Feeling optimistic the new year will usher in a change in stock market dynamics and shift sentiment from bear to bull? Well, Leon Cooperman has some bad news for you.

The billionaire investor has been a fully-fledged bear for a while now and 2023 has done little to change his stance. “Anybody looking for a new bull market any time soon is looking the wrong way,” Cooperman said.

In fact, Cooperman thinks there’s only a 5% chance the S&P 500 sees out 2023 above the 4,400 mark (up 13% from current levels), believing the stock market is far likelier to head back down from here.

Cooperman evidently knows a thing or two about investing in bear markets, and if we’re to heed his advice, it’s best to look for ‘safe havens’ to shield from further incoming volatility.

With this in mind, we delved into the TipRanks database and pulled out two stocks that analysts believe offer just that. Moreover, the view on Wall Street is that both are Strong Buys. Let’s see what makes them good shelters from the storm right now.

Ashland Inc. (ASH)

The first stock we’ll look at is American chemicals company Ashland. With a presence in 100+ countries, the company offers additives and specialty ingredients, providing services to clients in a variety of consumer and industrial sectors, such as personal care, automotive, energy, food and beverage, nutraceuticals, pharmaceuticals, and architectural coatings. With a workforce of 3,900, the company has a market cap of $5.77 billion.

And going against the general market trend, Ashland has managed to preserve that market cap over the past year, with the stock seeing out 2022 1% into the green, a far better display than the S&P 500’s losses of 19%.

Delivering strong earnings certainly helps in beating the market, and this is something the company’s most recent report – for the fourth quarter of fiscal year 2022 (September quarter) – managed to pull off. Revenue climbed by 6.8% year-over-year to $631 million, meeting Street expectations while adj. EPS improved by 20% to clock in at $1.46 – 5 cents above the $1.41 consensus estimate. Importantly, the company provided an excellent outlook, with sales for FY23 expected to be in the range between $2.5 billion to $2.7 billion compared to consensus at $2.39 billion.

Laying out the bull-case, BMO analyst John McNulty explains the myriad reasons to back the company.

“ASH’s defensive nature (60-65% of their revenue tied to personal care and life sciences) and its sold out positions in a host of product lines should help to insulate the company from the macro headwinds expected in 2023,” the analyst said. “Further, with ASH increasing its focus on selling products into applications that find /appreciate greater value from ASH’s products (up-selling), they should continue to see positive pricing for the portfolio. Finally, ASH has significant balance sheet strength that affords the company significant flexibility while offering investors financial stability. With all of the above in mind, ASH should provide investors a safe haven in 2023 as macro uncertainty continues.”

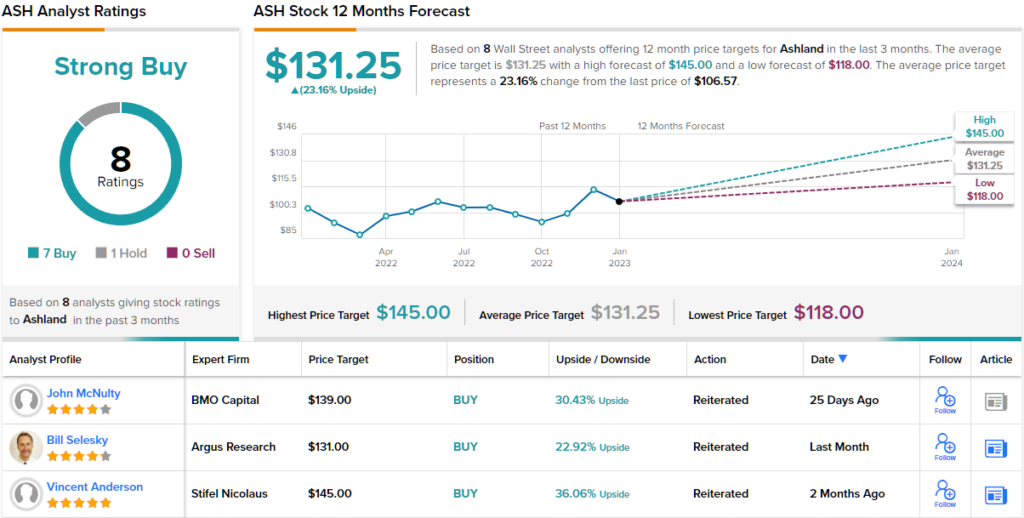

Accordingly, McNulty rates ASH shares an Outperform (i.e. Buy), backed by a $139 price target. Investors could be sitting on gains of ~30%, should McNulty’s forecast play out as anticipated. (To watch McNulty’s track record, click here)

Overall, it’s clear that Wall Street agrees with McNulty on the forward prospects for Ashland. The stock’s 8 recent analyst reviews include 7 Buys and 1 Hold, for a Strong Buy consensus indicative of a bullish outlook. The shares are priced at $106.57 and their $131.25 average price target implies a 12-month upside of 23%. (See Ashland stock forecast on TipRanks)

AmerisourceBergen Corporation (ABC)

If recent past performance amidst 2022’s bearish trends is anything to go by, then AmerisourceBergen’s credentials are hard to beat. The American drug wholesale company fared much better than average last year, generating for investors robust returns of 26%.

The company is one of the world’s biggest pharmaceutical service providers, focused both on pharmaceutical manufacturers and healthcare providers, and offering drug distribution and consulting services. In fact, such is its reach, around 20% of all the pharmaceuticals sold and distributed in the U.S. are handled by the company. Additionally, AmerisourceBergen has a strong international presence with more than 150 company-owned offices spread across the globe.

The fact the business is seeing strong demand even against the backdrop of an unfavorable macro was clear to see in the most recently reported statement – for the fourth fiscal quarter of 2022 (September quarter). Revenue came in at $61.17 billion, amounting to a 4% year-over-year increase while adj. EPS clocked in at $2.60. Both results beat Street expectations. For the 2023 outlook, the company called for revenue growth to be in the 5 to 7% range while it reiterated the F2023 adjusted EPS forecast of $11.45 at the midpoint it set at its June investor day.

This stock has picked up interest from J.P. Morgan’s Lisa Gill, who believes the company is set up well to deal with the current market environment.

“We remain positive on ABC given solid FY22 results and FY23 guidance outlook that offers a reasonable view into a challenging environment,” the 5-star analyst explained. “Ultimately, we believe the U.S. Healthcare Solutions business is poised for growth on the back of strong Rx and specialty volumes (including oncology and ophthalmology biosimilars), and should continue to offset FX and inflationary pressures within the International business, which will subside over time… We also believe the company could be a relative safe haven in an uncertain economic environment, as we don’t expect an impact to demand for prescription drugs in an economic downturn.”

These comments underpin Gill’s Overweight (i.e. Buy) rating on ABC shares, while her $191 price target implies one-year share appreciation of ~15%. (To watch Gill’s track record, click here)

Overall, ABC currently has a Strong Buy rating from the analyst consensus, based on 8 analyst reviews, breaking down to 7 Buys and 1 Hold. The shares are priced at $165.71 and have an average price target of $181.63, suggesting a one-year potential upside of ~10%. (See ABC stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.