Car rental company Hertz Global Holdings Inc. (HTZ), whose largest shareholder is billionaire investor Carl Icahn, has received “additional” time from its lenders and debtholders to formulate a financial plan to avert a possible bankruptcy. Shares plunged 15% to $3.04 in early afternoon trading in the U.S.

The struggling car rental company said it entered into a forbearance agreement with debtholders for certain loan repayments which will expire on May 22. The deadline will give Hertz more time to hold discussions with its key stakeholders with the goal of designing a financing strategy for its ongoing operating and financing requirements in light of the economic impact of the coronavirus pandemic.

“As a result of the COVID-19 global pandemic, Hertz and its subsidiaries have experienced a rapid, sudden and dramatic negative impact on their businesses,” Hertz said in a SEC filing. “While Hertz has taken aggressive action to eliminate costs, it faces significant ongoing operating expenses.”

On April 27, Hertz failed to make payments in accordance with an operating lease, which resulted in an amortization event on May 1, the company said in the filing. At the end of last month, Reuters reported that Hertz was working with debt restructuring advisers to help it cope with its $17 billion debt pile.

Global travel restrictions tied to the coronavirus outbreak have depressed revenue for car rental companies. Rival Avis Budget Group (CAR) this week announced a $400 million debt offering to shore up its finances. Avis Budget Group and other affected companies in the car rental industry, have asked the U.S. government to expand its $2.3 trillion stimulus program to provide aid for tourism-related businesses.

In addition, Hertz said in the filing that due of the impact of the global pandemic on the travel industry, it will not need to acquire new vehicles for its fleet this year.

“There can be no assurances that Hertz will be able to successfully negotiate any further forbearance or waivers extending relief past May 22,” Hertz said.

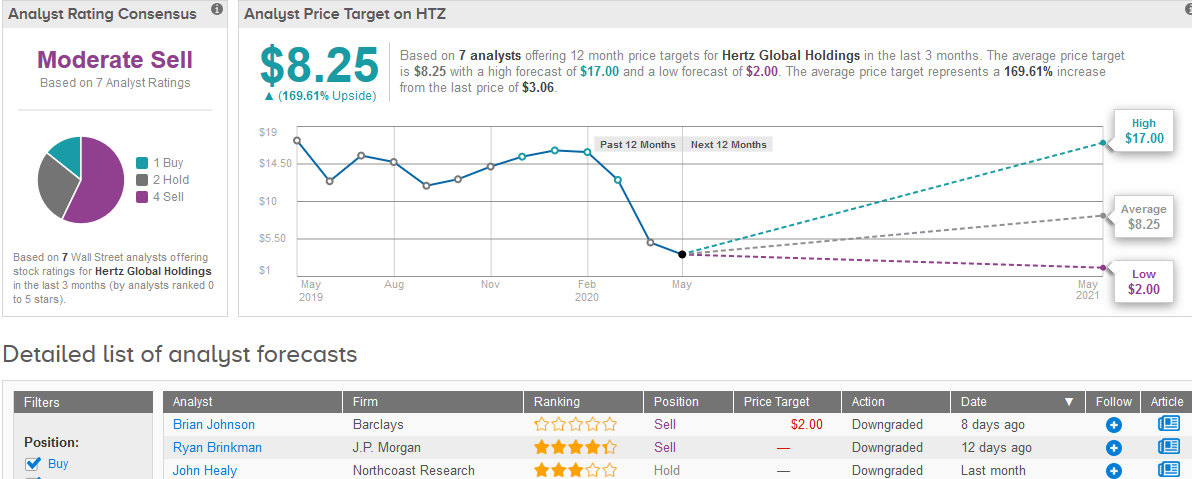

Wall Street analysts have a Moderate Sell consensus rating on the stock based on 4 Sells, 2 Holds and 1 Buy. The $8.25 average price target indicates 170% upside potential in the shares in the coming 12 months. (See Hertz stock analysis on TipRanks).

Related News:

Avis Budget Group Slides 7% Amid $400 Million Debt Offering

WestRock Reports Quarterly Sales Miss, Slashes Dividend Payout By 57%

Diamondback Reports Weaker-Than-Expected 1Q20 Results, But Dividend Stays Stable