Beyond Meat (BYND) served up a tasty alternative dish in its earnings report on Tuesday. Somewhat surprising the market, the plant-based meat pioneer posted beats both on top and bottom line. Investors reacted in glee and sent the stock up 25% after scouring the print.

Here’s a quick recap: BYND reported revenue of $97.07 million, beating the estimates by $9.97 million while exhibiting year-over-year growth 141.4%. The company, surprisingly, even reported a profit; net income came in at $1.8 million, compared to the $6.6 million net loss in the same period last year – amounting to EPS of $0.03 and beating the Street’s call for – $0.06.

Along with revenue more than doubling in the U.S. The company also grew on the international stage, where retail sales were particularly impressive. Revenue grew by more than 5000% to nearly $6 million in the quarter. Management expects further international launches later in 2020.

As expected, and has become customary during the pandemic, Beyond Meat didn’t provide any guidance for the rest of the year.

Despite the promising report, Jefferies’ Robert Dickerson is not entirely convinced. Although believing BYND’s strategy of heavy promotional activity and “lowering the blended unit price via larger frozen product offerings,” is the right way to go, there are too many variables at play, when considering the meat industry disruptor as an investment in the current economic climate.

Dickerson opined, “Beyond Meat’s Q1’20 results impressed the market, as gross margin topped consensus by over 750 bps, and alternative protein has a real chance to gain incremental share over animal protein in the near-term, but given near-term foodservice risk, other upcoming competitive launches, and uncertain volume elasticity vis-a-vis lower pricing, we remain sidelined.”

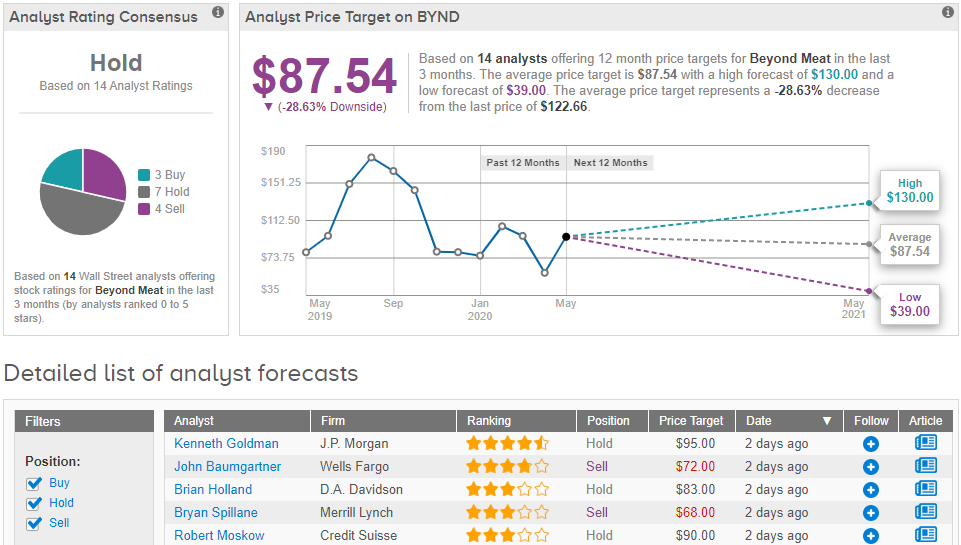

Accordingly, Dickerson reiterated a Hold along with a $95 price target. The analyst, therefore, expects downside of 23% over the next 12 months. (To watch Dickerson’s track record, click here)

Dickerson’s assessment is in line with the rest of the Street. 3 Buys, 7 Holds and 4 Sells add up to a Hold consensus rating. With an average price target of $83.5, the analyst community expects downside of 17%. (See Beyond Meat stock analysis on TipRanks)