Real estate investment trust Bluerock Residential Growth REIT Inc. (BRG) announced quarterly dividends on its common and preferred shares.

The company has declared a dividend of $0.1625 per share on its Class A and Class C common shares for the second quarter.

Furthermore, Bluerock has declared a dividend of $0.4765625 per share on its 7.625% Series C Cumulative Redeemable Preferred Stock for Q2. (See Bluerock Residential stock analysis on TipRanks)

On its 7.125% Series D Cumulative Preferred Stock, Bluerock has declared a dividend of $0.4453125 per share for Q2.

The respective dividends are payable on July 2 to stockholders of record as of June 25.

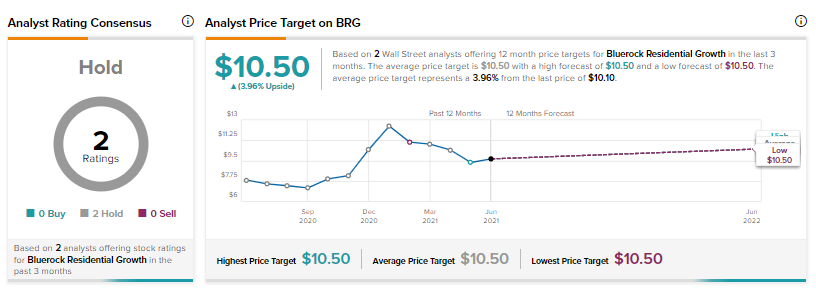

On June 3, Colliers Securities analyst David Toti reiterated a Hold rating on the stock and increased the price target to $10.5 (4% upside potential) from $10.

Toti commented, “BRG, while offering solid fundamentals in resilient assets/markets, has an overlay of structural complexity (i.e. joint ventures) that may temper enthusiasm.”

The other analyst covering the stock, BTIG’s James W. Sullivan also has a Buy rating on the stock but did not assign any price target.

Shares have gained 14.2% over the past year.

Related News:

United States Steel Sells Transtar for $640M, Shares Rise 3%

Southwest Airlines Foresees Revenue Growth; Orders 34 More Boeing 737 MAX Aircraft

CareDx Acquires Transplant Hero, Shares Rise