It was imperative that Canopy Growth (CGC) get a potentially permanent CEO in place after the upheaval caused by the firing of popular CEO Bruce Linton, who had been, for the most part, the face of the cannabis industry.

With the cash infusion of several billion from Constellation Brands (STZ), it propelled Canopy into the role of the perceived market lead in the sector. The major problem was that with the large amount of available capital, came great expectations and responsibility. Linton wasn’t able to deliver on those expectations, so he was fired.

With various comments on the weak performance of Canopy in regard to moving toward profitability, it’s not surprising that Constellation CFO David Klein was the choice made. He’ll take over as CEO on January 14.

In this article, we’ll look at the pros and cons of the hire.

Canopy de facto unit of Constellation Brands

It was apparent to me from the beginning of the $4 billion investment by Constellation Brands in Canopy Growth, that STZ was going to take control of the company. I drew that conclusion publicly in the past when noting the terms included Constellation being awarded two board seats, and receiving the authority to appoint two others. With the ousting of Linton, it signaled Constellation was now in control of Canopy.

The significance of that move at the financial level is Constellation didn’t need to spend more capital on shares in order to take control.

As for the reasoning behind the move, part of that was control, but also to placate shareholders that would predictably question the move based on write-offs by Constellation associated with inevitable losses in the near term.

The firing of Linton was directly related to those losses and accompanying spending. The move was made to communicate to Constellation’s shareholders that the company was willing to take the necessary steps to address the write-downs and earnings issue.

Taking control of the company was the first step in dealing with it.

Even so, there are a couple of things in the Canadian cannabis sector that no CEO can improve upon because they’re outside of their control.

What no CEO can change

There are two major challenges all Canadian cannabis companies will face for some time, and that is the extremely slow retail licensing approval process, and the time it’ll take to figure out what derivative products are in demand in Canada.

In the case of the licensing process, all that can be done is to manage production capacity until hundreds of more stores are opened up; especially in Ontario and Quebec. Canopy and its peers made production decisions based upon there being a lot more stores to sell their product out of at this stage of industry growth. There’s nothing any CEO or company can do but wait until more stores open.

With Canopy being one of the top cannabis production companies as measured by capacity, it will have a disproportionate impact on the performance of the firm until the stores roll out. That said, after the Canadian market is saturated with retail outlets, it will also benefit disproportionately against most of its peers.

Canopy will remain under pressure with earnings because the low-priced black market will continue to thrive in Canada until a large number of cannabis stores are operational.

When it comes to derivative products, Canopy has been less than inspiring, as last quarter it failed in a big way with oils. The problem there was it didn’t accurately measure cannabis oil demand for specific products in the Canadian market.

As it relates to David Klein, there’s nothing in his experience as a CFO that points to him being able to accurately identify what the market wants from derivatives.

The other challenge will be whether or not he will be able to boost infused beverage sales, as that was the primary motivation for Constellation taking the major position in Canopy Growth, as it relates to synergies.

If infused beverages don’t take hold and grow, then Constellation will have to depend upon cannabis sales outside of its core business for growth and return on investment. That could be a problem that would be difficult to solve.

Consensus Verdict

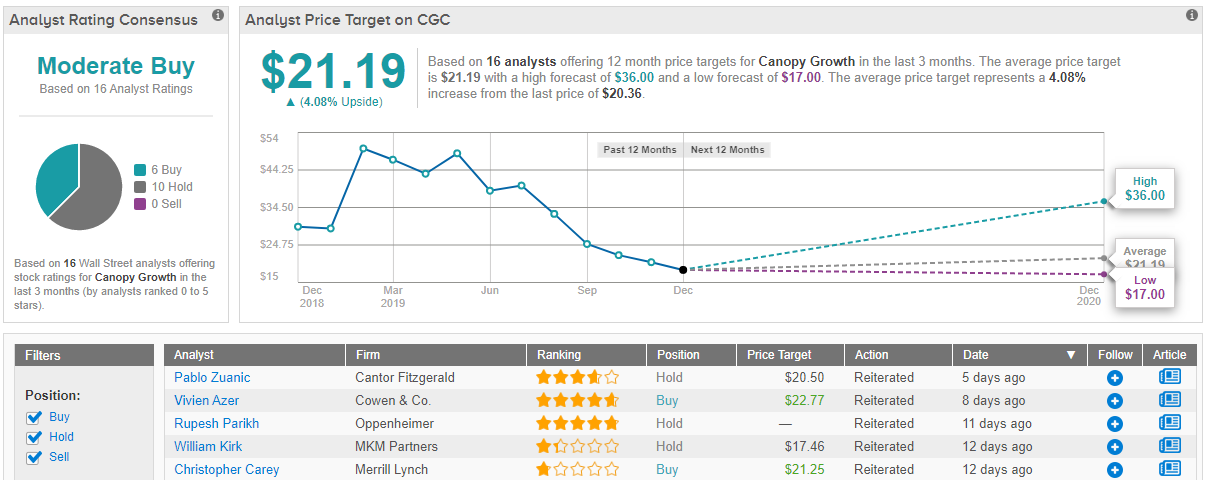

According to TipRanks, the consensus among Wall Street analysts is more of a mixed bag. CGC’s Moderate Buy consensus breaks down into 6 Buys and 10 Holds assigned in the last three months. In addition, the $21 average price target puts the potential twelve-month gain at a modest 4%. (See CGC price targets and analyst ratings on TipRanks)

Conclusion

It’s obvious the hiring of Klein was to ease fears of Constellation shareholders concerning the negative impact Canopy has had on its performance.

As it relates to Canopy, it’s questionable how much positive impact it’ll have on the company because of the retail issue, and the poor decisions on cannabis oil products that suggest internal research problems.

Combined with uncertainty on infused beverages, it’s going to take a long time before we know what level of success Canopy will have concerning derivatives, which generate wider margins and earnings potential; something the company must successfully execute on.

Klein may provide a sense of surety for some on the financial side of the business, but Linton already laid the growth foundation and most of the heavy spending, for now, is behind the company.

He must find ways to scale in order to lower costs. Under current market conditions in Canada, there isn’t much he can do until hundreds of more retail stores are opened.

Taking a few costs out of operations isn’t going to do much for Canopy’s performance in the near term. For that reason, shareholders and investors need to lower expectations until management proves it can successfully identify demand trends while taking advantage of the increasing number of stores it can sell out of.

Klein will have to prove he has the ability and capacity to do so. I’m not convinced he does at this time.