BP PLC (BP) will not cut jobs in the next three months even as the oil magnate is planning to implement a $2.5 billion cost-reduction plan by 2021 to combat the crude price plunge fueled by the coronavirus pandemic.

“This may be the most brutal environment for oil and gas businesses in decades, but I am confident that we will come through it,” BP Chief Executive Officer Bernard Looney, said in a statement. “We also entered this environment in great shape with good operating momentum and financial discipline, strong liquidity and extensive optionality in our portfolio. We remain committed to growing sustainable free cash flow and distributions to our shareholders.”

For the first quarter, BP sees “no significant operational impact” from the coronavirus outbreak on its global operations, but this could change through the second quarter, the company said.

Oil prices dropped to about $25 a barrel on Wednesday, nearing its lowest level in 18 years. BP forecasts spending this year to amount to about $12 billion, which is about 25% below its full-year guidance. For the first quarter of the year, BP expects to take an $1 billion impairment charge, while oil and gas output is poised to decline form the previous quarter.

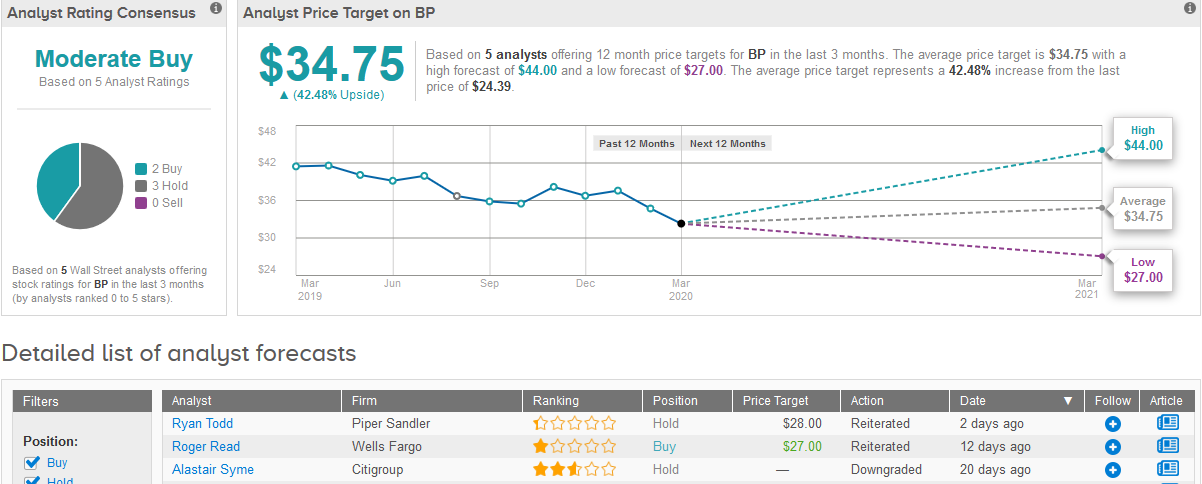

Wall Street analysts have a Moderate Buy consensus rating on the stock split into 2 Buys and 3 Holds. The $34.75 average price target proposes a potential 42% gain in the shares over the coming 12 months. (See BP stock analysis on TipRanks)

In addition, BP confirmed that its $15 billion divestment program for realization by mid-2021 remained on track. Since 2019, $9.6 billion in transactions have been announced, generating $3.4 billion in cash proceeds, the company said.

BP has around $32 billion of cash and undrawn credit lines as of the end of the first quarter. Last week S&P reaffirmed BP’s A- credit rating while revising its outlook from positive to stable. This week Moody’s reaffirmed BP’s A1 credit rating and revised its outlook from stable to negative.

Related News:

Veeco Instruments Issues Quarterly Guidance After Operations Deemed Essential

Lockheed Martin Scores $4.7 Billion Defense Contract Modification

3 Penny Stocks With Triple-Digit Upside Potential