If you think the broader market’s extreme pendulum swings are the definition of volatility, you should have a conversation with long-term investors of vaccine specialist Novavax (NVAX). To quickly recap the last 24 months: In 2018, the stock gained 73%, paid it back with interest during a 90% slide in 2019, and is back to gaining again. Unlike most other names, so far in 2020, the small cap biotech is up by a jaw dropping 198%. Yesterday, Novavax added another 20% to its share price.

So, the recent surge must be COVID-19 related, right? Well, yes and no. Novavax has received an initial $4 million grant from the CEPI (Coalition for Epidemic Preparedness) to prepare a Phase 1 clinical trial of a COVID-19 vaccine, which is expected to begin in late spring.

However, the reason for the latest burst of optimism involves another vaccine the company is developing. On Monday, Novavax reported positive data from a Phase III trial for its experimental flu vaccine, NanoFlu. The trial met all primary and secondary endpoints in adults over 65, while also exhibiting a safety profile that compares well to Sanofi’s Fluzone Quadrivalent. Novavax plans to file a BLA in 2021, with a potential launch for the drug in 2022.

Oppenheimer’s Kevin DeGeeter applauded the development by reiterating an Outperform rating on NVAX and hiking up the price target. The figure increases from $13 to $19. Expect returns in the shape of 61%, should the target be met over the next 12 months. (To watch DeGeeter’s track record, click here)

The analyst also connects the dots between NanoFlu and Novavax’s development of a COVID-19 vaccine. DeGeeter said, “Our forecast calls for peak sales of $550 million as NanoFlu splits difficult-to-treat elderly market with Fluzone High Dose based on superior efficacy compared to other seasonal influenza vaccines. From a strategic perspective, we see synergies between commercial influenza and COVID-19 vaccines for commercial distribution, production scale-up and securing non-dilutive financing. Specific to NVAX, Nanoflu includes the same Matrix-M adjuvant used in its COVID-19 vaccines. Securing FDA clearance and commercial experience with Matrix-M may de-risk safety profile for NVAX’s COVID-19 vaccines.”

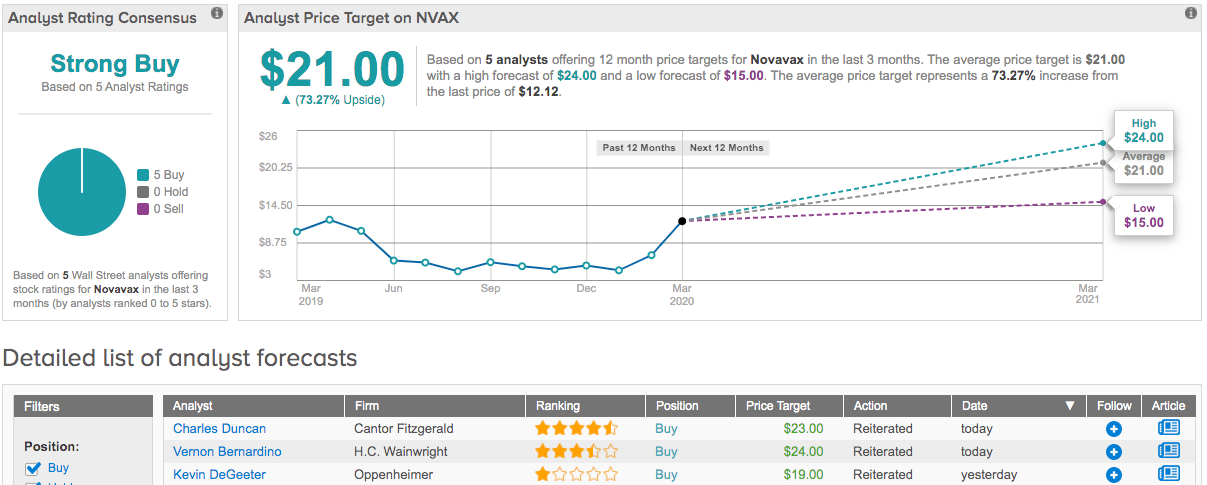

Four other calls published by Wall Street analysts over the last three months all deliver the same verdict: Buy. Accordingly, Novavax has a Strong Buy consensus rating. The average price target is $21 and implies upside potential of a further 73%. (See Novavax stock analysis on TipRanks)