Boeing Co (BA) shares surged 15% on Friday after the largest U.S. planemaker said it plans to resume production at its Philadelphia plant, as well as, restart manufacturing of its commercial jets in Washington state next week.

Following a two-week suspension, Boeing said it will restart production at its facilities in Ridley Township, Philadelphia on April 20. At the Philadelphia site, Boeing produces military rotorcraft, including the H-47 Chinook, V-22 Osprey and MH-139A Grey Wolf. Defense and commercial services work and engineering design activities are also performed at the site.

In a separate statement, the aerospace company informed investors that it will resume production of its commercial airplanes at its Washington state factory. About 27,000 Boeing workers in the Puget Sound area will return to production of the 747, 767, 777 and 787 jet programmes and to support global transportation infrastructure, cargo services and national defense and security missions.

Employees in the Puget Sound for the 747, 767 and 777 will return starting April 20, while employees on the 787 programme will return April 23 or April 24. On Friday, Boeing shares jumped 15% to close at $154.

The aerospace company has been hit hard from the beginning of the year as its stock plunged more than 50%. The fast outbreak of the coronavirus pandemic brought manufacturing at many aerospace companies to a standstill.

Last month, Boeing asked for at least $60 billion in U.S. government loans for itself and other American aerospace manufacturers to help the embattled industry cope with the the coronavirus-related financial drainage.

“Boeing should tap an additional $10B for both its own needs but also to provide a conduit of support to suppliers,” five-star analyst Myles Walton at UBS wrote in a note to investors earlier this month. “If this is the path that [Boeing] pursues, the market would likely welcome the avenue of liquidity, but we continue to worry about the hangover of the heavy debt load.”

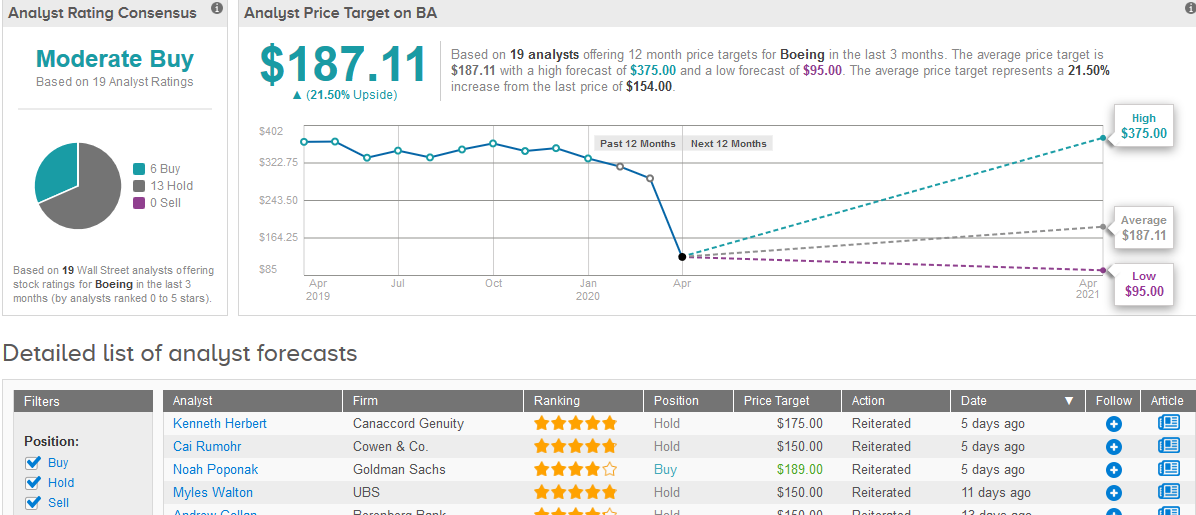

Walton has a Hold rating on the shares with a $150 price target tag.

Turning to other Wall Street analysts, the consensus views the stock as a Moderate Buy based on 13 Holds and 6 Buys. The $187.11 average price target foresees a 22% upside potential for Boeing shares in the next 12 months. (See Boeing’s stock analysis on TipRanks).

Related News:

AMC to Raise $500 Million in Debt Offer to Boost Cash Coffers; Shares Soar 31%

Got Guts? Get Tesla Stock at This High Valuation; This 5-Star Analyst Remains Sidelined

Weekly Market Review: Bulls Looking Past the Curve