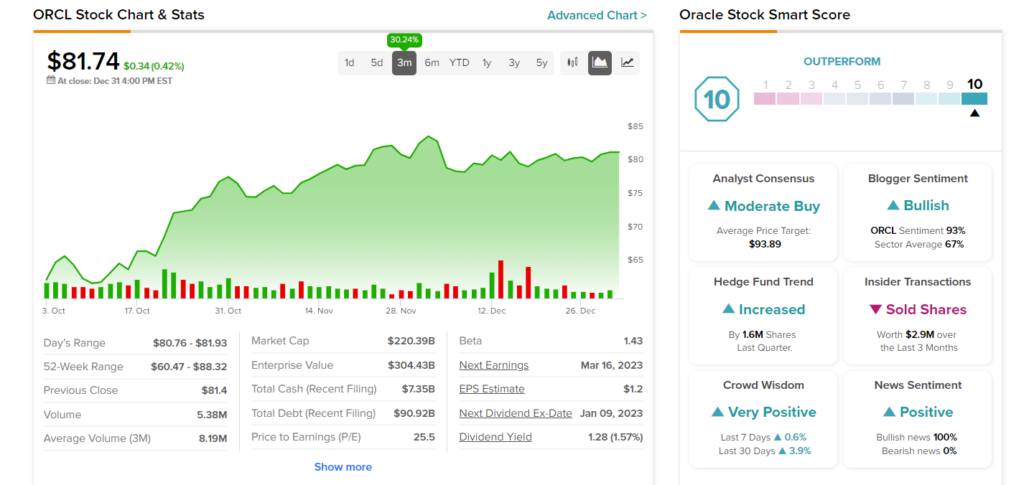

The technology giant Oracle (NYSE:ORCL) has a “Perfect 10” Smart Score, which implies that the stock has the potential to beat the benchmark index. The company reported outstanding results in the second quarter, driven by strength in its Cloud segment. It has been able to mark its presence in the cloud market with the expansion of cloud services and product offerings. Given the company’s steady growth in the cloud space and solid fundamentals, it looks like there is more upside in the near term.

Also, the company’s strong balance sheet supports consistent dividend payments. Oracle’s dividend yield of 1.57% compares favorably with the sector’s average of 1.03%.

Further, Oracle acquired Cerner Corporation in June 2022. The deal expanded the company’s client base, thereby boosting its healthcare-related revenues. Further, the deal should help Oracle fully automate the clinical trials, further expanding the company’s customer base.

On the valuation front, the stock seems undervalued. Oracle is trading at a P/E ratio of around 25.5x, which reflects a discount of 9% from its five-year average of 28.07x. This represents a great buying opportunity for investors.

Is ORCL Stock a Buy or Sell?

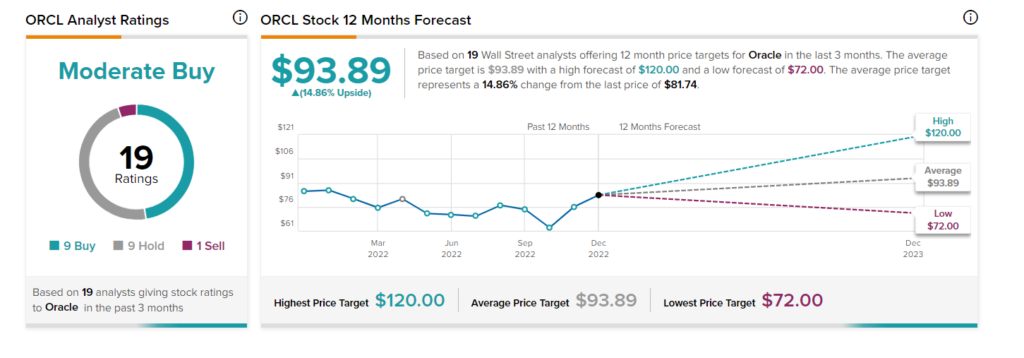

ORCL stock has a Moderate Buy consensus rating on TipRanks based on nine Buys, nine Holds, and one Sell. The stock has positive signals from retail investors and bloggers. Further, hedge funds are bullish on Oracle, as they have bought 1.6 million shares in the last quarter.

Over the past three months, ORCL stock has gained 30.2% in comparison to the 2.2% rally of the broader S&P 500 index (SPX). Moreover, analysts see an upside potential of 14.9% in Oracle stock based on the average price target of $93.89.