In the old days, companies needed to beat the operating performance metrics and Wall Street would reward them for that. That’s not enough these days — just look at Uber Technologies (UBER – See Price Targets).

Uber shares tumbled almost 10% Monday following the release of the ride-hailing giant’s third-quarter earnings report, which revealed a $1.16 billion net loss. The sell-off comes despite Q3 numbers outperforming Wall Street’s estimates. Uber posted diluted losses per share of 68 cents and revenue of $3.81 billion, beating consensus estimates of 81 cents and $3.69 billion.

With Uber’s lock-up agreement ending on Wednesday, the sell-off could further continue, as early investors finally get the go-ahead to sell their shares. These make up about 85% of the current fully diluted share count. While the expiration day usually applies downward pressure on share price, Uber’s price trajectory has been such a disaster that many pre-IPO shareholders are still in the red and might be reluctant to sell right now.

Looking at the bright side, Uber reported revenue growth of 33%, and the company forecasts further growth in Q4. Moreover, with added focus on financial restraint, the company maintains its on track to achieve its target EBITDA profit for the full year in 2021. In contrast, its rival, Lyft, expects to be in profit by 4Q21.

Reflecting on Uber’s mixed report, Stifel 5-star analyst Scott Devitt said, “We are lowering our target price [from $50 to $34] as a result of a lower bookings outlook and as we increase our discount rate to 11.5% from 11.0% previously, primarily as a reflection of a higher required rate of return due to underlying volatility and remaining execution required for the company to achieve its growth path to profit generation […] We are steepening our near-term profitability ramp, though our long-term margin expectations remain unchanged […] We will continue to monitor Uber’s progress in expanding the platform, growing user reach in order to achieve long-term growth expectations, delivering against its new target for generating leverage across its businesses, and strategic execution.”

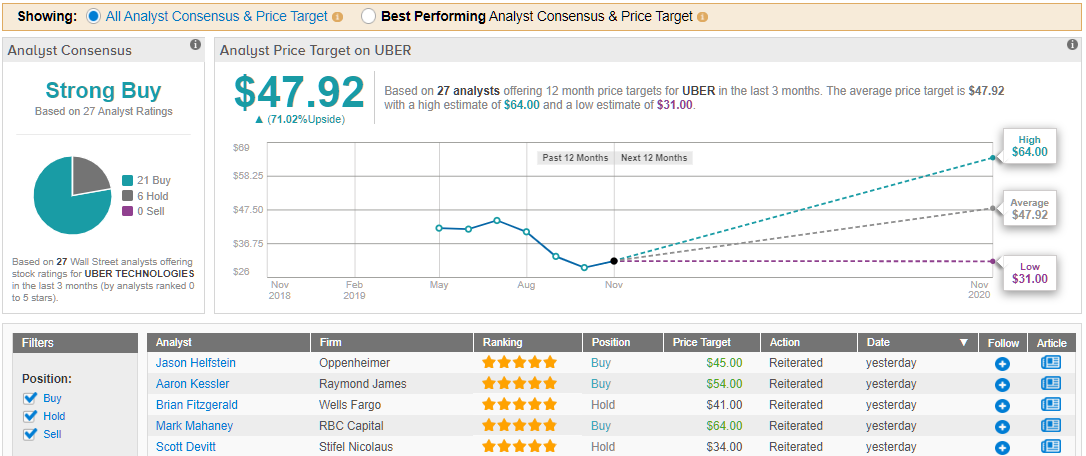

Devitt remains sidelined on Uber stock with a Hold rating and $34 price target, which still implies about 20% upside from yesterday’s closing price. (To watch Devitt’s track record, click here)

In contrast to Devitt’s skepticism, the rest of the Street is rather bullish on Uber’s long-term prospects, with its current low valuation providing an opportunity for the risk tolerant investor. According to TipRanks, a Financial Accountability Engine that measures and ranks analysts based on their performance, 21 analysts are bullish on UBER, while 6 are neutral. Meanwhile, the average 12-month price target on the stock is $47.92, which represents about 70% potential upside from current levels. (See Uber stock analysis)