“Be greedy when others are fearful” is Buffett’s famous saying. And now he has been proved right yet again.

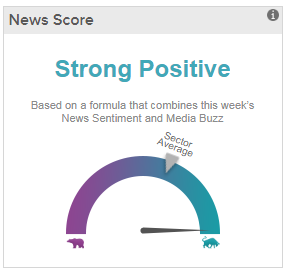

The Oracle of Omaha is about to make a snap $12 billion profit on Bank of America (BAC) stock. Six years ago, Buffett invested $5 billion in BAC via a mix of preferred stock and warrants- now the stock has tripled and Buffett intends to exercise the warrants. The acquisition of 700 million common shares would make Berkshire Hathaway BAC’s biggest shareholder- as well as paying out a sweet dividend of about $336 million a year. We can see the news reflected in TipRanks’ Strong Positive news score:

So what is the Street saying about BAC- and is it too late to invest now?

Well the stock certainly is unlikely to result in such stellar gains as it would have six years ago, however the Street is still confident about BAC’s outlook and investment potential. Indeed, from TipRanks’ BAC stock analysis page, we can see that the stock has a Strong Buy analyst consensus rating. In the last three months, the stock has received 9 buy and 3 hold ratings. Most importantly, the average analyst price target of $26 still represents a very respectable upside potential from the current share price of 7.17%.

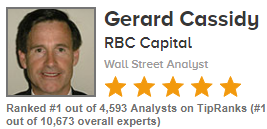

TipRanks No 1 Analyst

If we break this down we can see that the most recent recommendation comes from RBC Capitals’ Gerard Cassidy. He is the number 1 analyst on TipRanks with a very impressive 89% success rate and 28.9% average return. In mid-June Cassidy reiterated his buy rating on the stock with a $26 price target. Cassidy has previously told CNBC’s Squawk Box that BAC is one of his three top sector picks, as the stock stands to gain from rising rates and increasing revenues.

Meanwhile, top Credit Suisse analyst Susan Roth Katzke has a slightly more bullish $27 price target on BAC. Following the release of the US Treasury’s 150-page plan to radically simplify the country’s financial regulation she gave an optimistic outlook for BAC and other key financial stocks:

“Looking at a weighted average of our blue sky, base case and gray sky scenarios translates to ~10% total return in our recommended names— BAC, JPM, C, and GS. We strongly favor the universal banking model, with its multiple levers for growth and greater potential for realization of scale economies.”

TipRanks tracks the complete market activity on over 5,000 stocks from eight different sectors, including financial, health, tech and services.