Shares of BlackBerry spiked another 5.7% in Tuesday’s extended market session after closing 19% higher on the day, as the Canadian software company joined forces with Amazon to develop a cloud-based vehicle data platform.

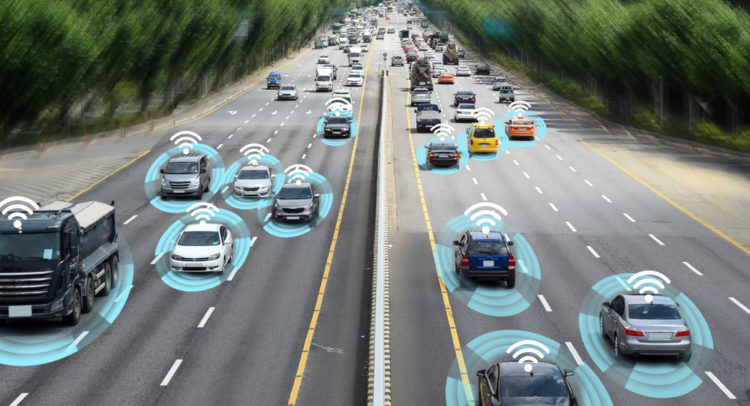

According to the multi-year agreement, BlackBerry (BB) and Amazon Web Services (AWS), the tech giant’s cloud business, will jointly develop and market its so-called intelligent vehicle data (IVY) platform. IVY is a cloud-connected software platform, which seeks to provide automakers with a secure way to read vehicle sensor data and create actionable insights from that data both locally in the vehicle and in the cloud. Automakers can use this information to create responsive in-vehicle services to boost driver and passenger experiences.

“Data and connectivity are opening new avenues for innovation in the automotive industry, and BlackBerry and AWS share a common vision to provide automakers and developers with better insights so that they can deliver new services to consumers,” said BlackBerry CEO John Chen. “This software platform promises to bring an era of invention to the in-vehicle experience and help create new applications, services, and opportunities without compromising safety, security, or customer privacy.”

The IVY platform will support multiple vehicle operating systems and multi-cloud deployments for compatibility across vehicle models and brands. The platform will be built on BlackBerry’s QNX, a vehicle data operating system, and feature AWS’s portfolio of services, including IoT and machine learning. It will run inside a vehicle’s embedded systems but will be managed and configured remotely from the cloud.

As a result, automakers are expected to gain greater visibility into vehicle data, control over who can access it, and edge computing capabilities to optimize how quickly and efficiently the data is processed. The IVY platform aims to help automakers offer new features, functionality, and better performance to customers over the lifetime of their cloud-connected vehicles, as well as unlock new revenue streams and business models built on vehicle data, the two companies stated. Specifically, the platform will enable automakers to compress the time to build, deploy, and monetize in-vehicle apps and services across multiple vehicle brands and models.

For instance, BlackBerry IVY could provide vehicle data to recognize driver behavior and hazardous conditions such as icy roads or heavy traffic and then recommend that a driver uses relevant vehicle safety features such as traction control, lane-keeping assist, or adaptive cruise control. Drivers of electric vehicles could choose to share their car’s battery information with third-party charging networks to proactively reserve a charging station and tailor charging time according to the driver’s current location and travel plans.

BlackBerry shares have surged 56% over the past month and are now up almost 9% year-to-date. Meanwhile, the Street has a cautious Hold analyst consensus on the stock’s outlook based on 3 recent Hold ratings. Looking ahead, the average analyst price target of $6.08 indicates 13% downside potential from current levels.

Meanwhile, Canaccord Genuity analyst Michael Walkley sticks to his Hold rating on the stock with a $6 price target, saying that he expects near-term declines in auto sales for the next several quarters and continues to model QNX with a slow and gradual recovery.

“While management has created a cogent long-term strategy and the shares are potentially compelling for longer-term-oriented investors, we await more proof in execution on the new product roadmap, evidence of cross-selling opportunities emerging, stabilizing to growing ESS sales, recovering QNX sales, and the potential for upside to our estimates before becoming more constructive on the shares,” Walkley commented in a note to investors.

Related News:

S&P Global To Snap Up IHS Markit In $44B Mega Deal; Street Stays Bullish

Amazon’s Cloud Unit To Run Apple’s MacOS System; Street Sees 21% Upside

ServiceNow Snaps Up Element AI; Stock Up 90% YTD