Coming up from humble beginnings to manage one of the world’s largest hedge funds, Paul Singer has never shied away from risk. He holds degrees in both psychology and law, and understands the important of reading people and events to mitigate that risk. He started his asset management firm, Elliot Management, back in 1977, after leaving a short-lived career in real estate law. He had $1.3 million in seed money, and since turned that into a $38.2 billion portfolio of assets under management.

Singer’s career hasn’t been without controversy. In 2009, it was revealed that his firm held more than one-third of its portfolio in distressed securities, and Elliot was accused of being a vulture fund, profiting greatly from the debts of the less fortunate. Today, Singer and Elliot Management operate a more diversified portfolio, and functions as a multi-strategy hedge. But that doesn’t mean that controversy has gone away.

His fund is still accused of predatory activity, but on level both more sophisticated and higher scale. In one example, Singer’s fund acquired a controlling interest in Cabela’s, the chain of sporting goods stores, and within a short time was pressuring the company Board of Directors to sell out. The board balked – Cabela’s was bringing in over $1 billion annually – but the fund pushed harder, an offer came in from Bass Pro Shops, and the sale was made. The town of Sidney, Nebraska, where Cabela’s had been headquartered, saw a loss of 2,000 jobs while Elliot Management pocketed $90 million.

“Elliott Management has made billions by buying large stakes in American companies, then firing workings, driving up short-term share prices, and in some cases taking government bailouts,” Fox News host Tucker Carlson explained. It’s a clear example of how the interests of investing and working classes can diverge.

But not every investment leaves a trail of bad news, however. Elliot Management has plenty of politically less contentious holdings among their $12 billion worth of 13F reported securities. These are a matter of the public record, and savvy investors can learn valuable lessons from perusing them. We’ve done some of the footwork for you.

Using those public records, and cross checking with the TipRanks Stock Screener, we’ve picked out two ‘Strong Buy’ stocks that Elliot bought into big-time in Q3. Each stock has a solid upside – upwards of 30% – and offers investors an above-average dividend payout. So, let’s dive in and find out why Paul Singer likes them.

Marathon Petroleum (MPC)

With an output of 2 million barrels per day of refined crude oil, Marathon is the largest oil refining company in the United States. It operates in several segments of the oil business, including its core refining operations, midstream well-to-refinery pipelines and transport, and end-use customer retail in both the consumer and industrial sectors. Marathon saw $96.5 billion in revenues in fiscal 2018.

So, like Elliot Management, Marathon is an example of gigantism. The oil company has a market cap of $39 billion, and at the end of October reported Q3 earnings of $1.63 per share. While down year-over-year (Q3 2018 showed $1.70 EPS), the current figure clobbered the forecast of $1.30 – beating it by 25%. Revenues were up almost 35%, to $31.2 billion for the quarter.

Investors like MPC first for its strong profits, and second for its reliable dividend. The company currently pays out 53 cents per share quarterly, or $2.12 annualized, and has been slowly and steadily increasing that dividend over the last 12 quarters. The current payment gives a yield of 3.53%, 1.3 times higher than the average yield of S&P listed companies.

So, there are obvious reasons for a diversified hedge fund to like MPC – strong profits and a steady payback. And we see that in Q3, Singer bought up 3,998,273 shares of the stock, boosting his firm’s holding by 87%. Elliot now owns 8.6 million shares of Marathon Oil, a holding worth over half a billion dollars.

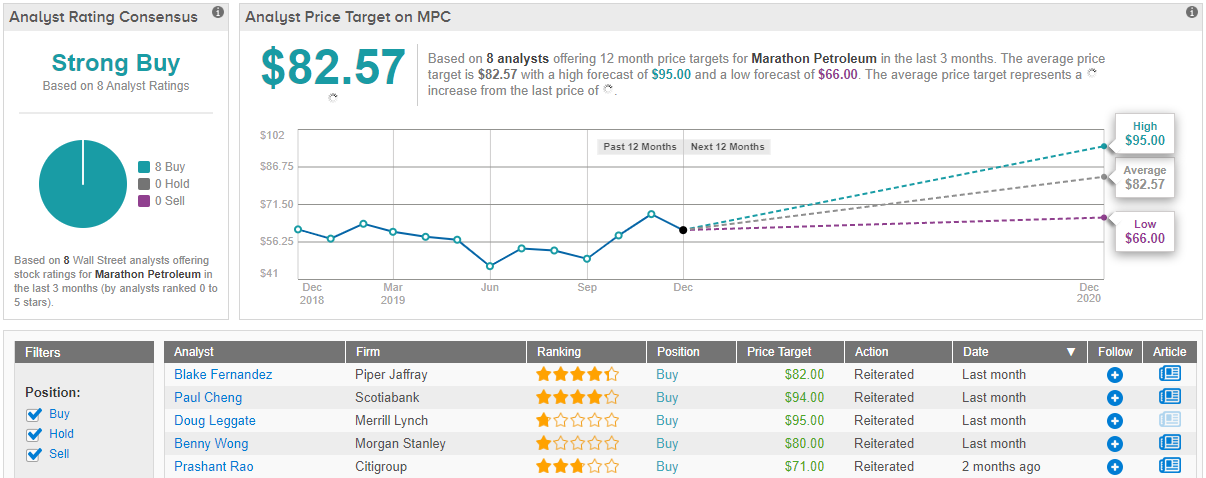

4-star analyst Paul Cheng, of Scotiabank, is bullish on MPC, writing after the Q3 earnings release: “We remain positive on the refining industry’s medium-term macro backdrop […] We view MPC’s various strategic announcements and 3Q19 earnings release positively […] we note that MPC’s sum-of-the-parts discount remains wider than that of peers.”

Cheng puts a $94 price target with his Buy rating on the stock, showing confidence in an impressive 56% upside potential. (To watch Cheng’s track record, click here)

With 8 Buy ratings given in recent months, MPC has a unanimous Strong Buy consensus rating. The stock currently sells for $60, and the $82 average price target suggests room for 37% growth on the upside. (See Marathon Petroleum stock analysis on TipRanks)

Mobile Mini (MINI)

The guy who invented the overseas shipping container came up with a thing of genius. These giant steel boxes, built to standard sizes, make loading and offloading the ocean’s freighters easier and cheaper. Mobile Mini brings that concept to land-based storage at a variety of scales, offering storage solutions for small and medium businesses. The company builds, and then sells or leases, welded steel storage containers. Mobile Mini’s boxes come in sized from 5 to 45 feet, and are readily convertible to more than 100 configurations, including sheds, guard rooms, and site offices. The company even offers options for the storage of water and other industrial liquids.

Where Marathon is a corporate giant, Mobile Mini lives up to its name. This small-cap company boasts a $1.6 billion market cap, and benefits from the agility inherent in smaller companies. Mobile Mini credits its strong growth since 2000 to aggressive marketing, a wide variety of storage container products, and a diverse customer base, including small and large businesses dealing in both solid and liquid materials.

In recent years, the company’s stock has been volatile, but has still shown an 18% gain in 2019. While underperforming the S&P 500 index, this is still solid growth, and MINI has accompanied it with a 2.92% dividend yield. At a 50% payout ratio, that dividend is easily sustainable – and better, the company has been increasing the payment each year for the last three years. The current payment is 28 cents per share quarterly.

As with MPC, it’s clear why Paul Singer would be interest in MINI. The stock has a firm niche in its business, and pays back investors at above-average rates. Elliot Management picked up a large block of MINI in Q3, opening a new position with a 2 million share purchase. That holding is worth over $75 million – a gain of $1.5 million since the reported purchase.

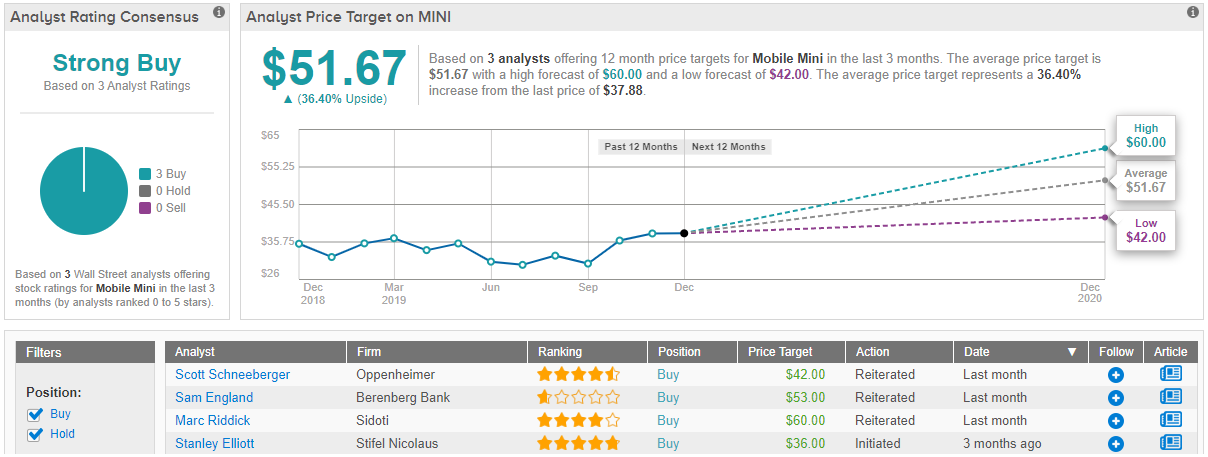

5-star Oppenheimer analyst Scott Schneeberger lays out the case for MINI is clear and simple words: “A straightforward story of financial metric improvement, MINI is well positioned for long-term profitable growth and free cash flow sufficient to fund organic/acquisitive growth, debt reduction, and increasing return of capital. We’re drawn to the long-lived asset characteristics and lengthy average rental period of MINI’s legacy portable storage container business, which is experiencing a solid demand environment expected to persist.”

Schneeberger back up his upbeat outlook with a $42 price target, implying an 11% upside – not spectacular, but straightforwardly profitable. (To watch Schneeberger’s track record, click here.)

Like MPC, shares in MINI have a unanimous Strong Buy consensus rating, this one based on 3 recent bullish reviews. The stock sells for $37, so the $51 average price target suggests an upside of 37%, significantly better than Schneeberger’s, and indicating that Wall Street, like Singer, is optimistic about Mobile Mini. (See Mobile Mini stock analysis on TipRanks)