Gabriel Plotkin, formerly a top trader for Steve Cohen’s Point72, put out his own shingle in 2014, opening Melvin Capital with $1 billion in seed money. Since then, Melvin has achieved high annual returns, hitting 47% in its first year of operations and 41% in 2017. Plotkin’s fund is consistently among the highest performers in the industry. According to its last 13F, Melvin Capital has over $7.7 billion in assets under management.

The largest holding in Melvin’s portfolio is Amazon, of which the fund has over 405,000 shares. It’s no wonder that a high-performing fund is heavy into the tech giant. Amazon’s share appreciation in recent years has been extraordinary, and Plotkin has steered his fund toward technology and consumer stocks. But he hasn’t built his success just on the obvious plays – Plotkin takes risks, too.

In recent weeks, in the midst of the largest market slide since the Great Depression, Plotkin has gone on a shopping spree. Taking Warren Buffett’s famous advice to heart – “Be fearful when others are greedy. Be greedy when others are fearful.” – Plotkin has made two unusual plays.

Opening up the TipRanks database, we’ve found that these stocks offer a bold investor attractive combinations of low entry points and a high growth potential. Let’s find out just what Plotkin did.

L Brands, Inc. (LB)

We’ll start with L Brands, a retailer whose stores you’ve almost certainly heard of. The company owns Bath and Body Works, as well as a 45% stake in Victoria’s Secret. Both are staples of the shopping mall segment, and the coronavirus hit to the consumer economy has put heavy pressure on L Brands.

The presser is evident in the earnings. The company is forecasting a 5-cent per share loss in Q1, as the social distancing restrictions really start to bite.

Even with the downbeat guidance, LB has taken care to maintain its dividend. The company pays out 30 cents quarterly, or $1.20 annualized, giving a hefty yield of 10.6%. That’s more than 5x the average dividend yield found among S&P listed stocks.

That’s the state of L Brands, as it stands now, and gives some background to Plotkin’s moves on the stock. In March his fund bought 14.2 million shares, and added another 5.8 million in April. This is a new position for Melvin Capital, and at 20 million shares, it is substantial, giving the fund 7.2% ownership of the company.

Deutsche Bank’s Tiffany Kanaga covers this stock, and sees the retailer with a path forward – somewhat counterintuitive for retail right now, but sensible considering Bath and Body Works’ product line. Kanaga writes, “We note that hand sanitizer, while rotating to new scents as we continue to check the website, remains completely sold out. We estimate soaps & sanitizers typically at ~19% of BBW sales, but also expect incremental basket addons in body care (~43% of sales) and home fragrance (~38%). Importantly, the majority of BBW products are produced in the U.S., minimizing supply chain disruption ahead.”

Kanaga places a Buy rating on the stock, along with a $29 price target. Her target suggests a highly robust 99% upside potential. (To watch Kanaga’s track record, click here)

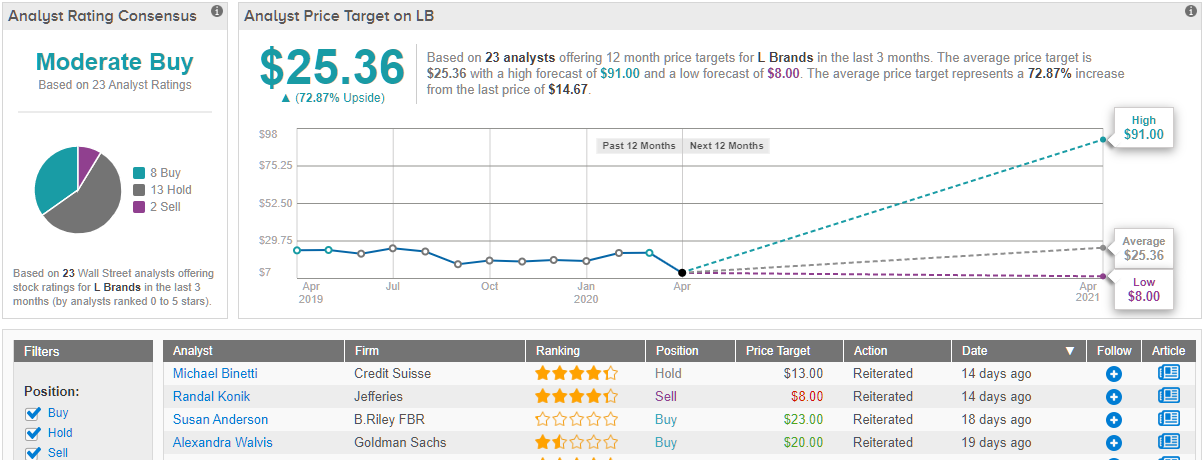

The overall outlook on LB, an analyst consensus rating based on 24 reviews, is a Moderate Buy. The reviews break down as 8 Buy, 14 Hold, and 2 Sell. Shares in L Brands are selling for a modest $14.69, and the $25.36 average price target indicates room for 73% growth in the coming year. (See L Brands’ stock analysis at TipRanks)

Hyatt Hotels Corporation (H)

The leisure industry is facing a particularly hard time, with travel heavily restricted and social distancing measures strongly encouraged to combat the COVID-19 epidemic. Fortunately for Hyatt, the company reported positive Q4 earnings just before the market collapse, allowing the stock to peak at $92, giving it some resilience as the downturn took hold.

Even so, Hyatt has been forced pull back its 2020 guidance, as the company attempts to predict just how deep the pandemic’s negative impact on travel and leisure will finally get. Among the important factors in the revised guidance: a three-month delay in construction during 2020.

Once the collapse came, however, share prices dropped and Plotkin moved in. His firm disclosed, on March 20, a purchase of 750,000 shares in H, bring the full holding to 2.6 million, or 7.3% of the company’s outstanding stock. It was an opportunistic move, taking advantage of lower prices to pick up an otherwise sound stock.

Hyatt’s value is supported by a strong brand and a reliable dividend with a 2% yield. The yield is solidly in line with the peer-company average, and promises a steady income stream from the stock as Hyatt finds its footing in the rest of the year.

The take on Wall Street seems to be, hang on to this one for the long term. Jefferies analyst David Katz writes, anticipating a rocky road, “H withdrew its 2020 guidance and COVID-19 Greater China sensitivities as the situation continues to evolve. The company noted the situation has intensified over the last week, with decreased transient bookings and increased group cancellations in North America and Europe.” Even so, Katz says to Hold on to H. He lowered his price target to $76, which still implies an upside potential of 47%. (To watch Katz’s track record, click here)

From Wells Fargo, Dori Kesten says of Hyatt, “The U.S. lodging industry is expected to see increasing pressure on revenue and margin growth as demand slows in the face of steady supply growth. Although we believe Hyatt’s EV/EBITDA spread to its brand peers will continue to lessen over time, we see limited nearterm price appreciation potential currently.” Kesten also rates this stock with as a Hold, seeing the smart play as patience. A price target of $72, indicating a 39% upside, rounds out the picture. (To watch Kesten’s track record, click here)

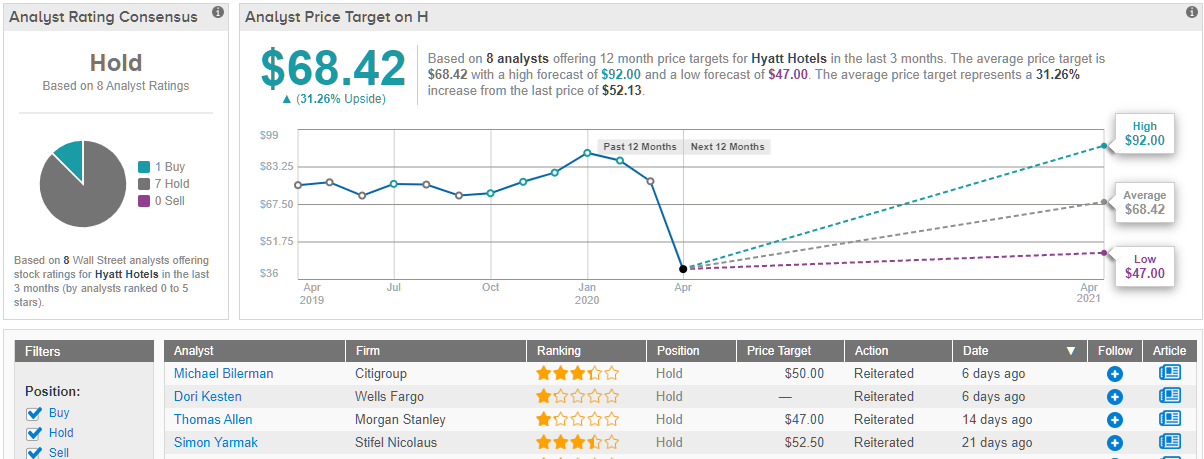

With 7 recent Hold reviews, and only 1 Buy, the analyst consensus on Hyatt is a Hold. As shares are priced at $51.84, the average price target of $68.42 suggests a potential upside of 31%. (See Hyatt stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.