The company’s 2019 has continued a whole decade’s worth of trending upwards and concludes with another 88% added to its share price. Lululemon also notched an all-time-high in December, only slightly pulling back from the December 11 close of $233.19. Following the almost parabolic runup, is it time for a downturn? Not according to the figures being posted.

The company’s recent 3Q report was a bit of a blockbuster, with same-store sales up by 17% and marking the third consecutive quarter in which the company raised its full year growth forecast. Expecting quarterly revenue of $899.7 million, the figure of $916 million easily trounced it and marked 23% year-over-year growth. The quarter also marked an 11th straight beat of the Street’s estimate on EBIT/EPS growth.

As with Nike, LULU’s online presence has displayed strong growth and sales were up by 30%. Additionally, LULU is adding to its core demographic as outerwear and men sales exhibited outstanding growth, too.

Deutsche Bank’s Paul Trussel, notes that the momentum has continued into Q4 with “record setting days over the Thanksgiving weekend and into Cyber Monday.”

The 4-star analyst said, “Moving ahead, we continue to model double-digit comps as we believe momentum will continue as the store experience is improving, guest engagement is increasing, and the product pipeline remains exciting… We believe our multiple is appropriate given good visibility around the company’s earnings algorithm combined with our belief that LULU can sustain robust comp trends over the next 12 months.”

Accordingly, Trussel reiterated a Buy rating on LULU, alongside a price target of $247. If the target is met, investors will be lining their LULU leggings with 8% gains. (To watch Trussell’s track record, click here)

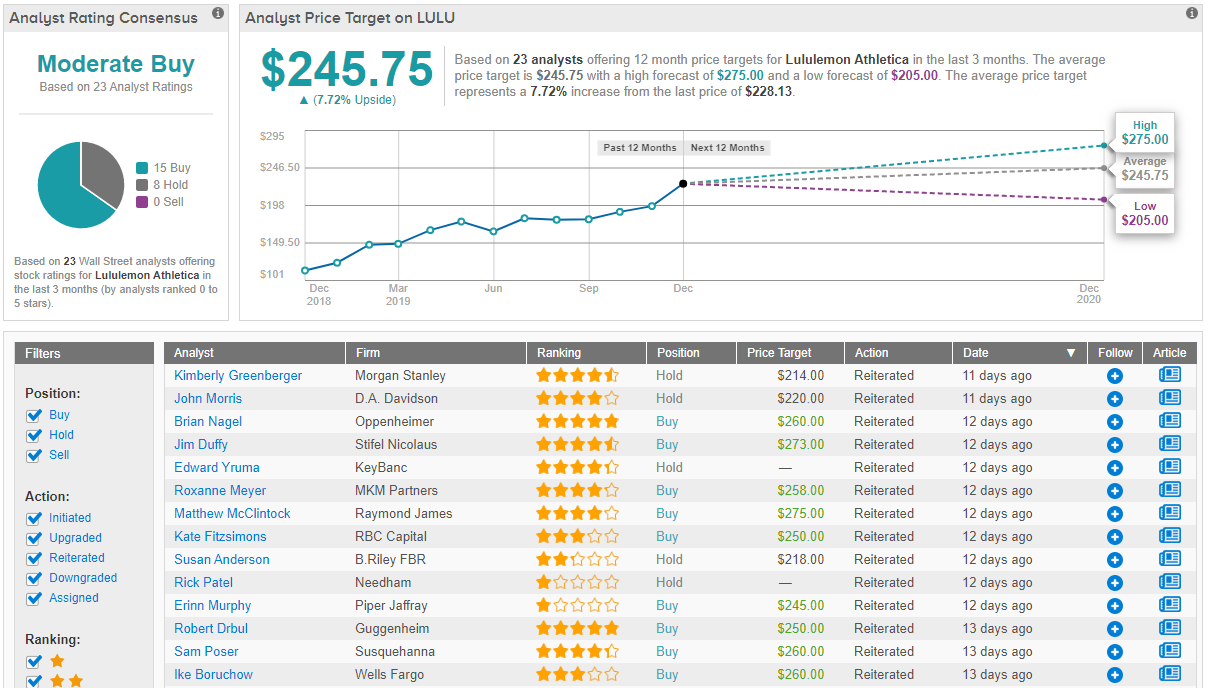

15 Buys and 8 Holds mean the sports apparel retailer has a Moderate Buy consensus rating. The Street’s average price target indicates there is further room for another 8% to be added to the company’s share price. (See Lululemon stock analysis on TipRanks)