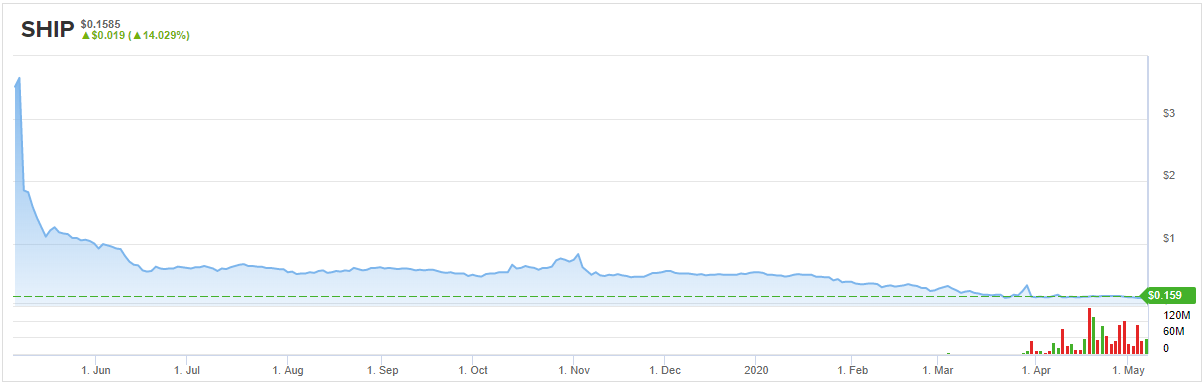

Over the past 5 years, with significant shareholder dilution along the way, Seanergy Maritime (SHIP) stock has declined by an incredible 99.70%.

As investment sage, Warren Buffet famously said, the time to pick up undervalued companies is while there’s blood in the street, but is an investment in SHIP worth the risk?

It is, according to Maxim analyst Tate Sullivan. Sullivan reiterated a Buy rating on Seanergy shares, although reduced the price target from $0.50 to $0.40, due to the company’s increase in shares outstanding following equity raises in the first quarter. Nonetheless, upside from current levels is a massive 150%. (To watch Sullivan’s track record, click here)

To boost its balance sheet, in Q1, Seanergy raised equity through four public offerings, all in all raising roughly $25 million. Sullivan believes the equity raises will be put to good use.

“We believe most companies, including SHIP, demonstrated ongoing access to capital during the spread of COVID-19. We expect SHIP will use proceeds from this quarter’s equity offerings to reduce debt, and as a result improve the company’s ability to extend debt maturities,” the analyst said.

Through a fleet of 10 Capesize vessels, Seanergy provides marine dry bulk transportation services and is the only pure-play Capesize ship-owner publicly listed in the US. The industry has taken a hit since the pandemic’s onset, but following a COVID-19 related near standstill at certain locations, factory and port activity in China increased dramatically in April, the result of which, the BCI (the Baltic Capesize Index) increased by over 370%. Sullivan believes that based on more iron ore exports from Brazil to China, the BCI will continue to rebound in 2020.

Alas, the renewed activity and the index’s rise have resulted in an increase to Sullivan’s 2020 and 2021 estimates for SHIP. The analyst increased 2020 EBITDA from $24.6 million to $25.3 million and 2021’s estimates to $45 million (from $44.6 million).

Looking at the consensus breakdown, only one other analyst has thrown an opinion into the mix. However, the rating was also bullish, making the Street consensus a Moderate Buy. With the average price target coming in at $0.77, the possible upside is a monumental 484%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.