The fast-approaching new decade will bring with it a plethora of trends most of us aren’t able to predict, or even imagine right now. One trend likely to continue, though, is the expansion of the plant-based meat industry. It is a market currently worth $12 billion and is estimated to reach $27 billion in the next five years.

One of the year’s major disruptors, Beyond Meat is at the forefront of the revolution, with its plant-based patties popping up in stores across the land. But what’s to stop more traditional meat-based companies from getting in on the action? Not much, as it happens. The world’s second largest meat and chicken processor, Tyson Foods, was an early backer of Beyond Meat but now has a dedicated plant-based brand of its own. Other companies are following suit, too.

Following the scent, then, TipRanks’ – a company that tracks and measures the performance of analysts –Stock Comparison tool lined up the two tickers alongside each other to give us an idea of what the Street thinks is in store for the two new rivals in the year ahead. Let’s dig in.

Beyond Meat Inc (BYND)

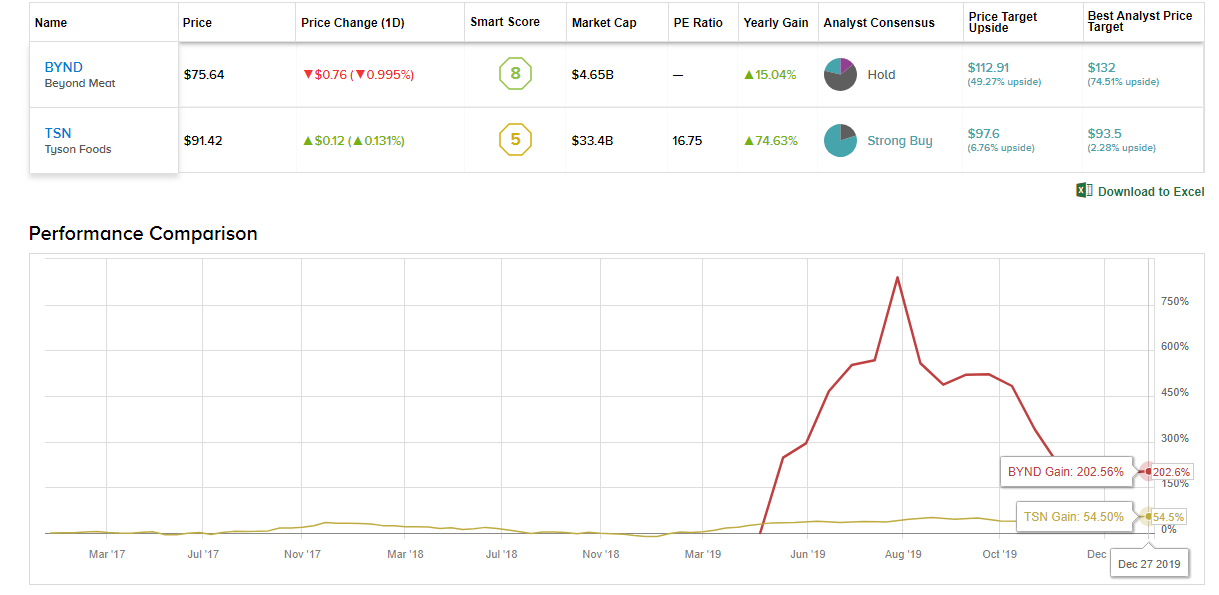

It has been a wild 2019 for the veggie patty manufacturer, Beyond Meat. The disruptor entered the market in May and soared over 420% at its $239.71 per share peak back in July. It is now trading at $75.64, a slide downwards of about 68%. So, what happened, then?

Apart from the obvious explanation of “too much, too soon” implying a sell-off was imminent at some point, some doubts have been raised about the long-term prospects of BYND.

Burger King’s recent decision to use Unilever’s Vegetarian Butcher for its ‘Rebel Whopper’ in approximately 2,500 outlets across 25 countries in Europe (Burger King uses Impossible Foods for its U.S. counterpart), indicated barriers to entry in plant-based meats are trivial, and brand burgers might not be a thing, after all, in the food service industry.

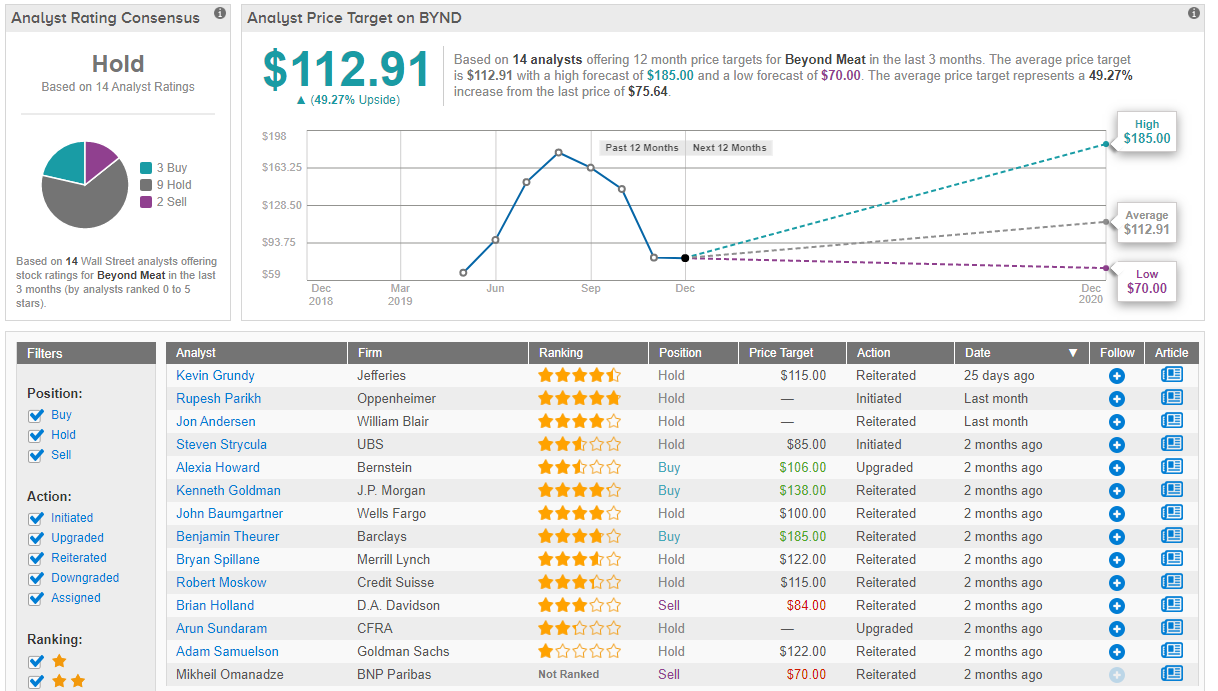

While acknowledging other players are likely to enter the market, Bernstein’s Alexia Howard believes Beyond Meat’s early-mover advantage remains key. “Demand growth seems strong both domestically and internationally and so there may be little incentive for leading players to compete on price even if newer upstarts try to do so to break into the market,” said the analyst.

Furthermore, the analyst believes that as livestock is a well-known contributor to global warming, the growing trend, particularly in Europe, of conscience investing will draw more people to BYND.

Howard, therefore, upgraded her rating on BYND to Outperform, alongside a price target of $106. This implies upside potential of 40%. (To watch Howard’s track record, click here)

Taking a more neutral view is Oppenheimer’s Rupesh Parikh, who initiated coverage of BYND with a Perform rating. The 5-star analyst noted, “We overall look quite favorably upon the Beyond Meat brand, product assortment, track record of innovation, longer-term prospects, and positioning to the very on-trend alternative meat category… However, a pricey valuation, increasing competition, and the potential for new selling pressures following the expiration of the lockup suggest more muted upside potential, in our view.” Parikh’s rating doesn’t currently include a price target. (To watch Parikh’s track record, click here)

The Street, it seems, is currently on the cautious side with its appraisal of the meat disruptor. 3 Buys, 9 Holds and 2 Sells add up to a Hold consensus rating. This, though, doesn’t tell the whole story. While the rating implies caution, the average price target comes in at $112.91 and implies gains of 49% could materialize in the coming year. (See Beyond Meat stock analysis on TipRanks)

See also: Corporate Insiders Pull the Trigger on 3 Buy-Rated Stocks

Tyson Foods (TSN)

It is interesting to note that Tyson Foods was an early investor in Beyond Meat. However, the company sold its 6.5% stake in BYND for a reported $79 million, a week before Beyond Meat went public.

The reason? Well, it looks like Tyson realized they could make their own version of the veggie products. As a marquee name and owner of a network of distribution partners and retailers, Tyson’s move into the plant-based meat industry presented an opportunity for expansion and growth. The veggie products are additions to the company’s current meat-based offerings, not replacements. And while consumers in the coming decade are likely to add alternative protein products to their diet, the majority won’t necessarily care where they buy it from, as long as it’s readily available.

Tyson’s Raised and Rooted brand rolled out to stores at the end of September, with it now in some 7,000 stores. The new brand currently has two offerings, plant-based nuggets and blended patties with a mix of beef and plant protein. Whole Foods recently cited blended burgers as one of its top 10 food trends in 2020. It will be interesting to see if this thesis plays out.

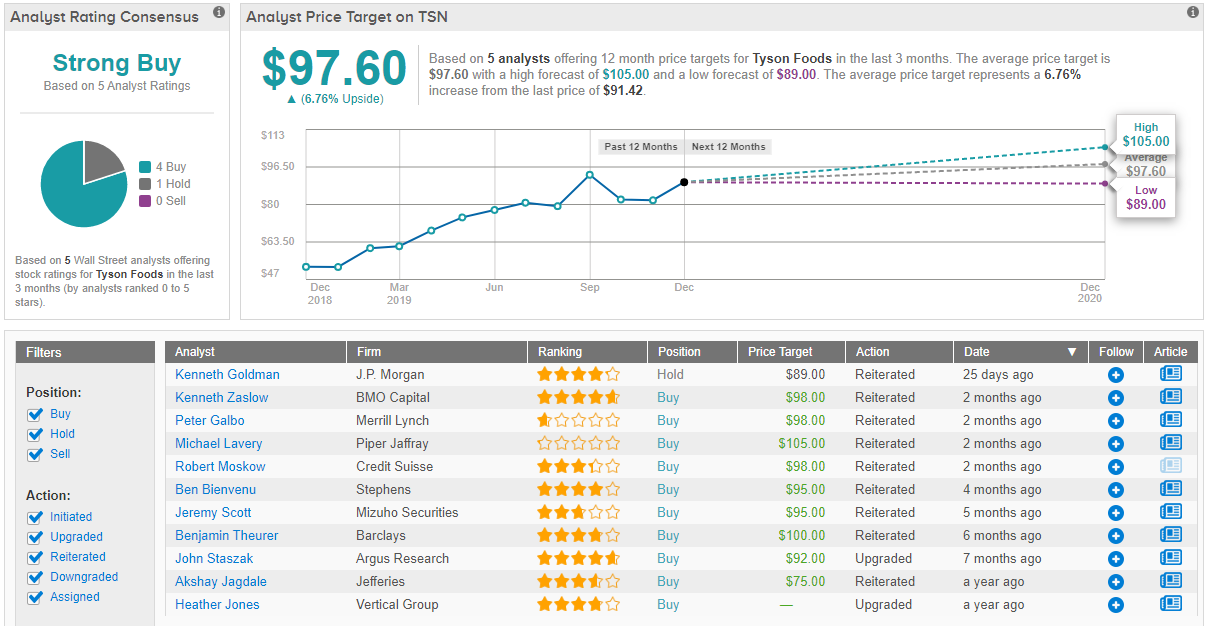

BMO Capital’s Kenneth Zaslow thinks Tyson has strong fundamentals and notes the company’s recent FY20 guidance calls for high single-digit earnings growth with “potential for profound upside.” The 5-star analyst reiterated a Buy on Tyson alongside a price target of $98, implying upside potential of a further 7%. (To watch Zaslow’s track record, click here)

J.P. Morgan’s Ken Goldman also notes the potential for the company’s fiscal 2020 earnings to beat expectations. Additionally, encouraging signs of US chicken being allowed into China and the recent strength displayed in US meat pricing are additional reasons Goldman raised his price target from $83 to $89. The 4-star analyst, though, kept his Neutral rating on account of the company’s high valuation. (To watch Goldman’s track record, click here)

And where does the Street stand on Tyson right now? As it happens, the Street is with the BMO analyst. A Strong Buy consensus rating breaks down into 4 Buys and 1 Hold. The average price target of $97.60 indicates upside potential of 7%. (See Tyson stock analysis on TipRanks)

To find good ideas for stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.