Boeing said it received firm orders for two 737-800 Boeing Converted Freighters (BCF) aircraft from an undisclosed buyer. With this, the world’s largest airplane maker now has 134 orders and commitments for 737-800BCF jets.

Boeing’s (BA) 737-800BCF freighter jets are based on its popular single-aisle Next-Generation 737 model which the company claims consume less fuel while they also have better reliability than other standard-body freighters. The airplane is ideal for domestic or short-haul cargo routes and has a capacity of carrying up to 23.9 tonnes and can fly up to 2,000 nautical miles.

The company also announced an agreement to open additional cargo conversion lines in Guangzhou, China, and Singapore. Boeing’s Ihssane Mounir said, “The freighter conversion program is an excellent way to double the life of an airplane and provide operators with an economical way to replace less efficient freighters.” (See BA stock analysis on TipRanks).

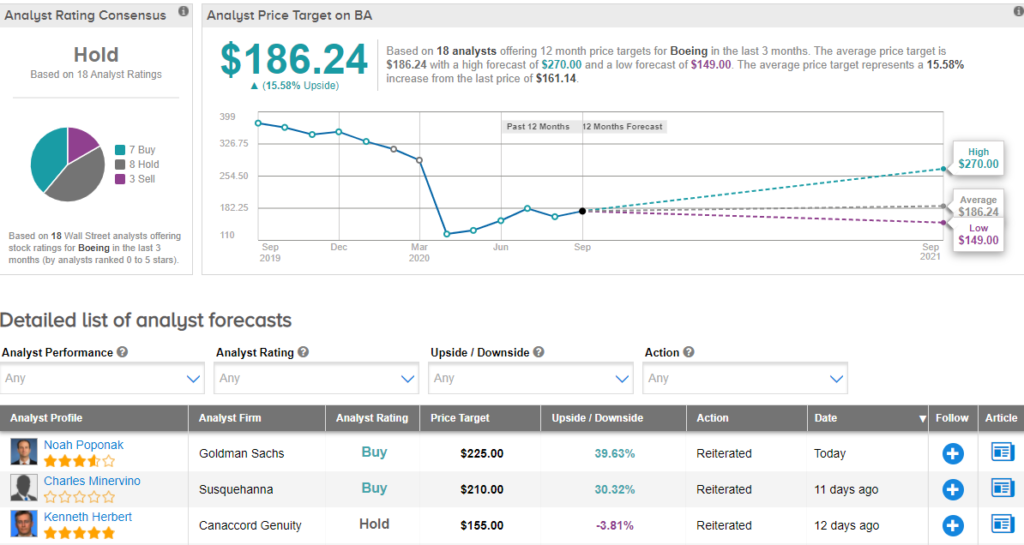

On Sept. 20, Goldman Sachs analyst Noah Poponak added the stock to his “Conviction List” and reiterated a Buy rating on the stock with a price target of $225 (39.6% upside potential). Poponak believes that despite the current challenging aircraft demand and supply environment, Boeing’s order backlog is “still robust.”

Currently, the rest of the Street is sidelined on the stock. The Hold analyst consensus is based on 8 Holds, 7 Buys, and 3 Sells. With shares down nearly 51% year-to-date, the average analyst price target of $186.24 implies upside potential of 15.6% from current levels.

Related News:

Don’t Go Bargain Hunting on Boeing Stock Quite Yet, Says 5-Star Analyst

Delta Upsizes Loyalty Program-Backed Debt Deal To $9B

Boeing 737 MAX Safety Changes Are “Positive Progress” – Report