Earnings season kicks off this week, and market watchers are preparing for the worst. The upcoming release of first quarter financial results is marred by historic levels of uncertainty, with worry looming over Wall Street as investors await a more detailed look at the extent of COVID-19’s impact on profits.

For those feeling lost in all of the stock market fog, investing gurus can offer a sense of clarity. No one more so than billionaire David Shaw, a former computer science professor at Columbia University. Since founding his investment firm, D.E. Shaw group, in a small New York City bookstore in 1988, he has grown the firm from six employees and $28 million in capital to an estimated $47 billion, with it delivering $25 billion to its investors as of the end of 2016. While most of D.E. Shaw’s day-to-day operations are now managed by the Executive Committee, Shaw still remains involved in higher-level strategic decisions.

As for how Shaw was able to achieve this growth, he used algorithms and other quantitative techniques, pioneering the intersection of technology and finance. Thanks in part to his work, the quantitative revolution was born.

Bearing this in mind, we used TipRanks’ database to get the data on two stocks Shaw’s firm snapped up recently. Let’s get started.

Yelp Inc. (YELP)

The crowd-sourced business review company has certainly had a rough going recently. As the COVID-19 pandemic is hitting it hard, Yelp announced that it will need to lay off and furlough workers in order to survive. In response to the news, shares sunk even lower, with the year-to-date loss currently landing at 44%.

Having said that, Shaw viewed the recent weakness as a unique buying opportunity. According to an April 13 disclosure, D.E. Shaw bumped up its Yelp holding by 19.1%, adding 575,589 shares to be precise. This makes the firm a 5% owner of the company, with its total position coming in at 3,593,836 shares.

Writing for Aegis Capital, five-star analyst Victor Anthony is cautiously optimistic. He doesn’t dispute the fact that it has earned a reputation as a “material under-performer,” with the stock falling flat over the last three years. In addition, its fourth quarter results were disappointing as revenue, adjusted EBITDA and EPS all fell below estimates partly due to greater than expected seasonality in December.

Anthony added, “Yelp’s stock is facing an uphill battle to reward shareholders by relying on the core business alone, and that’s in spite of the $681 million of share repurchases over the past ~2.5 years. It should be clear, that, for the stock to work, Yelp needs a transformative event.”

As for this “transformative event”, Anthony suggests a merger with Groupon. He argues that such a merger would result in both revenue and cost synergies, as well as drive share price upside. Expounding on this, he stated, “Given the weak 4Q performance, underwhelming guidance versus our/consensus, lack of clear identifiable catalysts, and longer-term guidance on revenue and EBITDA margin that, in our view, are a stretch to achieve, it is hard to believe that the Board will continue to accept the share price underperformance. As such, we believe the Board will see no choice but to act to enhance the value of the stock beyond the new $250 million share repurchase.”

To this end, Anthony decided to stay with the bulls, reiterating a Buy rating. Based on his $45 price target, the upside potential lands at a whopping 131%. (To watch Anthony’s track record, click here)

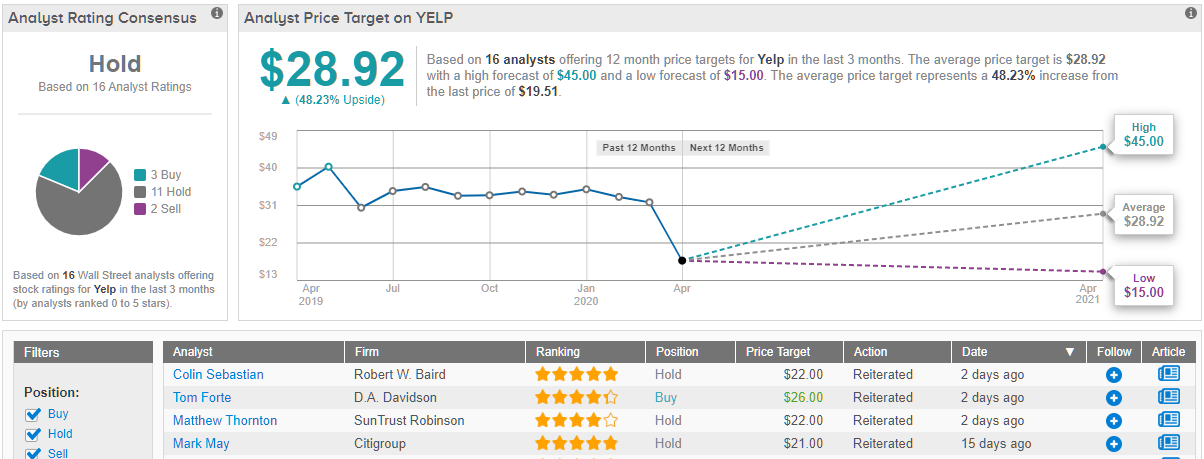

What does the rest of the Street think about Yelp’s long-term growth prospects? The stock has received 3 Buy ratings, 11 Holds and 2 Sells in the last three months, making the analyst consensus a Hold. However, the $28.92 average price target implies shares could climb 48% higher in the next twelve months. (See Yelp stock analysis on TipRanks)

Blue Apron Holdings (APRN)

Moving on to a completely different industry, Blue Apron delivers all of the ingredients needed to make home cooked meals in exactly the right proportions. As lockdowns in cities across the U.S. prevent people from eating out, it makes sense that the company has attracted significant attention. On top of this, it notched a 213% gain in the last month.

Counting itself as one of APRN’s fans, D.E. Shaw acquired a new position in the company. Disclosed on April 6, Shaw’s firm bought up 424,863 shares, giving it a 5.2% stake in APRN.

Meanwhile, Canaccord Genuity’s Maria Ripps isn’t quite as optimistic. During the fourth quarter, active customers decreased by 35,000 sequentially to 351,000, the seventh quarter in a row of net customer losses as it pulls back on marketing spending and shifts the focus to high affinity customers. While average revenue per customer increased 6% and orders per customer grew 7%, revenue dropped.

Commenting on APRN’s lackluster performance, Ripps noted, “Blue Apron’s Q4 results showed continued active customer and revenue declines, although several metrics, including average revenue per customer and orders per customer, showed some strength. To preserve financial resources, the company is closing down its previously downsized Arlington, TX fulfillment facility and consolidating its production volumes to its two larger facilities in Linden, NJ and Richmond, CA.”

That’s not to say the news is all bad. The company upgraded its menu during Q4 by expanding its selection from eight to eleven recipes, with more than half of its recipes now being considered healthy. Not to mention APRN is strengthening its partnerships. Its Weight Watchers relationship now offers more flexibility, it added two diabetes-friendly recipes per week as part of its ADA collaboration and it will now work with Chef Seamus Mullen on healthy recipes. The company also just added a new standalone Meal Prep option.

However, all of this wasn’t enough to convince Ripps to side with the bulls. She remains on the sidelines, maintaining a Hold recommendation and reducing the price target from $7 to $5. This new target implies 58% downside potential. (To watch Ripps’ track record, click here)

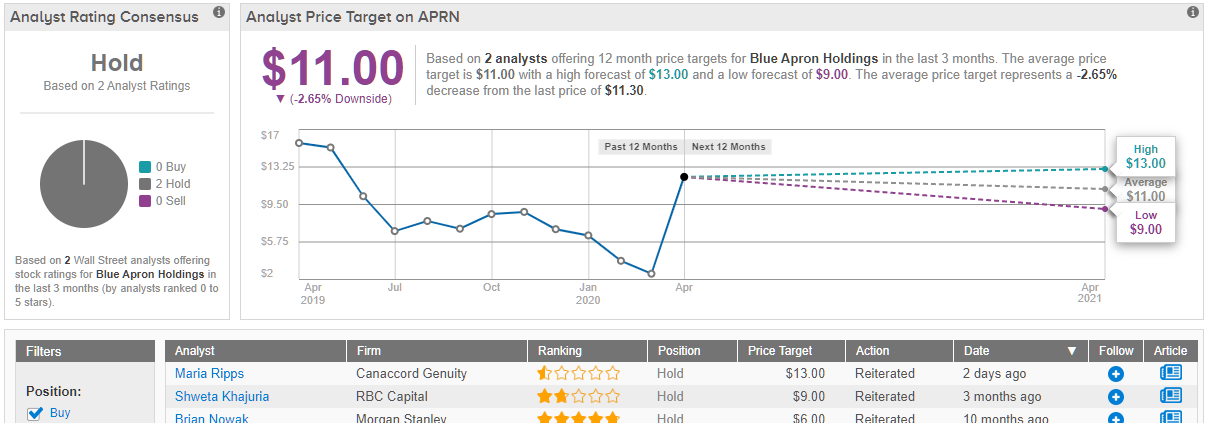

Turning now to the rest of the Street, APRN’s Hold consensus rating breaks down into 2 Holds, which were assigned in the last three months. It should also be noted that the $11 average price target puts the downside potential at 8%. (See Blue Apronv stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.