The COVID-19 pandemic was difficult for the retail industry, due to restrictions or outright closures. At the same time, websites of retail chains did see brisk business.

According to the U.S. National Retail Federation (NRF), citing the U.S. Census Bureau, retail sales in August inched up by 0.7% after seasonally adjusting for July, and were up 15.1% year-over-year.

NRF chief economist Jack Kleinhenz stated that retail sales in August overcame “unusual twists and turns that have affected shopping behavior both in terms of the timing and composition of sales.”

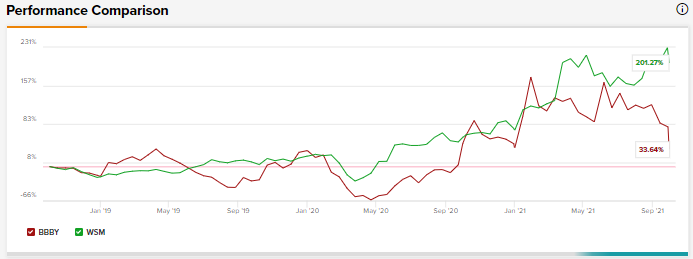

Using the TipRanks stock comparison tool, let’s compare two retail companies, Bed Bath & Beyond (BBBY), and Williams-Sonoma (WSM), and see how Wall Street analysts feel about these stocks.

Bed Bath & Beyond

Bed Bath & Beyond is an omnichannel retailer that sells a wide array of merchandise including bedding, home organization, and personal care items.

The company reported disappointing Q2 results on Thursday, with net sales falling 26% year-over-year to $1.99 billion and falling short of analysts’ estimates of $2.06 billion. Adjusted earnings came in at $0.04 per share, falling short of consensus estimates of $0.52.

Management explained the disappointing results were due to “unexpected, external disruptive forces towards the end of the quarter that impacted our outcome. In August, the final and largest month of our second fiscal period, traffic slowed significantly and, therefore, sales did not materialize as we had anticipated.” (See Bed Bath & Beyond stock charts on TipRanks)

Moreover, the challenging environment was exacerbated by the Delta variant, particularly in the key states of “Florida, Texas and California, which represent a substantial portion of our sales.”

Adding to BBBY’s woes, were supply chain challenges resulting in rising cost inflation. This significantly affected the company’s sales and gross margin.

However, Bed Bath & Beyond CEO Mark Tritton stated in the company’s press release that BBBY remained on track when it comes to its new growth strategy, as its higher-margin brands owned by the company outperformed “our penetration goals across the overall chain, and even stronger in remodeled stores.”

The company had unveiled its new growth strategy in October last year. That included the launch of 10 new owned brands over the next 18 months, improving its base price competitiveness, and following an omnichannel growth strategy.

In Q3, BBBY expects net sales to range between $1.96 billion to $2 billion, reflecting sales from the company’s core banners like Bed Bath & Beyond, buybuy BABY, Harmon Face Values and Decorist.

The company expects to feel impact of supply chain challenges through Q3 and as a result, anticipates adjusted gross margin to be between 34% to 35%. BBBY projects adjusted earnings to break even or come in at $0.05 per share in Q3.

BBBY revised its outlook for FY21 and now anticipates higher net sales in the range of $8.1 billion to $8.3 billion. Adjusted earnings are expected to come in at $0.70 to $1.10 per share.

While BBBY’s management still believes that it is on track to achieve its gross margin target of 38% in FY23, Wells Fargo analyst Zachary Fadem is skeptical. The analyst believes “Q2’s hiccup undeniably casts doubt on BBBY’s ability to deliver on its aggressive multi-year turnaround plans.”

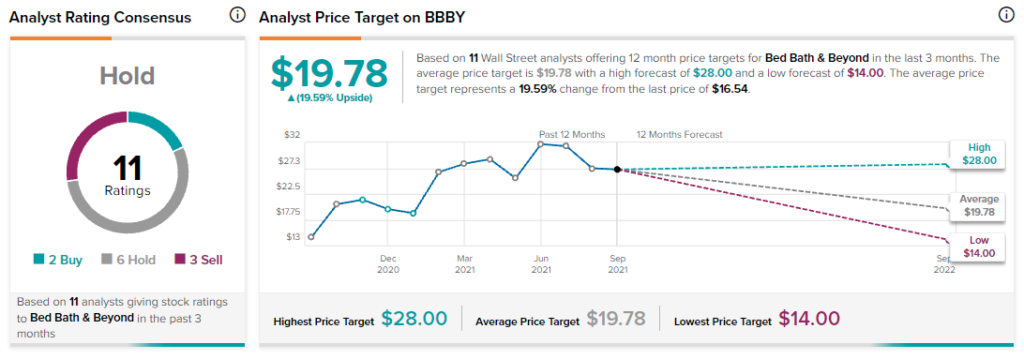

Fadem is bearish on the stock, and reiterated a Sell and halved his price target from $28 to $14 (approximately 15.5% downside) on the stock.

Wall Street analysts are sidelined about Bed Bath & Beyond, with a Hold consensus rating, based on two Buys, five Holds, and three Sells.

The average Bed Bath & Beyond price target of $19.78 implies 19.6% upside potential from current levels.

Williams-Sonoma

Williams-Sonoma is a specialty retailer of sustainable home products, and markets its merchandise through a combination of retail stores, e-commerce websites, and direct-mail catalogs. The company’s brands include Pottery Barn, Williams-Sonoma, West Elm, Rejuvenation, and Mark and Graham.

In contrast to Bed Bath & Beyond’s disappointing Q2 results, Williams-Sonoma had a strong second quarter. In Q2, the company delivered revenues of $1.95 billion, a 30% year-over-year growth that exceeded consensus estimates of $1.81 billion. Adjusted diluted earnings came in at $3.24 per share, surpassing analysts’ estimates of $2.60 per share.

Laura Alber, president and CEO of Williams-Sonoma commented, “We are proud to report another quarter of outperformance with a 30% comp, strong growth across all brands and channels, and 360 basis points of operating margin expansion. We have an advantage in the industry due to our exclusive in-house design capability, our channel strategy which is digital-first but not digital only.”

More importantly, Alber also said that the company did “not see any evidence that growth trends are waning, and in fact, we see favorability in the macro environment as more people prioritize their homes and home décor.” (See Williams-Sonoma stock charts on TipRanks)

The company raised its FY21 outlook following the strong Q2 results and expects revenues to grow in the “high teens to low twenties” while operating margin is expected to lie between 16% to 17%. WSM also remained confident of achieving $10 billion of revenues in 2024, one year earlier than expected.

Fadem, while positive about WSM’s Q2 results, was also of the opinion that a “narrative of decelerating comps appears inevitable, supply chain challenges remain and the return of normalized industry promo [category promotions] remains a looming threat as the 2H bar continues to rise.”

The analyst also expects “potential mean reversion in home goods-related spending.” Fadem reiterated a Hold rating and raised his price target from $180 to $195 (12.1% upside) on the stock following the Q2 results.

Turning to the rest of the Street, Wall Street analysts are sidelined about Williams-Sonoma, with a Hold consensus rating, based on four Buys, seven Holds, and four Sells.

The average Williams-Sonoma price target of $190 implies 9.8% upside potential from current levels.

Bottom Line

While analysts are sidelined about both stocks, it remains to be seen how BBBY navigates its supply chain challenges and the threat of the Delta variant. In contrast, Williams-Sonoma seems to be better positioned to navigate this turbulence.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.