Shares of travel reservation services provider Booking Holdings (BKNG) are stuck in a rut, down just over 30% from their all-time high.

From the COVID-19 pandemic to recessionary headwinds, the travel tech firm can’t seem to catch a break. Though the stock hasn’t gone anywhere over the past five years, the company has made intriguing innovations to keep up with smaller, up-and-coming rivals. Indeed, innovation is still very much alive at Booking.

That said, innovative capabilities and enhancements are unlikely to prevent a hit to sales come the next inevitable economic downturn. With many investors’ sights set on a recession, Booking stock is one of the discretionaries that could face more downside than the broader markets.

Even with the risk of recession, Booking Holdings stock isn’t at all that cheap at 6.3 times sales and around 20 times next year’s expected earnings. Although Booking may be slightly cheaper than some of its peers in the space, the entire industry seems at risk of considerable downside as the perfect storm of headwinds. Issues such as stagflation and COVID-19 could bring the recent travel recovery to a crashing halt.

While the first-quarter results were far better than what Wall Street expected, with per-share earnings of $3.90 beating the estimate of $0.90, the travel industry’s medium-term future remains clouded in a haze of uncertainty. For that reason, I am neutral on the stock.

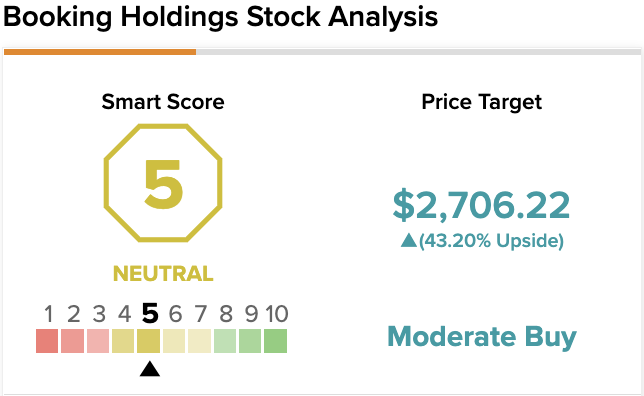

On TipRanks, BKNG scores a 5 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in line with the broader market.

Booking Holdings Stock: Are Pandemic and Recessionary Headwinds Baked In?

The travel industry has come a long way since the dark days of early 2020. Much of the world has adapted to the new normal. Still, there’s no telling what variants will be on the horizon once the next COVID-19 winter strikes.

While travel is quick to recover after it’s safe to venture outside again, it also tends to be the fastest to fold. Come the autumn season, a weakening economy and the return of COVID-19 restrictions could weigh heavily on travel bookings once again. Fresh off a better-than-expected quarter, the market may be overestimating the staying power of the global travel recovery.

On the plus side, Booking Holdings is an incredibly popular platform in the European market, where vaccination rates are high. Even if we’re due for another COVID-19 winter, it seems likely that many Europeans will be quick to follow up by getting their seasonal boosters.

In any case, COVID-19 risks, which many may have shrugged off by now, are still very much on the table. Travel tech firms like Booking Holdings may be most at risk from further pain as the consumer wallets become more stressed with time.

If it’s not inflation’s impact, it’s economic storm clouds that could drastically curb travel spending.

Today, the pent-up demand argument still holds strong. But there’s no telling when such pent-up demand could be met with the new set of macro hurdles that could be ahead. Indeed, pent-up demand for pleasure travel could be delayed anywhere from a few months to more than a year, depending on the macro picture and severity of local outbreaks.

At this juncture, the market seems too optimistic about Bookings’ ability to navigate through what could be a rough end to 2022.

Sure, Bookings’ earnings outlook remains upbeat, and that’s where the real risk could lie if the macro picture were to deteriorate far quicker than management expects. Given the uncertainties, it’d only be prudent to hold back on giving guidance.

Warren Buffett and his right-hand man, Charlie Munger, were never big fans of forward-looking guidance, even during normalized conditions.

Booking Holdings Doing a Great Job of Keep Rivals at Bay

Booking Holdings has done a fantastic job of keeping tabs on rivals over the years. The firm has expanded into various verticals, most notably alternative accommodations and payments.

Though alternative accommodations are not Bookings’ strong suit, CEO Glenn Fogel was quick to acknowledge its weaker positioning relative to competitors in a recent conference call.

He also noted Bookings’ plan to invest more in the arena of alternative accommodations. Arguably, Booking has a lot of room to grow in a market dominated by players like Airbnb (ABNB).

Wall Street’s Take

According to TipRanks’ analyst rating consensus, BKNG stock comes in as a Strong Buy. Out of 25 analyst ratings, there are 18 Buy recommendations and seven Hold recommendations.

The average Booking Holdings price target is $2,706.22, implying an upside of 43.2%. Analyst price targets range from a low of $2,100 per share to a high of $3,210 per share.

The Bottom Line on Booking Holdings Stock

The management team at Booking is doing many things right to weather the storm. However, the storm could worsen before it gets better with a recession on the horizon.

The severity of the coming downturn and the future of COVID-19 are giant question marks that are sure to dictate the trajectory of Booking stock and the rest of the travel industry. Given such massive unknowns, I’m taking a raincheck on BKNG until some storm clouds clear up.