Biotech stocks give a whole new meaning to risk/reward plays. Unlike names inhabiting other areas of the market, these tickers can witness explosive movements in the blink of an eye, giving them a Street reputation for their high volatility.

So, how are investors supposed to determine which biotech stocks are capable of outperforming the rest? Tracking the analyst community’s activity can be an effective strategy. The pros, who have in-depth knowledge of the industry, offer insight into many biotechs, some of which fly relatively under-the-radar.

Covering the biotech sector for Canaccord, 5-star analyst Whitney Ijem has stepped up to show us two biotech firms that are poised to bring in solid returns this coming year. These are buy-rated equities, and Ijem explains why they could surge over 80% over the next 12 months. Here are the details.

Ultragenyx Pharmaceutical (RARE)

The first stock we’ll look at is Ultragenyx, a biopharma company working at both the commercial and clinical stages. Ultragenyx boasts a suite of approved drugs on the market and generating revenues, along with an active research pipeline pursuing multiple tracks at once. Ultragenyx has its focus on rare diseases, defined by the FDA as impacting fewer than 1 in 50,000 people. While this small patient base can limit the sales potential of the commercial drugs, the company can share the costs through partnership programs with other biotechs.

The company has found success on all of these fronts. Starting with commercialization and revenues, Ultragenyx has a leading product, burosumab (trade name Crysvita), on the market as a treatment for two conditions, X-linked hypophosphatemia and tumor-induced osteomalacia. Crysvita generates the larger portion of Ultragenyx’ quarterly revenues; in 3Q22, the last reported, Crysvita sales accounted for $64.5 million of the total top line of $90.7 million, and European sales generated $5.4 million in royalty payments.

Also contributing to the company’s top line were sales of Dojolvi, a treatment for long-chain fatty acid oxidation disorders. Dojolvi, the brand name of triheptanoin, brought in 13.3 million during the quarter. Ultragenyx’ revenues in 3Q22 were up 11% year-over-year; the company’s sales income has been remarkably consistent for the last half-dozen quarters, coming in between $80 million and $90 million.

On the pipeline side, the company’s most important development comes from its Phase 1/2 clinical trial of GTX-102, a potential treatment for Angelman Syndrome. Enrollment and dosing in this trial is ongoing, with the expansion cohorts expected to receive dosing during 1H23. Interim clinical data was described as ‘encouraging,’ and further data releases are expected later this year.

In an interesting move, Ultragenyx last summer purchased GeneTx Biotherapeutics, its partner in the GTX-102 clinical program. The acquisition was made for $75 million.

All of this points to a company with a sound footing in its niche, and that prompted Canaccord’s Whitney Ijem to rate the stock a Buy along with a $90 price target. That figure indicates a potential for 94% share growth in the coming year. (To watch Ijem’s track record, click here)

Backing her bullish stance, Ijem writes: “Ultragenyx has built an impressive, and truly patient-focused, rare disease company. By leveraging CEO Emil Kakkis’ rare disease connections and regulatory prowess, the company has built an impressive and diversified rare disease business with global commercial capabilities…”

“We like the combination of a growing top line and multi-modal earlier stage pipeline, plus the company’s commitment to R&D spend discipline. On the commercial side we model sales approaching $1B in 2030 representing a ~10% CAGR for the existing commercial business for the next several years. For the pipeline, we’re most focused in the near term on GTX-102 for Angelman Syndrome and expect the Ph1/2 update coming sometime this year will be an important catalyst,” Ijem added.

Wall Street is mostly in agreement that this stock is a Strong Buy, as the 12 recent analyst reviews break down 11 to 1 in favor of Buys over Holds. The shares are selling for $46.44 and their $89 average price target indicates potential for ~92% upside by year’s end. (See RARE stock forecast)

Rhythm Pharmaceuticals (RYTM)

For the second pick, we’ll look at Rhythm Pharma, a biopharmaceutical firm moving from clinical trials to commercialization. Rhythm’s research programs focus on rare genetic conditions resulting in obesity. Obesity is well-known as a contributing factor to numerous health issues, which helps ensure a patient base. Rhythm is working on drug candidates that will work on the melanocortin-4 receptor (MC4R) pathway, brain pathway responsible for regulating weight and hunger. As such, this pathway is considered a root cause in multiple genetically-based obesity conditions.

Rhythm currently has one product undergoing commercialization, setmelanotide, which is marketed as Imcivree. This drug received its approval from the FDA in November of 2020, and is now used to treat obesity caused by several different conditions: pro-opiomelanocortin (POMC) deficiency, proprotein subtilisin/kexin type 1 (PCSK1) deficiency, leptin receptor (LEPR) deficiency, and Bardet-Biedl syndrome (BBS). In these indications, the drug is approved for patients over the age of 6 in need of chronic weight management.

Following the approval of Imcivree for BBS, the drug saw strong demand in the November 2022 report for 3Q22, with accumulated prescriptions totaling 120. Sales of the drug totaled $4.3 million, up from $1 million in the prior-year quarter. Rhythm had a cash position at the end of the quarter totaling $347.8 million in liquid assets. This was up almost 18% y/y.

The company is working to expand the indications for Imcivree, and has several ongoing clinical trials of the drug in the treatment of additional conditions. These include a Phase 3 study of the drug for pediatric use, in patients under age 6, for the same conditions already approved in older children and adults.

Among the bulls is Canaccord’s Ijem, who paints a positive picture of Rhythm going forward.

“Following a productive 2022, Rhythm’s Imcivree for the management of genetic obesity is positioned well headed into 2023. The launch of this product has been slightly unorthodox leading to sales expectations that we think are reasonable/beatable (we model $82M in 2023 sales vs. cons of $64). As such, we expect quarterly updates throughout the year will help build confidence in the global commercial infrastructure that RYTM has built. Meanwhile, the company also continues execution on the clinical side as it is working to start a Ph3 trial of Imcivree in hypothalamic obesity,” Ijem opined.

These comments back up Ijem’s Buy rating on the stock, while her $52 price target indicates potential for 82% upside by the end of this year.

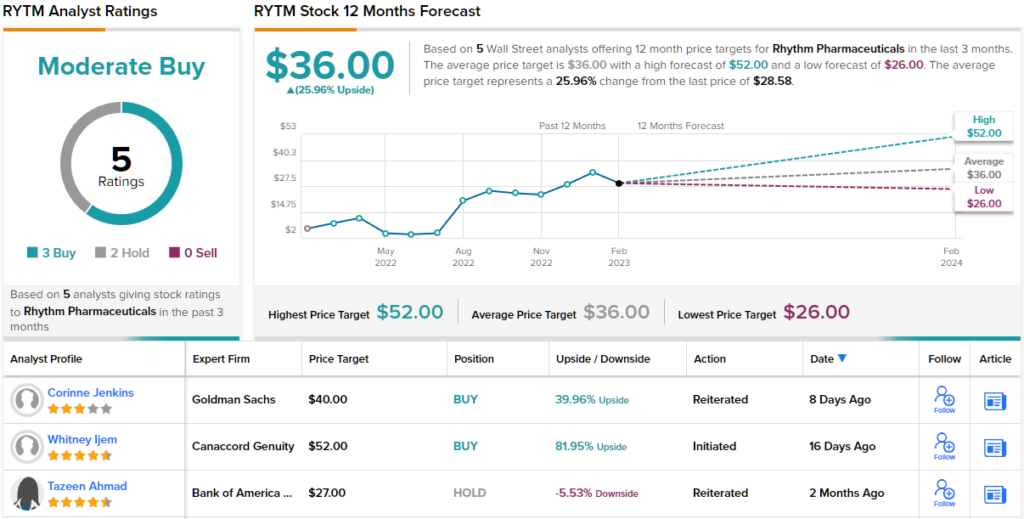

Overall, Rhythm has a Moderate Buy consensus rating from the Street, based on 6 recent reviews that break down 4 to 2 favoring Buys over Holds. The shares have a current trading price of $28.58 and the $36 average price target suggests ~26% upside over the next 12 months. (See RYTM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.