Billionaire hedge fund manager Bill Ackman said Pershing Square Capital Management no longer has hedges on its portfolio, but still has cash to invest if shares decline further as the coronavirus outbreak continues to spread across the U.S.

In a Twitter thread, Ackman said Pershing on Friday invested $500 million to increase its stake in Howard Hughes Corp. (HHC), one of the largest real estate development companies in the US. Howard Hughes said it agreed to sell 10 million shares at $50 a share, to Pershing raising $488 million in net proceeds.

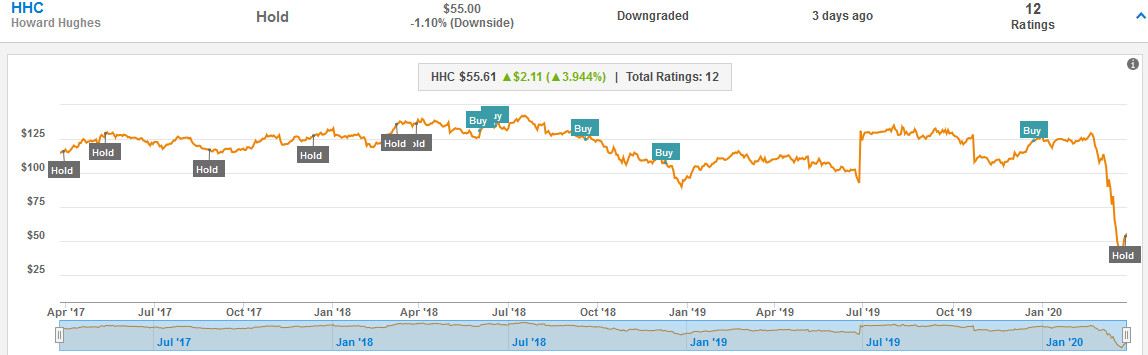

Alexander Goldfarb, four-start analyst at Piper Sandler last week downgraded Howard Hughes’ rating to Hold from Buy. Sandler’s $55 price target suggests little potential for gains in the shares in the next 12 months with the stock priced at $55.61 as of March 27.

“HHC’s equity offering on Friday is the first, hopefully of many, equity offerings that will provide fuel for an economic recovery,” Ackman said. “Without this capital, HHC would have had to mothball many of its projects.”

Ackman added that at the beginning of the year, Pershing bought enough insurance to protect the $8.5 billion portfolio that had been invested in the stock market.

“Our actions were no different than a home owner buying flood insurance,” Ackman said. “We saw the tsunami coming and the sellers of CDS insurance were not similarly concerned.”

Pershing Square yielded $2.6 billion from hedging its stock portfolio through credit protection.

“By reinvesting the $2.6 billion of insurance proceeds in the stock market, we have helped to support the stock prices of our portfolio companies, reducing other investors’ losses,” Ackman said. “We have also provided capital to support our companies’ growth which will in turn support the economy.”

Related News:

Hedge Fund Billionaire Ackman Denies TV Interview Helped $2.6 Billion Hedge Trade ProfitHedge Fund Billionaire Ackman Says Stocks to Soar on US Lockdown Prospect

2 Biotech Giants in the Hunt for New Coronavirus Drug