The semiconductor sector has been under pressure all year, as the economy slows down and consumers’ buying power shrinks. Adding fuel to fire, the Biden Administration announced last week a new set of semiconductor export restrictions to China – and the chip stocks have been falling since.

On the positive side, however, investors should remember that semiconductor chips are essential products, and are always in demand even if that demand is slowing. Chip companies, in the meantime, are making moves to ramp up their US infrastructure investments.

With this in mind, we’ll take a look at a couple of chip stocks, using the latest data collated from TipRanks. Both have Strong Buy ratings from the analysts, and after steep losses this year, both have also feature plenty of upside potential going forward.

Broadcom, Inc. (AVGO)

The first chip stock we’re looking at, Broadcom, has been one of the chip industries leading players for the better part of a decade, and its 2021 annual revenues, at $23.8 billion, made it the fifth largest chip maker by total sales. The company is based in Irvine, California, and its product lines have found use in cybersecurity, mainframe and enterprise software, storage and memory systems, wireless and wired networking systems, and optical connections. And with all of that, AVGO shares are still down 33% so far this year.

The year-to-date share losses have come even as the company’s revenues and earnings have been climbing, steadily, for the past two years. In the last quarter reported, Q3 of fiscal year 2022 which ended on July 31, Broadcom reported $8.46 billion in total revenue. This represented a gain of 25% year-over-year, and was the highest total in the last two years. The revenues supported earnings of $3.07 billion by GAAP measures, for an EPS of $7.15 per share. By non-GAAP measures, the EPS came out to $9.73 per diluted share. This last metric was up 39% from the year-ago quarter.

These weren’t the only positive metrics. Broadcom also reported $4.42 billion in cash from operations in fiscal Q3, with $4.3 billion in free cash flow. The FCF was 51% of total revenue, and supported the company’s capital return program. Broadcom, through its dividend and share repurchases, returned $3.2 billion to shareholders in Q3, with $1.7 billion of that through the dividend and $1.5 billion through the repurchase program.

The dividend, which was paid out on September 30, was set at $4.10 per common share. The annualized rate of $16.40 gives a yield of 3.75%, well above the average yield found among peer companies.

Big names like Broadcom typically catch the eye of the Street’s best analyst, and Deutsche Bank’s 5-star stock watcher Ross Seymore, who holds the #23 ranking overall from TipRanks, covers AVGO. He sees the company as a sound defensive move for investors, writing in a note early this month, “[We] do not expect AVGO to remain totally immune from rising macro headwinds, we believe they can weather the situation better than most due to a consistent scrubbing of backlog to ensure shipments are only matching ‘true demand,’ long lead times on non-cancellable orders, and heavy infrastructure exposure (~80% of revs). Looking forward, we believe these defensive attributes will remain especially appealing as macro headwinds likely accelerate, with AVGO able to further boost its investor appeal by raising its dividend at the end of F4Q22…”

Building on this optimistic stance on AVGO, Seymore rates the stock as a Buy, with a $635 price target that indicates room for ~49% one-year upside potential. (To watch Seymore’s track record, click here)

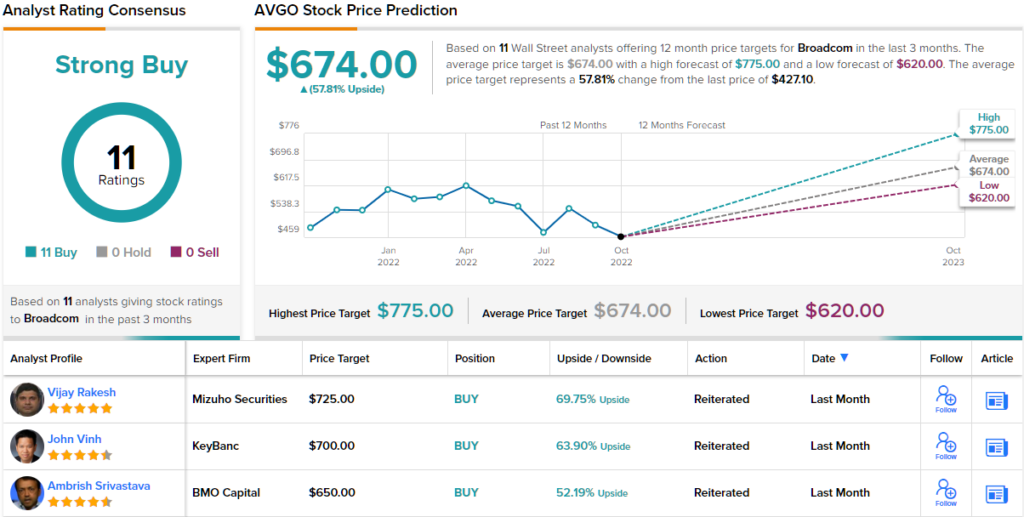

Broadcom’s major-league status in the chip industry has attracted 11 recent analyst reviews, and these unanimously agree that the stock is one to Buy, making for a Strong Buy consensus rating. The shares are priced at $427.10 – and the $674 average price target implies a gain of ~58% in the next 12 months. (See AVGO stock forecast on TipRanks)

Taiwan Semiconductor Manufacturing (TSM)

Next up is Taiwan Semiconductor, one of that island’s major high-tech manufacturing firms. TSM is the only Taiwanese company on the ‘top 10’ list of the world’s largest semiconductor chip companies, where it ranks first by market cap and second by total revenue. TSM boasts a market value of $343 billion, and saw revenues of $56.8 billion last year. Taiwan Semi operates as the world’s largest contract chip maker, or foundry, mass producing chips that are designed by smaller firms elsewhere.

Like Broadcom above, Taiwan Semi has seen its revenues and earnings grow steadily in recent quarters, even as the share price has dropped. Shares of TSM are down 43% this year, reflecting both the country’s exposure to China and saber rattling, as well as the more recent US export restrictions. But as the 3Q22 report – just released today – shows, geopolitics and a falling share price haven’t stopped Taiwan Semi from bringing in profits.

The company’s top line came in at $20.23 billion in Q3, a total that was up more than 11% from Q2 – and up an even more impressive 36% from the year-ago quarter. The top line supported earnings of $1.79 per share, which came in well above the $1.65 forecast and grew 67% y/y.

In addition to the sound headline numbers, Taiwan Semi’s management has also recently announced that the company will reduce its capital expenditures by 10%, from $40 billion to $36 billion, as the company adjusts its ‘capacity optimization’ for its N7 chip manufacture. This has been interpreted as a move to match capabilities with projected customer demand.

Needham analyst Charles Shi describes the Q3 results here as ‘largely in-line’ with his firm’s forecast, and goes on to say, “While the company’s bullish comments on N5 and N3 are encouraging, we are taking our 2023 sales growth estimate down by 3pts to reflect likely extended weakness of N7. Yet, we believe the market is not pricing in TSMC’s 2023 as an up year but as a down year; this makes the stock very attractive at its current all-time-low multiple, as we see it.” Shi adds, also, that the company is sanguine of near term, writing, “TSMC believes 2023 will be a down year for the industry–not a surprise to anyone–but will be a growth year for the company, driven by stronger technology differentiation, growth of its high-performance computing (HPC) portfolio, and pricing (more on this later). Notably, TSMC sees data center and automotive demand remaining steady…”

For Shi, the bottom line is that he keeps his Buy rating on TSM, and his $110 price target implies a one-year upside potential of 72%. (To watch Shi’s track record, click here.)

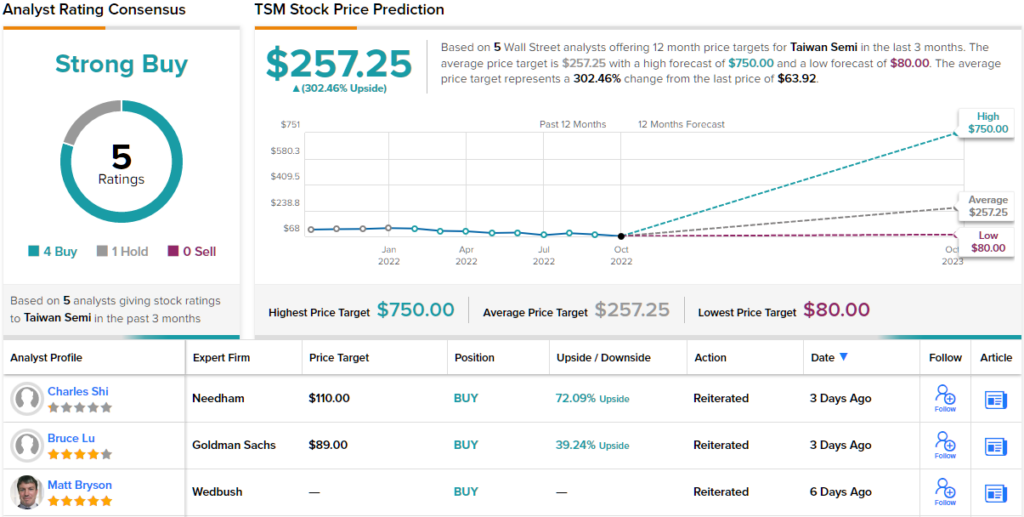

Taiwan Semi has 5 recent analyst reviews on file, and these include 4 Buys against 1 Hold, for a Strong Buy consensus rating. The stock’s $257.25 average price target suggests a robust 302% increase over the next 12 months, from the current trading price of $63.92. (See TSM stock forecast on TipRanks)

To find good ideas for chip stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.