Yesterday, biotech company BioNTech (BNTX) added a further 9% to an already bulging share price in 2020. The latest surge came following an announcement that clinical testing of BioNTech and partner Pfizer’s potential COVID-19 vaccine program BNT162 had begun in the US. The market has responded enthusiastically to the German biotech’s speedy efforts to produce a vaccine. Year-to-date the stock is up by an impressive 45%.

The US phase 1/2 trial of BNT162 was initiated with the dosing of two patients and follows last week’s dosing of the first patients in a Phase 1/2 trial in Germany. The trial will enroll up to 360 healthy patients in two age groups (18-55 and 65-85).

The collaboration marks a differentiated approach as the study will assess four different mRNA vaccine candidates evaluated in one study. Normally, the different options would be narrowed down to one, on which the trial would focus.

The partners anticipate the program to yield positive results, as steps have already been taken to ramp up production and meet the expected global demand. Pfizer’s clout means the company has an extensive manufacturing network which it will utilize to deliver an approved COVID-19 vaccine as fast as possible. Pfizer’s head of R&D Mikael Dolsten believes the partnership will be able to produce more than 20 million vaccine doses in 2020, rising to hundreds of millions in 2021.

With the pandemic still running rampant in hotspots across the globe, H.C. Wainwright’s Robert Burns highlights the urgent need for a vaccine.

The 5-star analyst said, “Over 3.6M people are known to be infected with COVID-19, with millions more likely infected while remaining undetected. The virus has officially killed over 252K people thus far—unreported deaths may be much higher. In the U.S. alone, over 1.2M cases have been reported, with roughly 70K people having died following infection. From our vantage point, these statistics merely serve to underscore the dire need for an effective vaccine, without which normalcy cannot be envisaged.”

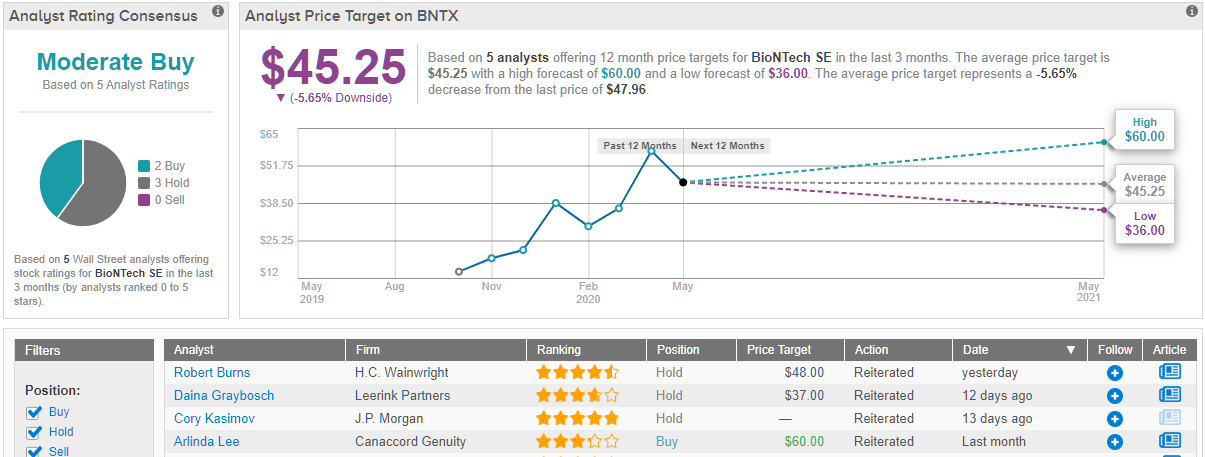

However, the elevated share price means Burns keeps a Hold rating on BNTX, along with a $48 price target. (To watch Burns’ track record, click here)

BNTX’s share appreciation appears to have caught the Street off guard. Based on 2 Buys and 3 Holds, the biotech has a Moderate Buy consensus rating. The average price target, though, is $45.25, and implies share depreciation of 6% over the coming months. (See BioNTech stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.